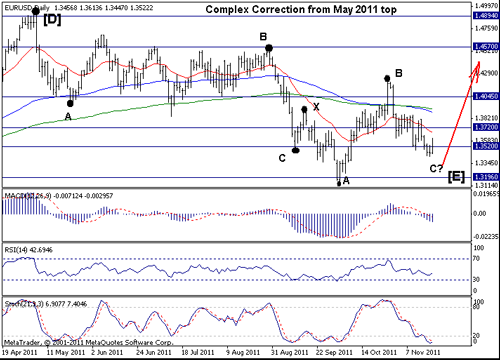

EUR/USD

EUR/USD: 1.3504

Short-Term Trend: weak downtrend

Outlook:

Last week I thought wave [E] from the May 2011 top was over but the price action last week proved I was wrong. The October low may still be the lowest point of this corrective pattern but right now it is obvious the wave strucutre is incomplete. Thus, further weakness can't be ruled out but the price should stay abv the Oct low at 1.3146 for the presented wave count to remain valid. A decline below there will bring much bigger bearish expectations. Anyway, right now the trend is still slightly on the downside, so I do not like the idea of bottom picking.

GBP/USD

GBP/USD: 1.5802

Short-Term Trend: downtrend

Outlook:

The break below 1.5870 last week confirms the wave B from the early Oct low is over and if the presented wave count is correct, weakness twd 1.5000 lies ahead. Thus, I am bearish now as long as the prices stay below 1.6000 and 1.6100. A decline below 1.5680 will further solidify that bearish view. The daily oscillators more or less confirm the bearish outlook as well. So, with all this in mind, I favor shorts here as the downside potential is quite large at this point.

USD/JPY

USD/JPY: 76.82

Short-Term Trend: weak downtrend

Outlook:

The move down has been very choppy last week but still the prices moved lower. The daily trend is still firmly on the downside as the prices remain below the declining 100-day and 200-day moving averages. But this market remains difficult to trade because the price action is so boring. Still, I believe that eventually the price will firmly break below the 76.10/00 support and the downside pressure will accelerate.

On the upside, only a move abv 79.50 will negate this bearish view