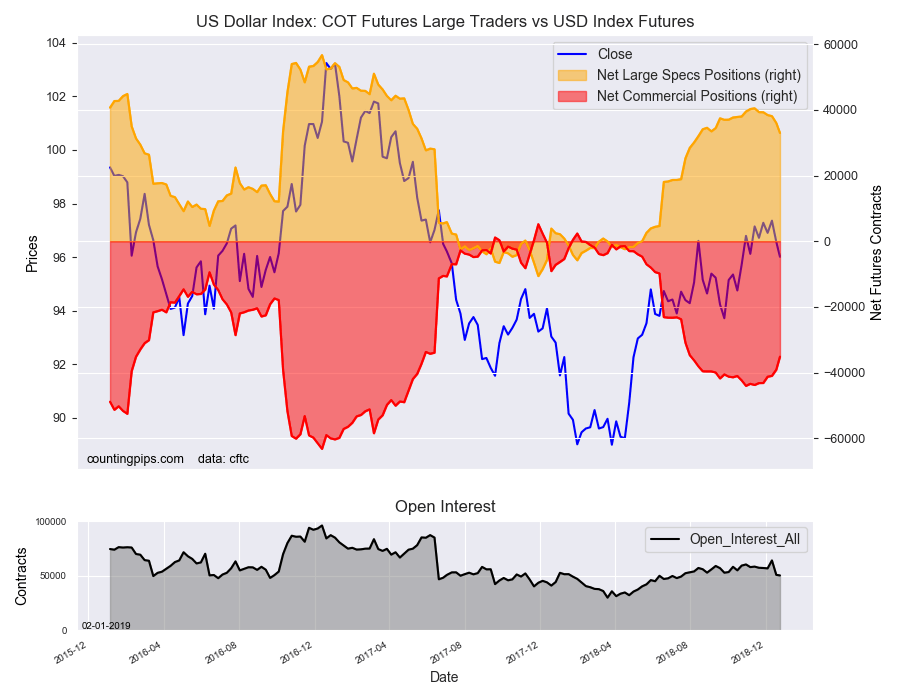

U.S. Dollar Index Speculator Positions

Large currency speculators were cutting back on their bullish net positions in the U.S. Dollar Index futures markets into late December, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

This latest COT data is from late in December due to the government shutdown which halted the releases. The CFTC will be releasing data on Tuesdays and Fridays going forward until the data is back up to date.

The non-commercial futures contracts of U.S. Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 32,985 contracts in the data reported through Tuesday, December 24th. This was a weekly lowering of -3,064 contracts from the previous week which had a total of 36,049 net contracts.

The week’s net position was the result of the gross bullish position (longs) decreasing by -2,945 contracts to a weekly total of 40,353 contracts compared to the gross bearish position (shorts) which saw a rise by 119 contracts for the week to a total of 7,368 contracts.

The speculative position fell for six straight weeks through December 24th after a remarkable run of only two down weeks in the previous thirty. The spec position remained bullish but was cooling off in that period.

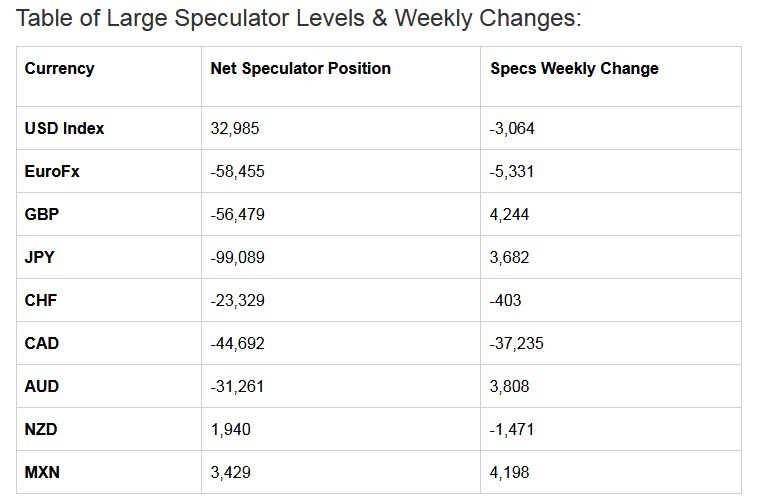

Individual Currencies Data:

In the other major currency contracts data, we saw only one substantial change (+ or – 10,000 contracts) in the speculators' category.

