I guess I might have surprised some with my comments in Current Thoughts yesterday on a bounce now in the precious metals. When I say in my comments certain things, all the other pieces have to fall in place. In this case, the dollar has to test its recent lows too and yes, the ECB can trump current thought this week but for now we have a small bounce occurring in gold off of the $1,200 mark.

For whatever reason we are hearing the Fed talk the talk more than normal about a rate increase, but if they disappoint, which is my take, gold can move higher. This move down was based on talk too, not any action. Don’t you love how things like fundamentals and valuations and debt and data don’t matter for investing any longer? What’s the Fed going to do? I reference this in detail with my upcoming book.

In Chapter 4 of my first book written in 2010 I reference that deflationary/contraction outlook with over 100 footnotes. We know since then I have been overall dollar bullish and I have said this would put pressure on metals. I follow many things that give me insight for micro calls. In fact, I wake up every morning and spend a minimum of an hour just reading the many financial sites to get a grasp on what’s happening in the world. I don’t come to the conclusions I do by accident.

Tuesday we had a decline in the overall markets coupled with a fall in oil prices and all eyes are on Thursday’s meeting of OPEC members.

I want to point out something that should be on everyone’s minds and that is the crisis in Venezuela. Oil prices falling have devastated this country and this bounce higher in oil hasn’t come quick enough to fend off a severe economic crisis. They are literally running out of food, toilet paper, medicine, and even beer. Airlines have stopped flying there and they are selling what gold reserves they have to pay for things.

