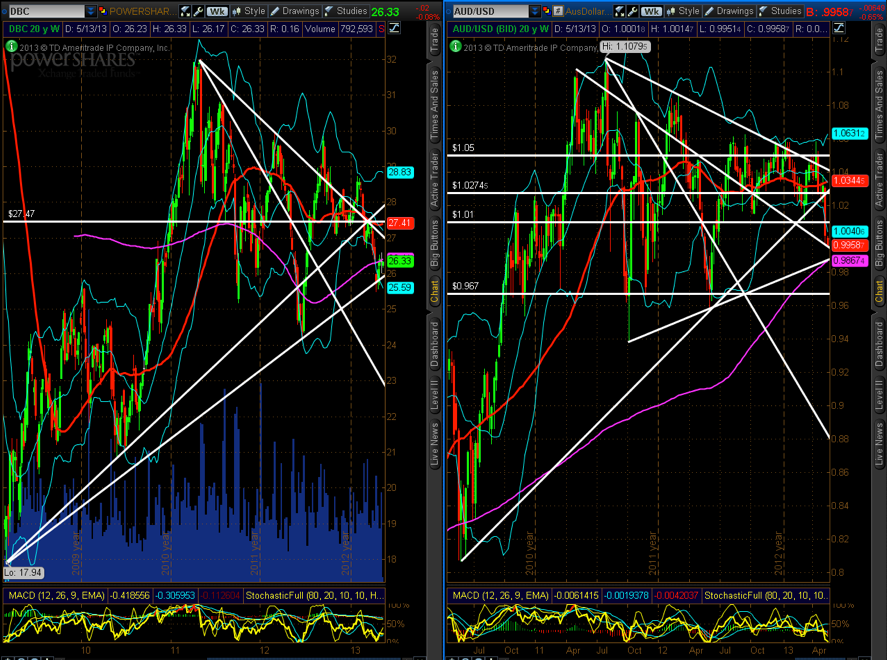

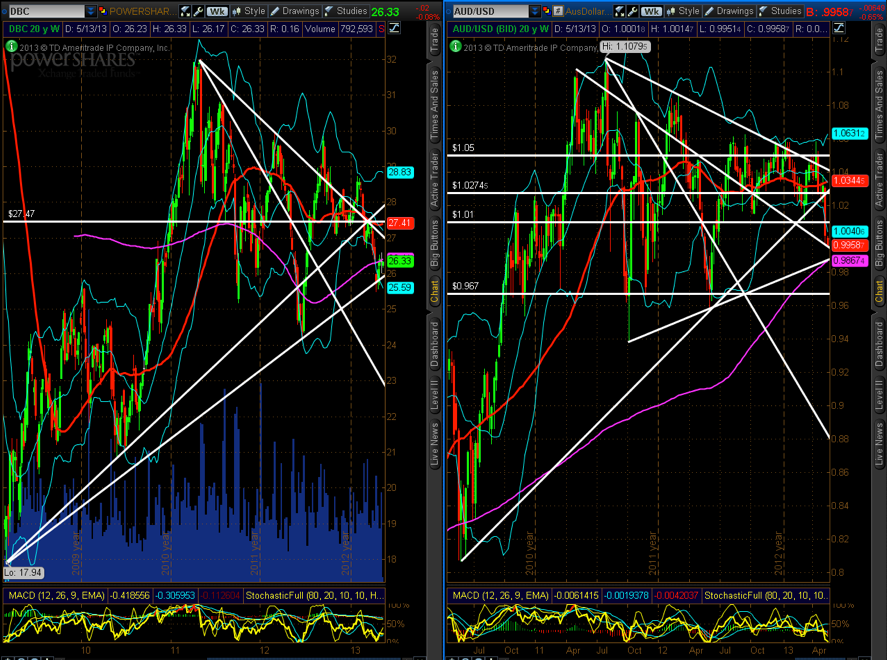

The Aussie dollar is hugging support half-way through Monday's U.S. trading day. AUD/USD" width="887" height="660" />

AUD/USD" width="887" height="660" />

I'll need to see China's Shanghai Index advance and hold above the Daily 50-MA to, potentially, support any attempted rally in the AUD/USD forex pair.