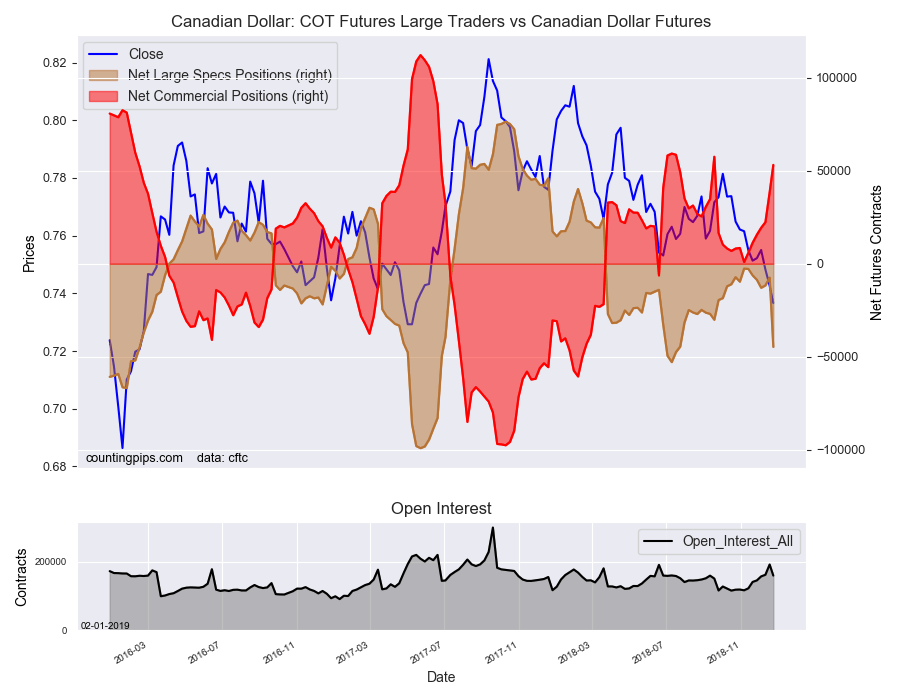

The Canadian dollar speculative positions dropped sharply by over -37,000 bets on Dec.24th. This decline pushed the bearish position to its highest level since July 17th of 2017.

Overall, the major currencies that saw improving speculator positions that week were the British pound sterling (4,244 weekly change in contracts), Japanese yen (3,682 contracts), Australian dollar (3,808 contracts) and the Mexican peso (4,198 contracts).

The currencies whose speculative bets declined were the U.S. dollar index (-3,064 weekly change in contracts), euro (-5,331 weekly change in contracts), Swiss franc (-403 contracts), Canadian dollar (-37,235 contracts) and the New Zealand dollar (-1,471 contracts).

