Last week in a relatively quiet week for the currency majors in the run up to Thanksgiving, it was the euro and the British pound which came under most pressure with the Australian dollar and the Canadian dollar trying to hold onto recent gains.

Last week in a relatively quiet week for the currency majors in the run up to Thanksgiving, it was the euro and the British pound which came under most pressure with the Australian dollar and the Canadian dollar trying to hold onto recent gains.

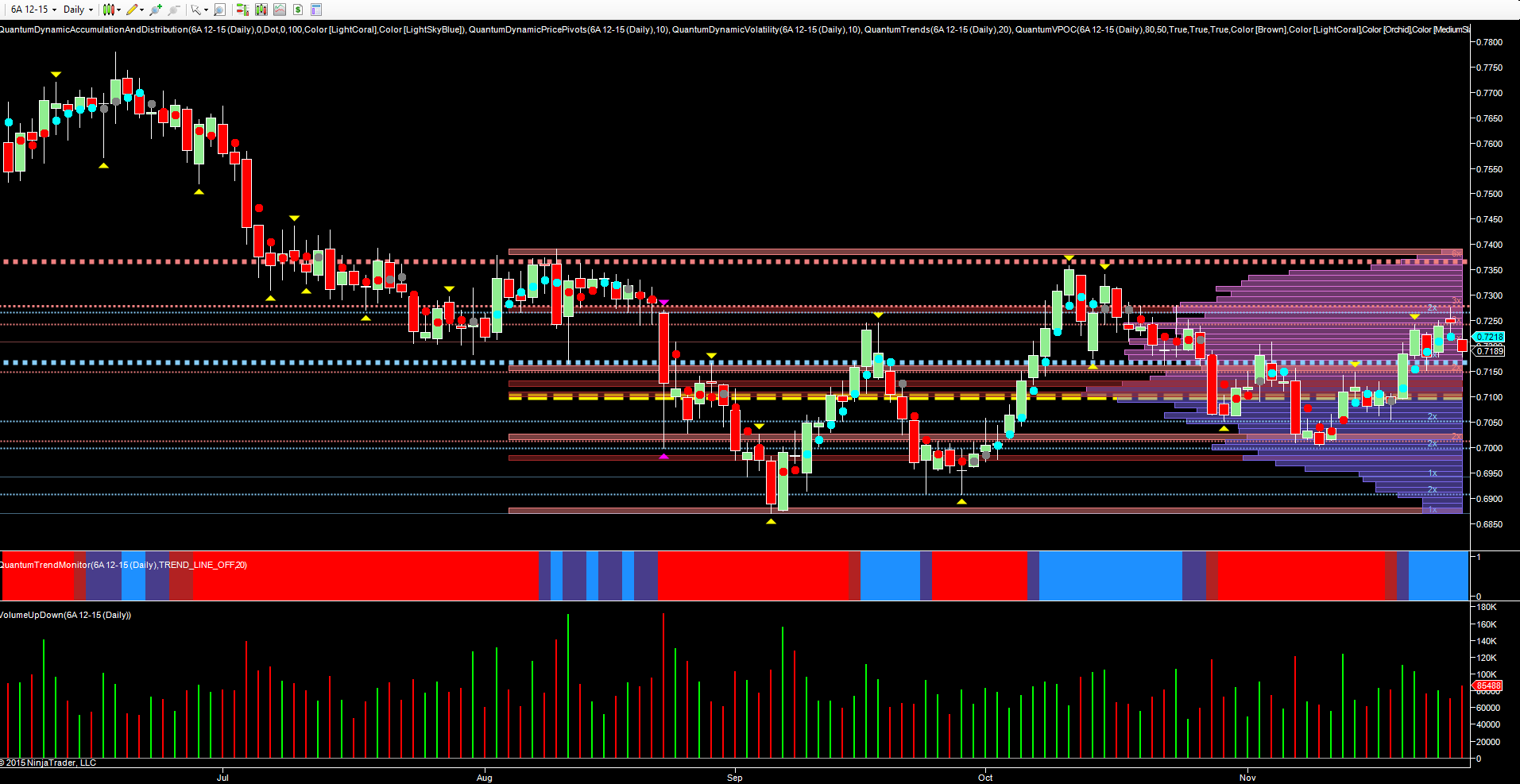

If we start with the AUD/USD the key level on the chart continues to be the strong platform of support in the 0.7170 area, as denoted with the blue dotted line of the accumulation and distribution indicator, which held firm again last week. However, the pair continues to remain under pressure, and with RBA Governor Stevens continuing to advocate further weakness for the Aussie dollar, any further move higher is likely to be fragile. Indeed the currency rally ran into resistance in the 0.7280 area before pulling back to close in quiet trading on Friday testing the platform of support below once again. Volumes are continuing to build around the volume point of control, and with the spinning top candle now in evidence, the current rally is looking increasingly weak with the prospect of a return to test the 0.7010 area in due course.