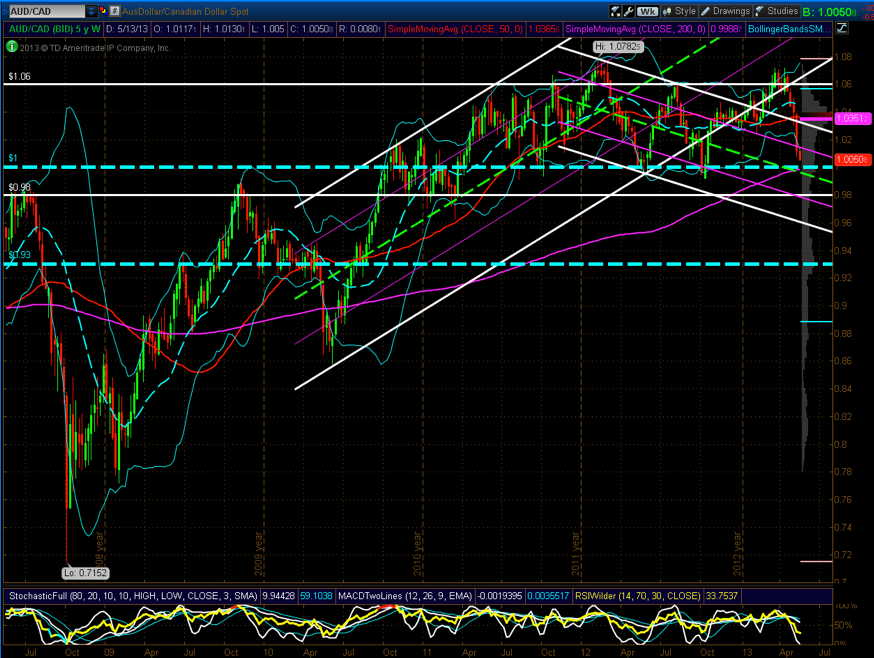

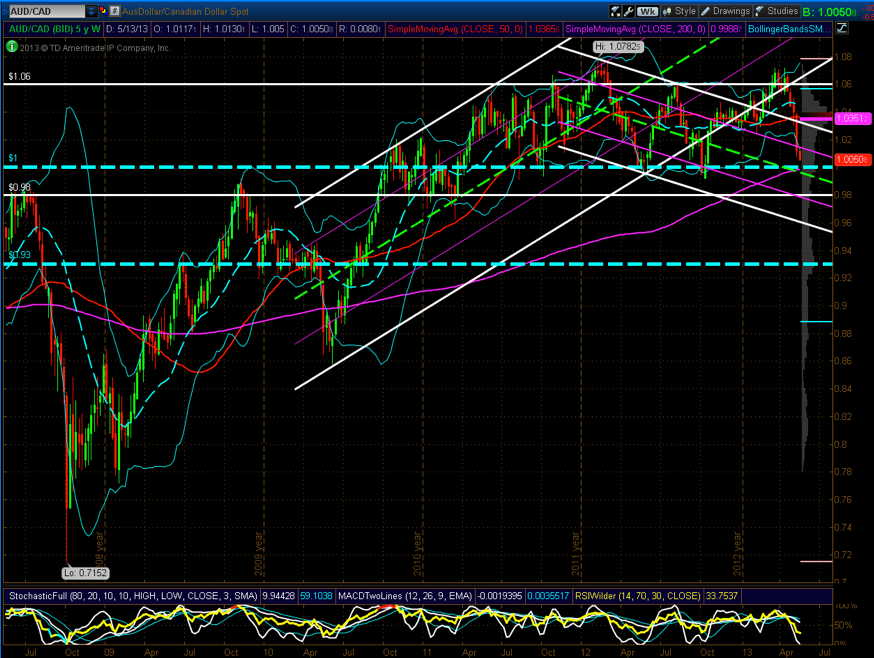

A drop and hold below 1.00 on the AUD/CAD forex pair could signal harder times ahead for China, particularly if the above scenarios do not materialize.

AUD/CAD" width="874" height="658" />

AUD/CAD" width="874" height="658" />

That may, then, produce a drag on any further advancement in North American markets. As well, further weakness in commodities may also produce the same effect. You can see from the first chart above that DBC (the Commodities ETF) is attempting to stabilize -- after experiencing considerable weakness this year and, basically, since 2011. I'll be watching for any break-and-hold below its last weekly swing low.

AUD/USD" width="887" height="660" />

AUD/USD" width="887" height="660" />I'll need to see China's Shanghai Index advance and hold above the Daily 50-MA to, potentially, support any attempted rally in the AUD/USD forex pair.

A drop and hold below 1.00 on the AUD/CAD forex pair could signal harder times ahead for China, particularly if the above scenarios do not materialize.

AUD/CAD" width="874" height="658" />

AUD/CAD" width="874" height="658" />That may, then, produce a drag on any further advancement in North American markets. As well, further weakness in commodities may also produce the same effect. You can see from the first chart above that DBC (the Commodities ETF) is attempting to stabilize -- after experiencing considerable weakness this year and, basically, since 2011. I'll be watching for any break-and-hold below its last weekly swing low.