EUR/USD:

EUR/USD: 1.3237

Short-Term Trend: downtrend

Outlook:

Theoretically the count presented a week ago is still valid as the prices have not moved below the 1.3196 level. So, please, take a view at the last week's analysis. However, the fact that the prices declined so much last week is a sign of weakness and it looks more likely now that the market is actually following the count presented on the chart above. If that's the case, further weakness lies ahead, most likely twd 1.2670 level. Only a move abv 1.3610/20 will be a strong evidence that the last week's wave count is unfolding and in this case, the Short-Term picture will become quite bullish.

Strategy: Shorts favorable on a modest recovery against 1.3620. Target=1.2700.

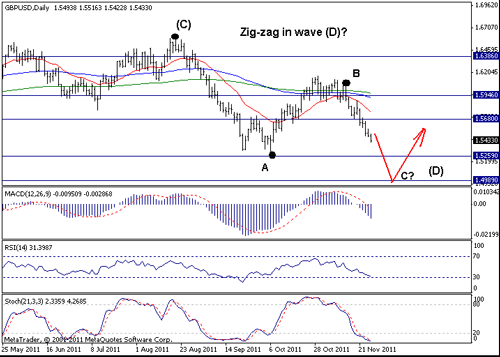

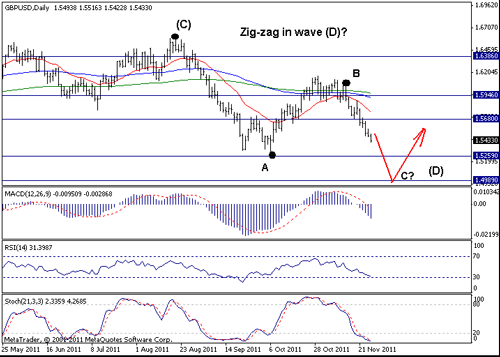

GBP/USD:

GBP/USD:1.5433

Short-Term Trend: downtrend

Outlook:

We were bearish a week ago and we were bearish the entire week in our daily's updates. And GBP fell gradually twd 1.5450/1.5400 area. This price action is a clear sign that the wave count presented on the chart above is correct and we expect to see further weakness this week twd 1.5260 and eventually to 1.5000 level. The market is now oversold, but that by itself does not mean the decline should stop. So, as long as the prices stay below 1.5680, we favor the downside. On the upside, a move abv 1.5680 negates, risks recovery twd 1.5950...

Strategy: Trading from the short side (holding short) remains favorable as long as the prices stay below 1.5700. Target=1.5000.

USD/JPY:

USD/JPY: 77.71

Short-Term Trend: weak downtrend

Outlook:

This market remains quite boring but if we are objective we have to acknowledge that the bulls have managed to gain slight advantage last week. Right now there is a weak uptrend on the very short-term charts (hourly, 30-min) and the daily oscillators try to turn up. So, some follow through buying may be expected early this week. However, as long as the prices stay below the prev. swing high at 79.50/60, the larger-degree outlook remains bearish and we expect to see a resumption of the daily downtrend later this week. But only a move below 76.10/00 will indicate that the bears are taking control here.

On the upside, abv 79.60 negates, risks stronger recovery twd 81.50/82.00 area...

Strategy: Stand aside.

EUR/USD: 1.3237

Short-Term Trend: downtrend

Outlook:

Theoretically the count presented a week ago is still valid as the prices have not moved below the 1.3196 level. So, please, take a view at the last week's analysis. However, the fact that the prices declined so much last week is a sign of weakness and it looks more likely now that the market is actually following the count presented on the chart above. If that's the case, further weakness lies ahead, most likely twd 1.2670 level. Only a move abv 1.3610/20 will be a strong evidence that the last week's wave count is unfolding and in this case, the Short-Term picture will become quite bullish.

Strategy: Shorts favorable on a modest recovery against 1.3620. Target=1.2700.

GBP/USD:1.5433

Short-Term Trend: downtrend

Outlook:

We were bearish a week ago and we were bearish the entire week in our daily's updates. And GBP fell gradually twd 1.5450/1.5400 area. This price action is a clear sign that the wave count presented on the chart above is correct and we expect to see further weakness this week twd 1.5260 and eventually to 1.5000 level. The market is now oversold, but that by itself does not mean the decline should stop. So, as long as the prices stay below 1.5680, we favor the downside. On the upside, a move abv 1.5680 negates, risks recovery twd 1.5950...

Strategy: Trading from the short side (holding short) remains favorable as long as the prices stay below 1.5700. Target=1.5000.

USD/JPY: 77.71

Short-Term Trend: weak downtrend

Outlook:

This market remains quite boring but if we are objective we have to acknowledge that the bulls have managed to gain slight advantage last week. Right now there is a weak uptrend on the very short-term charts (hourly, 30-min) and the daily oscillators try to turn up. So, some follow through buying may be expected early this week. However, as long as the prices stay below the prev. swing high at 79.50/60, the larger-degree outlook remains bearish and we expect to see a resumption of the daily downtrend later this week. But only a move below 76.10/00 will indicate that the bears are taking control here.

On the upside, abv 79.60 negates, risks stronger recovery twd 81.50/82.00 area...

Strategy: Stand aside.