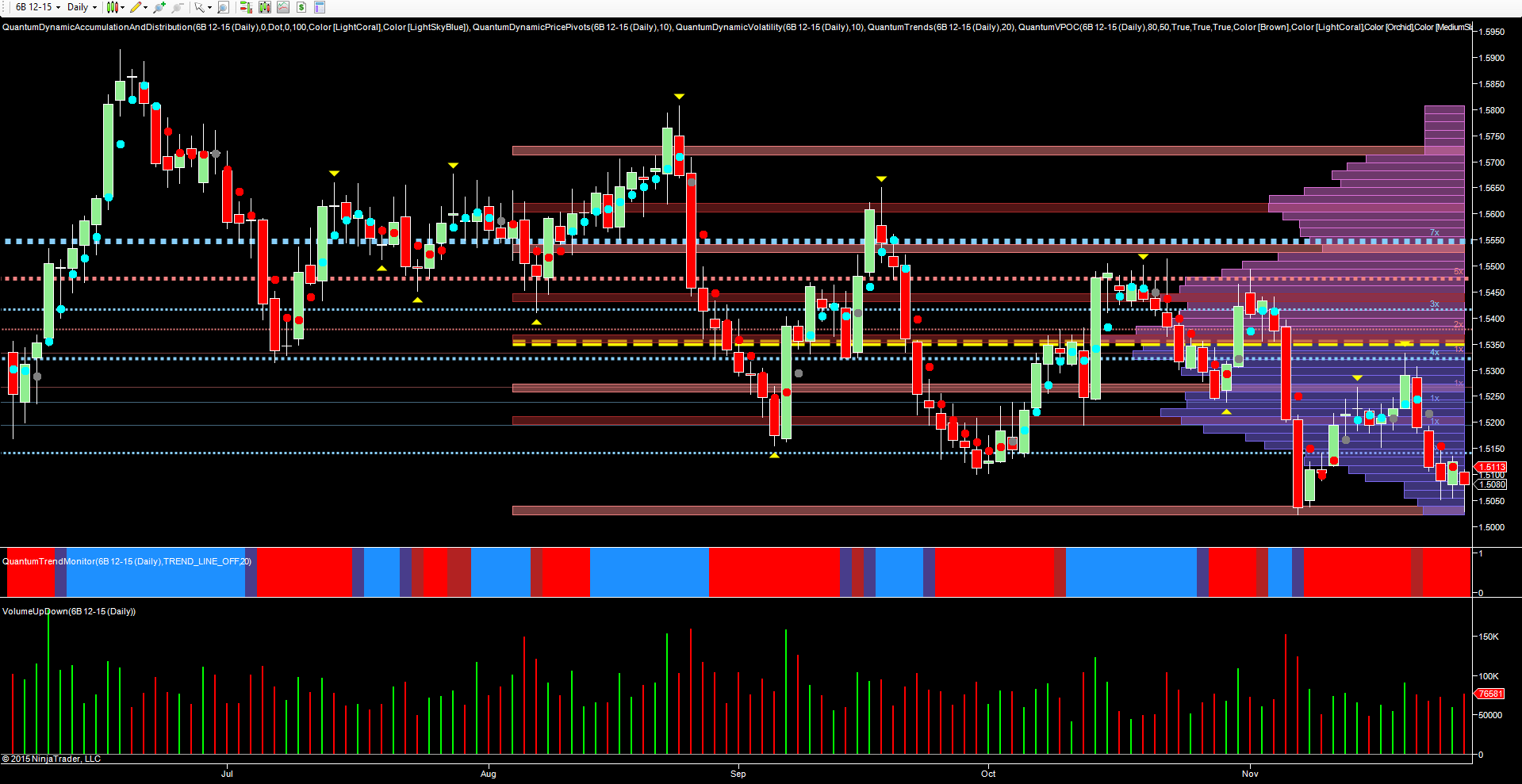

For the British pound and the 6B futures contract, bearish momentum picked up once again last week, with the pair closing the week testing the lows of early November in the 1.5020. Should this level of potential support be breached, this is likely to open the way for a deeper move and back to test the lows of mid April in the 1.4600 region. This platform in the 1.5020 is denoted with the blue dotted line, and any close below this level, coupled with the weight of volume at the fulcrum of the VPOC, then this will add further pressure with an increase in downwards momentum.

For the British pound and the 6B futures contract, bearish momentum picked up once again last week, with the pair closing the week testing the lows of early November in the 1.5020. Should this level of potential support be breached, this is likely to open the way for a deeper move and back to test the lows of mid April in the 1.4600 region. This platform in the 1.5020 is denoted with the blue dotted line, and any close below this level, coupled with the weight of volume at the fulcrum of the VPOC, then this will add further pressure with an increase in downwards momentum.

