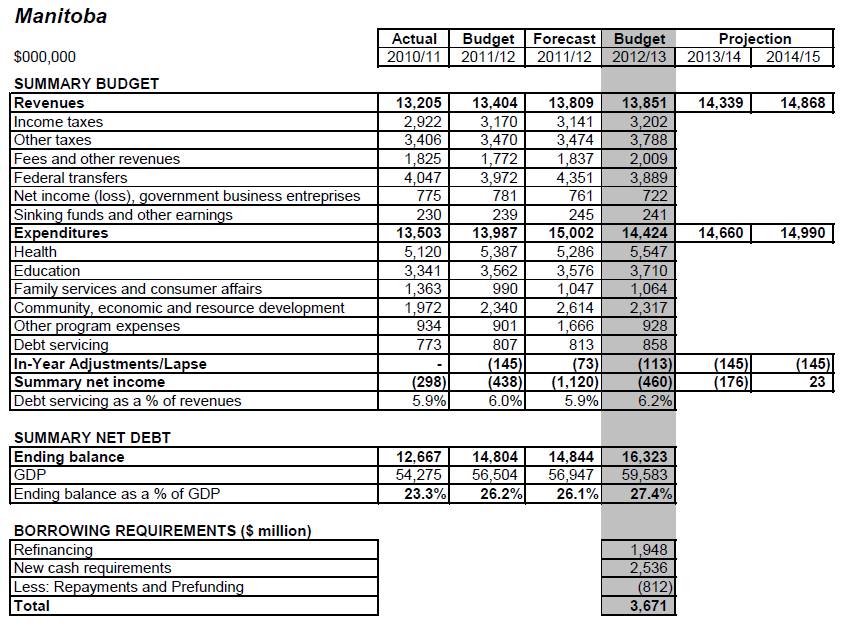

Highlights- Deficit last year swelled to $1.1 billion due to flooding costs.

- In 2012-13, the deficit is projected at $460 million. A balanced budget is still forecasted for 2014-15.

- A program portfolio management review is estimated to bring $128 million in savings in 2012-13.

- Selected tax changes are estimated to bring $182.3 million in new revenues (full-year impact), such as broadening sales tax base ($106.5 billion) and an increase in gasoline tax and motive fuel tax ($48.6 million).

- Budget 2012 includes $1.7 billion in capital investment.

- As a percentage of GDP, the Summary net debt at the end of 2012-13 is forecast at 27.4%, compared to 26.1% estimated at last March 31, and to 32.9% in 1999-2000.

- Real GDP is estimated to grow 2.3% in 2012 and 2.4% in 2013.

- Borrowing requirement for 2012-13 are estimated to total $3.7 billion, of which $2 billion is required for refinancing purposes.

Commentary

Finance Minister Stan Struthers’ 2012 budget covers year three of a five-year strategy aiming at eliminating the deficit that first appeared in 2009-10. With the impact of the 2011 flood behind, the Minister combines expense management and selected increases in taxes and fees in order to respect the schedule of a balanced budget in two years.

Curbing expenses is reached through rationalization of government operations, such as reducing the number of regional health authorities and government-appointed agencies, boards and commissions, merging the Manitoba Liquor Control Commission and the Manitoba Lotteries Corporation and implementing a program portfolio management review. The latter is expected to bring $128 million in savings in 2012-13, or about 1% of core government expenditures.

Selected tax changes are introduced, producing an estimated increase of $182 million in revenues (or 1.3% of 2011-12 summary revenues). Effective July 1, 2012, the retail sales tax will be applied to some personal services ranging from hair services to property and casualty insurance (full-year impact: $106.5 million). Effective May 1, 2012, the fuel tax rate on gasoline and diesel fuel will increase from 11.5 cents to 14 cents per litre (full-year impact: $48.6 million).

Commencing with taxation years ending after April 17, 2002, the Corporation Capital Tax on Financial Institutions is increased from 3% to 4% (full-year impact: $11.6 million). Commencing with the 2012 taxation year, the dividend tax credit is reduced from 11% to 8% (full-year impact: $13.5 million). The tobacco tax is increased by 2.5 cents per cigarette (full-year impact: $10 million). However, $53 million must be subtracted from the fiscal impact of the tax changes to account for tax reductions previously announced that take effect after 2011. Also, vehicle registration fees are increased by $35.

Over the next two years, with summary revenues projected to grow 3.6% on an annual basis, summary expenses growth has to be limited to 1.9% in order to balance the books.

The government acknowledges that the net debt to GDP ratio will rise in the short term as the government makes investments in infrastructure projects including repairing the damage caused by the 2011 flood and mitigating the impact of any future floods. In 2012-13, the $1.5 billion increase in net debt comes from the projected $460 million summary budget deficit and from $1 billion for financing investment in capital assets. The ratio is expected to return to a downward trend in 2014-15.

Source: Budget documents from the Ministry of Finance, Manitoba.