Weekly Charts: Large Trader Weekly Positions vs Price

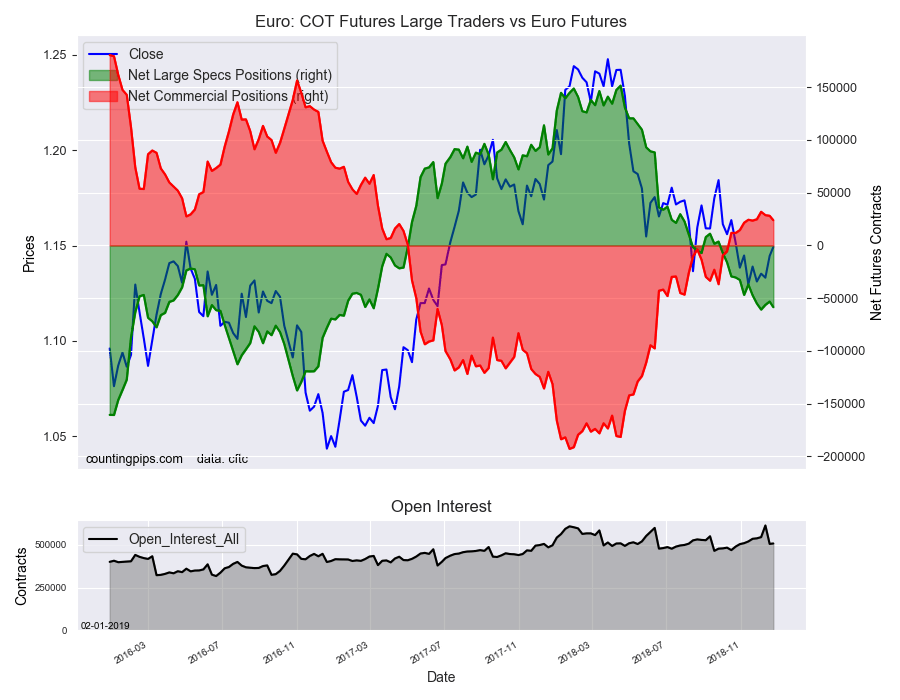

Euro:

The euro large speculator standing totaled a net position of -58,455 contracts in the data reported through Tuesday December 24th. This was a weekly decrease of -5,331 contracts from the previous week which had a total of -53,124 net contracts.

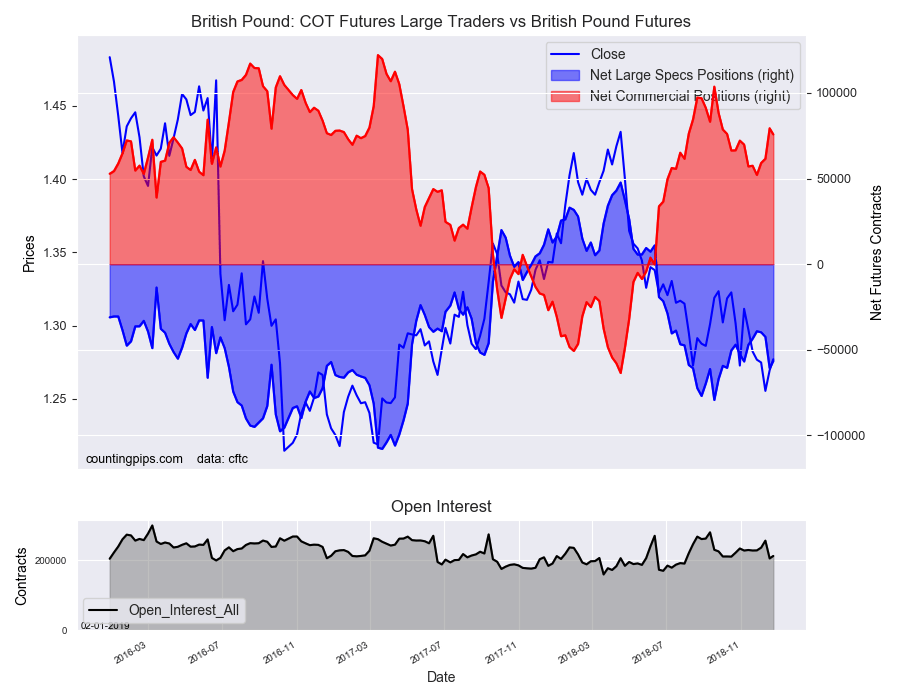

British Pound Sterling:

The large British pound sterling speculator level was a net position of -56,479 contracts. This was a weekly boost of 4,244 contracts from the previous week which had a total of -60,723 net contracts.