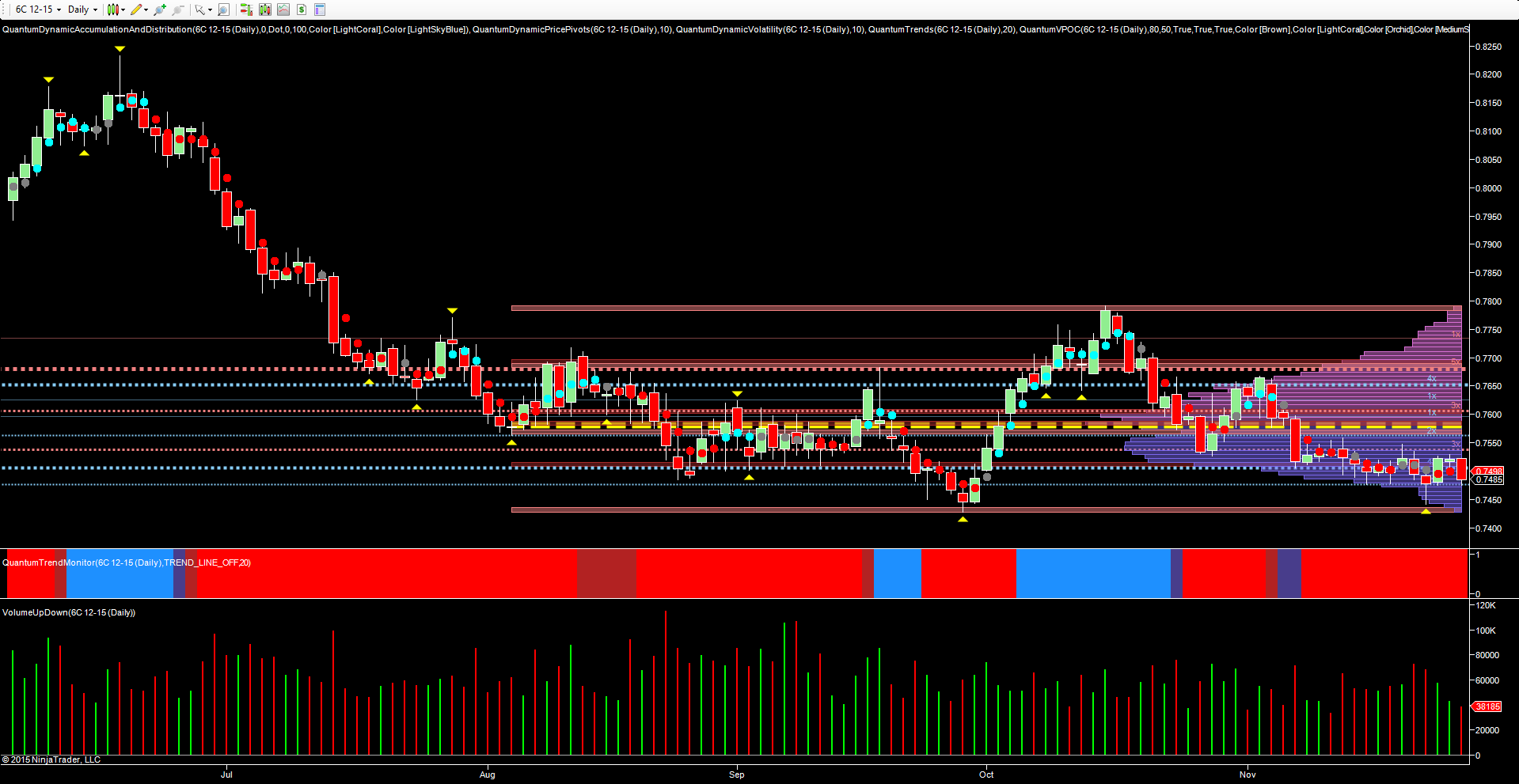

Moving to the CAD/USD, the Canadian dollar continues to battle on two fronts, as the combined effects of falling oil prices, and US dollar strength continue to pressure the currency. For much of November, the pair has maintained its position on the chart, trading in a tight range, but under increasing pressure with the trend monitor continuing to register this bearish sentiment. Much will now depend on the 0.7430 area which was tested back in late September and duly held. Indeed this level was tested again on Monday last week, when it held once again with a pivot low delivered on the subsequent price action. However, with the volume point of control firmly overhead. and with oil and the US dollar combining, it is perhaps not a question of if, but when this level is breached.

Moving to the CAD/USD, the Canadian dollar continues to battle on two fronts, as the combined effects of falling oil prices, and US dollar strength continue to pressure the currency. For much of November, the pair has maintained its position on the chart, trading in a tight range, but under increasing pressure with the trend monitor continuing to register this bearish sentiment. Much will now depend on the 0.7430 area which was tested back in late September and duly held. Indeed this level was tested again on Monday last week, when it held once again with a pivot low delivered on the subsequent price action. However, with the volume point of control firmly overhead. and with oil and the US dollar combining, it is perhaps not a question of if, but when this level is breached.

