1.2283

Very Short-Term Trend: Downtrend

Outlook:

EUR/USD is still in downtrend on its hourly chart, but that's the case only as long as the prices stay below 1.2320 level. A move below 1.2240 is needed to confirm our bearish view and to signal a decline twd this year's low at 1.2042. On the upside, above 1.2320 negates, signals a rally back twd 1.2440...

Strategy: Holding short from 1.2266 remains favored. Stop= 1.2320. Target=1.21000

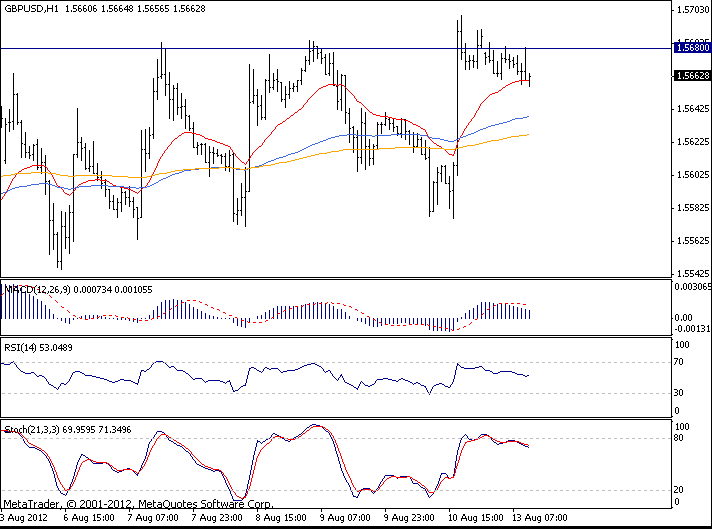

GBP/USD: 1.5661

Very Short-Term Trend: Sideways

Outlook:

As expected GBP rallied to 1.5680 level on Friday. Now, it is pulling back from there and the hourly oscillators are turning negative (but honestly, they are still neutral at this stage). So, I expect to see a move lower today - back twd the lower limit of the recent range. As for the hourly chart to turn bearish, we need to see a break below 1.5570.

Strategy: Holding short from 1.5680 is favored. Stop=1.5740.

USD/JPY: 78.22

Very Short-Term Trend: Sideways

Outlook:

Nothing new to add here. The hourly chart is absolutely neutral and I have no clue when the next significant move will take place. In such conditions, I tend to avoid this market.

Strategy: Stand aside.

Legal disclaimer and risk disclosure: The services provided by Trend Recognition Ltd are intended for informational and educational purposes only. While a course of conduct regarding investments can be formulated from the presented analysis, at no time will Trend Recognition make specific recommendations for any specific person, and at no time may a reader, caller or viewer be justified in inferring that any such advice is intended. The service is not a recommendation to buy or sell securities or an offer to buy or sell securities. The publishers of Trend Recognition website are not brokers or registered investment advisors and are not acting in any way to influence the purchase or sale of any security and/or its derivatives. The data for information provided by this website is obtained from sources deemed reliable but is not guaranteed as to accuracy, or completeness. The use of Trend Recognition services is done so at your own risk. Trading and investing in any financial markets, including, but not limited to the stock market, options market, futures market, bond market, and/or the commodities market involves serious risk of loss, and in some cases, greater loss than the amount invested. You should not rely solely on the information provided on this site in trading. Use of this site is your agreement to assume full responsibility for any losses, and your acknowledgment that we do not guarantee any results or information provided in this site and that you acknowledge that you are forming an independent opinion based upon your own research and resources, and not on the information contained herein. Trend Recognition recommends that you do your own due diligence and research when considering placing any kind of transaction.

It is possible at this or subsequent date, the publishers of Trend Recognition may own, buy or sell the securities discussed therein or their derivatives. Trend Recognition or its publishers are not liable for any losses or damages, monetary or otherwise, that result from trading the securities and/or derivatives discussed within the Trend Recognition website. The publishers of the Trend Recognition recommend that anyone trading securities and/or derivatives should do so with caution and consult with an experienced broker and/or investment advisor before doing so. Past performance of Trend Recognition may not be indicative of future performance and does not guarantee future results.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Currencies Daily Outlook: August 13, 2012

Published 08/13/2012, 02:58 AM

Updated 05/14/2017, 06:45 AM

Currencies Daily Outlook: August 13, 2012

EUR/USD:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.