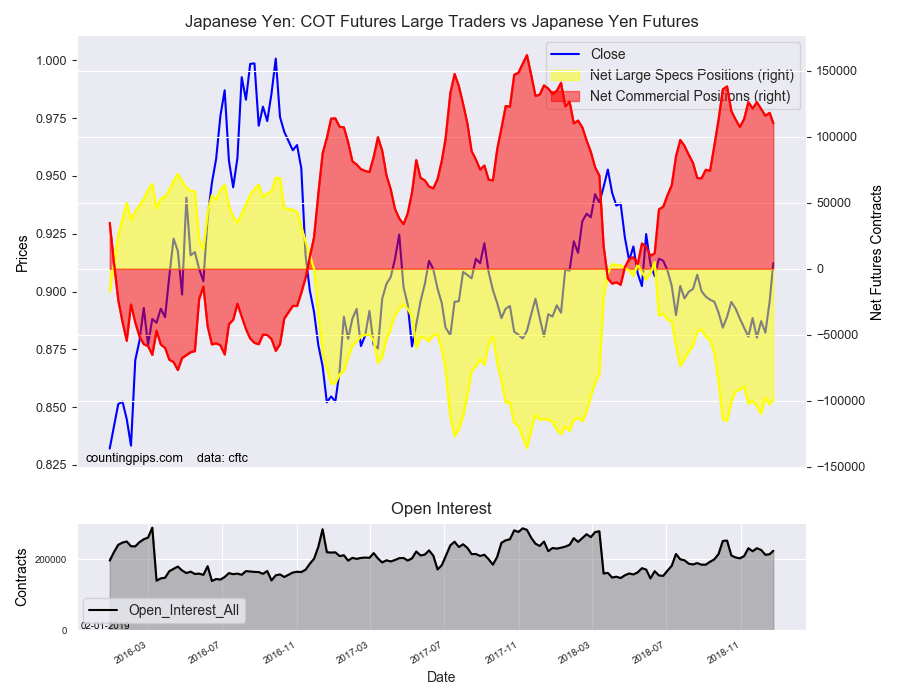

Japanese yen:

Large Japanese yen speculators totaled a net position of -99,089 contracts. This was a weekly rise of 3,682 contracts from the previous week which had a total of -102,771 net contracts.