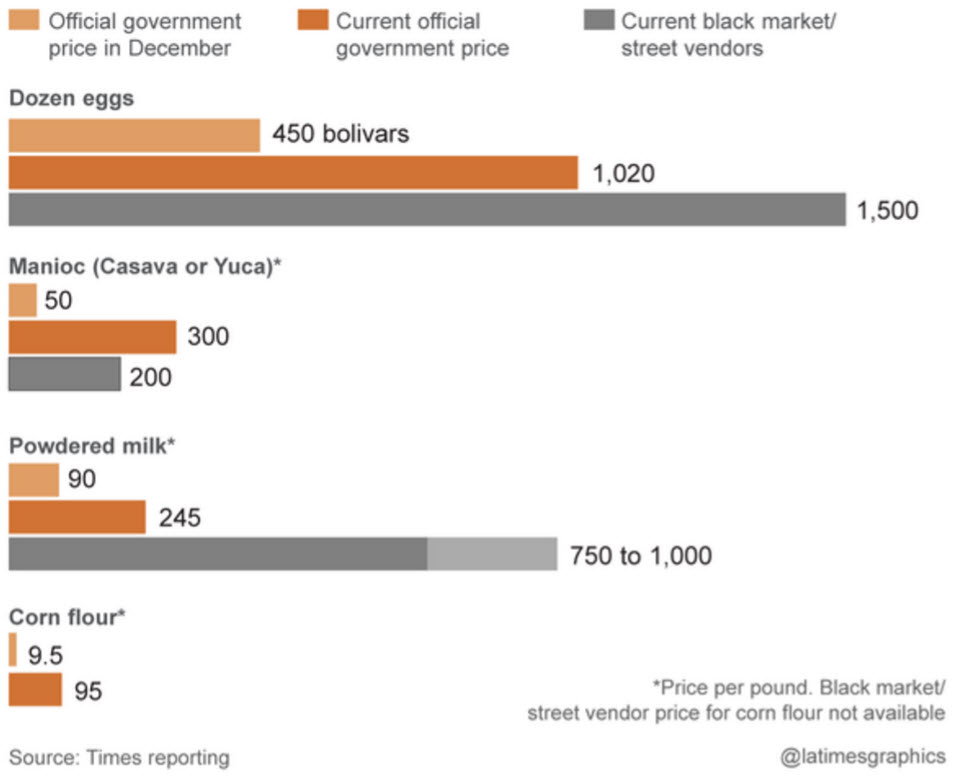

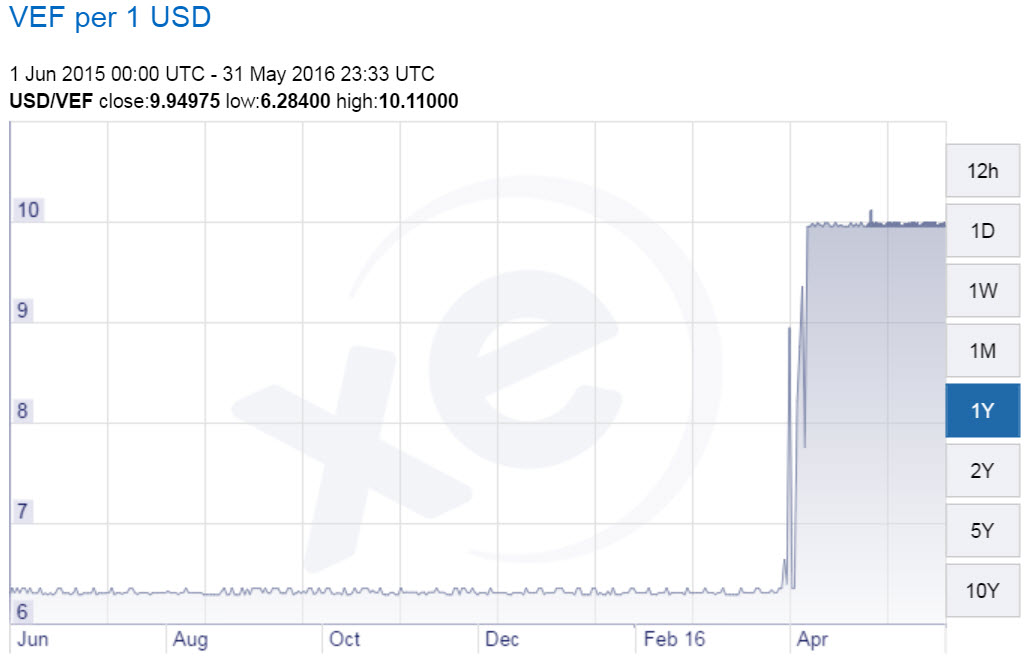

The IMF predicted Venezuela’s inflation to be 720% in 2016 but now some are saying that rate may be 1200% as it already costs $150 to buy a dozen eggs. Today one U.S. dollar will get you 9.95 Venezuelan Bolivar. The equivalents in the following chart won’t last. It will get worse because that’s what happens when you lose faith in a currency. Interestingly enough, the IMF was there for Greece but Venezuela under the leadership of Hugo Chavez severed ties to the IMF and World Bank in 2007 saying Venezuela no longer needed institutions “dominated by US imperialism”.

First, let me state that the U.S., is not Venezuela. Nowhere near it. Argentina is who I would watch in Latin America along with Brazil once the Olympics are over. Venezuela is living proof of what a one horse economy can do when that horse isn’t performing and is exactly why countries like Saudi Arabia in the Middle East are diversifying from oil. This also means to me that these countries are going to continue pumping oil and paying their bills and Saudi Arabia itself will not let Iran get all the profits from selling oil now that they can.

But for us here in the U.S. it is the euro and yen that matter most to the U.S. dollar as they make up 71.2% of the dollar. Throw in the UK/pound and a potential Brexit and we’re at 83.1%. I have written that after this current downturn in the dollar and upturn in gold, which we have not finished either yet, that the dollar will go past 100 on the index. This will put pressure on gold still as it has been since 2011.

If you were in Venezuela right now, would you want dollars instead of your depreciating currency? Can you see how this type of attitude can snowball into something bigger should some of these other Latin America countries begin to implode? What about Europe with all their issues? What about Asia? When money needs to be raised, these countries that need capital will actually look to sell gold as Venezuela is because it’s just sitting there. In a deflationary credit contraction, illusions of wealth flow to real wealth. First that will be perceived wealth found in U.S. treasuries and dollars, and eventually gold.

Remember, the Asian financial crisis started with little old Thailand devaluing their currency. Eventually the dollar and gold will move up together, but we are not there yet.