The Russell 2000 pulled the broad market out of the depths of February. It continued higher until reaching a peak 2 weeks ago. Since then it hasn't had such a good ride. It has fallen a little less than 5%, which isn't a huge pullback given the 22% rise that preceded it. The real question is, will it continue to fall or will it soon reverse?

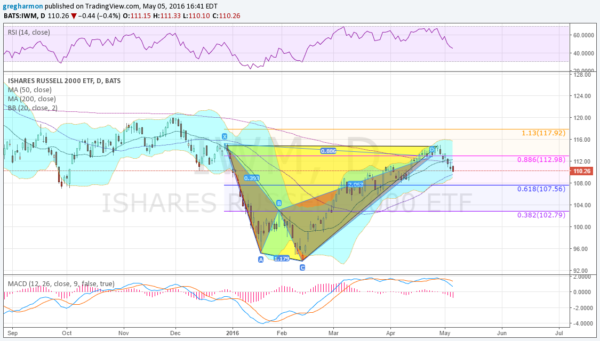

The chart below shows two overlapping patterns that suggest the downside is not over yet. The yellow pattern is a Cup and Handle. The Cup has been built, with Handle representing the pullback. If the Russell 2000 is simply digesting, then it should not fall below the 105 area.

The two orange triangles represent a bearish harmonic Shark pattern, which reached its Potential Reversal Zone (PRZ) 2 weeks ago and triggered to the downside. The first target would be a 38.2% retracement of the pattern -- or to 107.56. Failure there would target 102.79.

Both of these patterns look for more downside and momentum supports that too. The RSI and MACD are both falling. But both also remain in bullish ranges. The Bollinger Bands® are pointing higher and price is near the bottom band. The 50-day SMA close by may also be an area to attract buyers.

For now, the Russell is in limbo. A move under the 50-day and lower Bollinger Band at about 109 would add weight to the extended downside. A stall and reversal before breaking 107.5 would add weight to the case for it just digesting the long run higher and prepping for the next leg up.