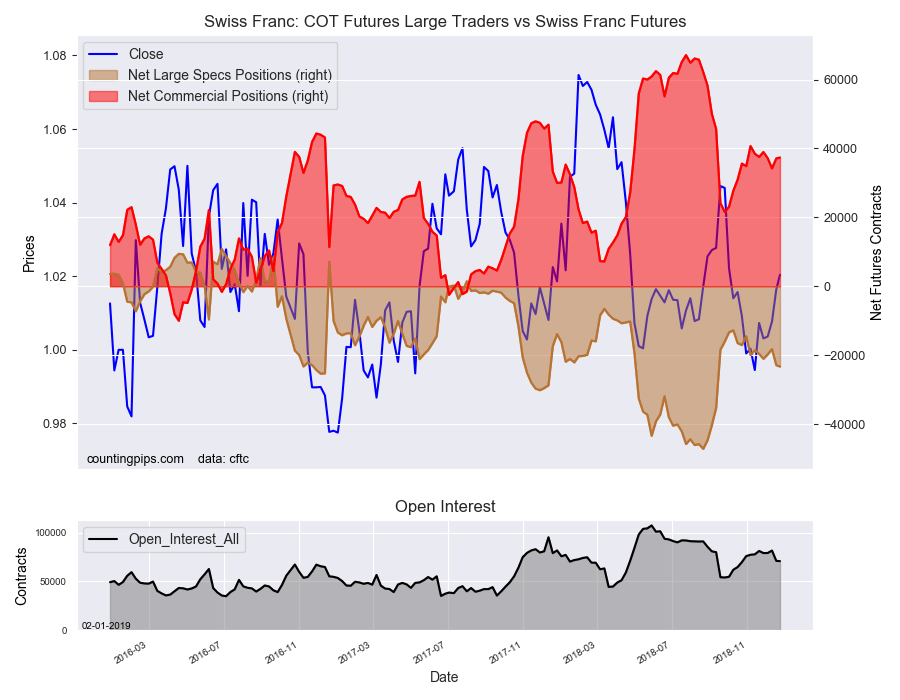

Swiss franc:

The Swiss franc speculator standing resulted in a net position of -23,329 contracts. This was a weekly decrease of -403 contracts from the previous week which had a total of -22,926 net contracts.

Canadian dollar:

Canadian dollar speculators equaled a net position of -44,692 contracts. This was a decline of -37,235 contracts from the previous week which had a total of -7,457 net contracts.

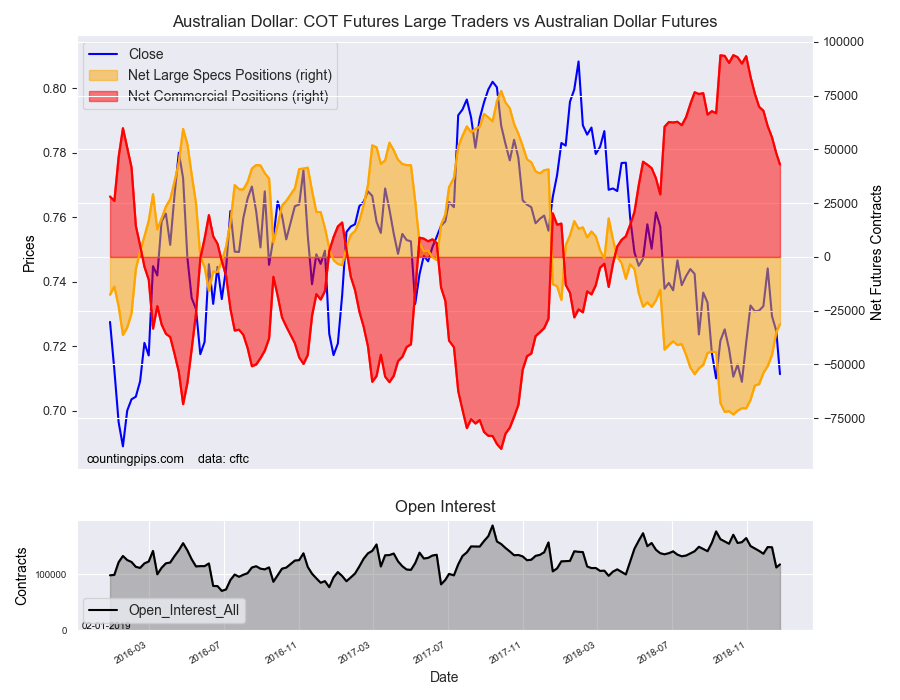

Australian dollar:

The large speculator positions in Australian dollar futures was a net position of -31,261 contracts. This was a weekly lift of 3,808 contracts from the previous week which had a total of -35,069 net contracts.