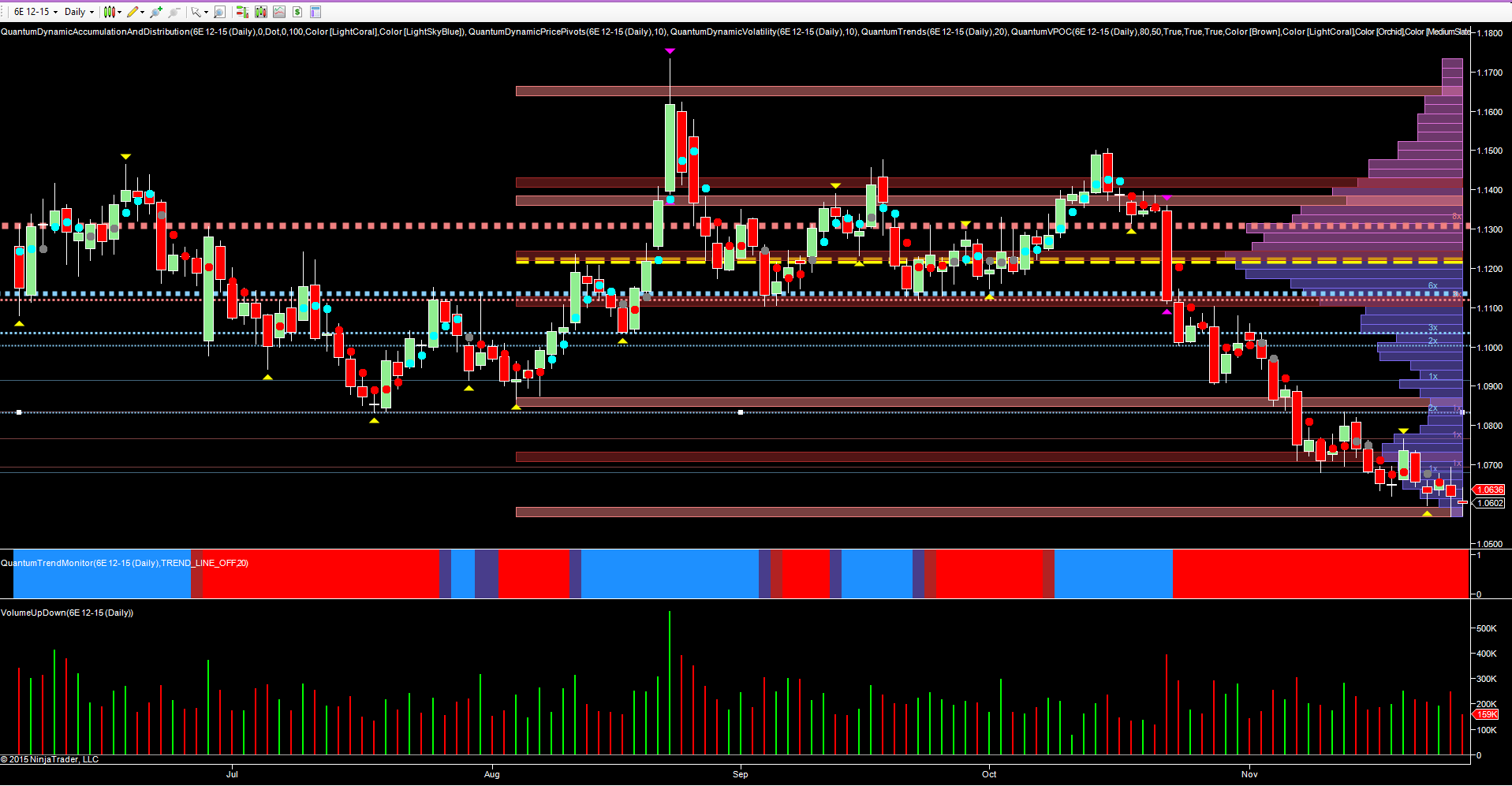

Finally to the euro, and the 6E for December, which continues to grind ever lower although at a slower pace than that seen in late October and early November. The trend monitor continues to confirm the heavily bearish sentiment for the pair, and with the high volume node having been breached at 1.0700, this too is adding further downwards pressure coupled with the volume point of control which remains firmly in place at 1.1200. With the ECB now set on a path of further stimulus, the outlook for the euro is one of further weakness, with the almost inevitable move towards parity in the longer term. There is little to suggest any serious buying at present in the slower timeframes, and until we see a buying climax of any substance, then the longer term outlook is negative for the single currency.

Finally to the euro, and the 6E for December, which continues to grind ever lower although at a slower pace than that seen in late October and early November. The trend monitor continues to confirm the heavily bearish sentiment for the pair, and with the high volume node having been breached at 1.0700, this too is adding further downwards pressure coupled with the volume point of control which remains firmly in place at 1.1200. With the ECB now set on a path of further stimulus, the outlook for the euro is one of further weakness, with the almost inevitable move towards parity in the longer term. There is little to suggest any serious buying at present in the slower timeframes, and until we see a buying climax of any substance, then the longer term outlook is negative for the single currency.