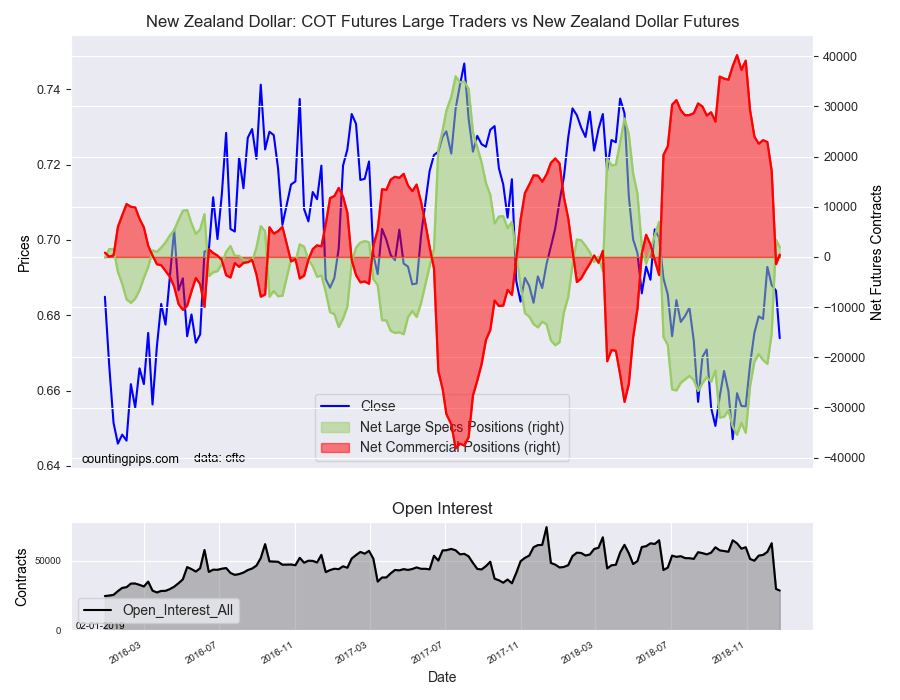

New Zealand dollar:

The New Zealand dollar speculative standing was a net position of 1,940 contracts in the latest COT data. This was a weekly decrease of -1,471 contracts from the previous week which had a total of 3,411 net contracts.

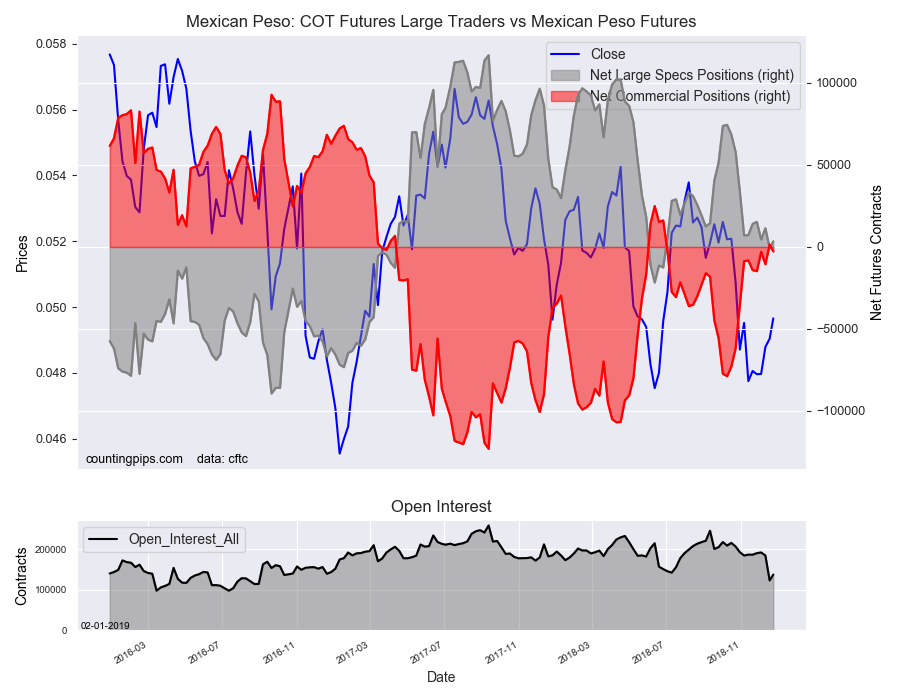

Mexican peso:

Mexican peso speculators totaled a net position of 3,429 contracts. This was a weekly gain of 4,198 contracts from the previous week which had a total of -769 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).