Dividend growth investors should pay attention to Cummins (NYSE:CMI). A few compelling stats about the company’s stock are below:

- 25% dividend hike in July

- 3.1% dividend yield

- Price-to-earnings ratio of 13.4

- 25 years without a dividend reduction

- 14.3% earnings-per-share CAGR over the last decade

Are you interested in Cummins Inc (NYSE:CMI) yet? This article takes a deeper look at Cummins’ business, valuation, and dividend prospects.

Cummins is the world’s largest manufacturer of diesel engines. The company was founded in 1919 and is headquartered in Columbus, Indiana. Cummins has grown to reach a market cap of $22.7 billion.

Segment Overview & Geographical Breakdown

Cummins operates in 4 segments. Each segment is shown below along with the percentage of total EBIT the segment generated in fiscal 2014 to show the relative size of each segment:

- Engine: 48% of company EBIT

- Distribution: 19% of company EBIT

- Components: 27% of company EBIT

- Power Generation: 6% of company EBIT

The engine segment manufactures and markets diesel and natural gas powered engines. The segment manufactures engines for the following vehicles: trucks, buses, motor homes, and recreational vehicles. In addition, the segment manufactures engines for the following industries: agriculture, rail, mining, and power generation.

The distribution segment consists of 34 company-owned and 8 joint-venture distributors. The segment controls 400 locations across the world. The distribution segment sells the full range of Cummins products and parts, and provides service to Cummins customers.

The components segment supplies products that compliment the engine segment. The segment manufactures and sells the following equipment for diesel engines: turbochargers, fuel systems, filtration systems, and after treatment systems. The segment has a joint-venture partnership with Scania.

The power generation segment designs and manufactures power generating equipment (as the name would suggest). The segment is a global provider of power generation systems, components, and services.

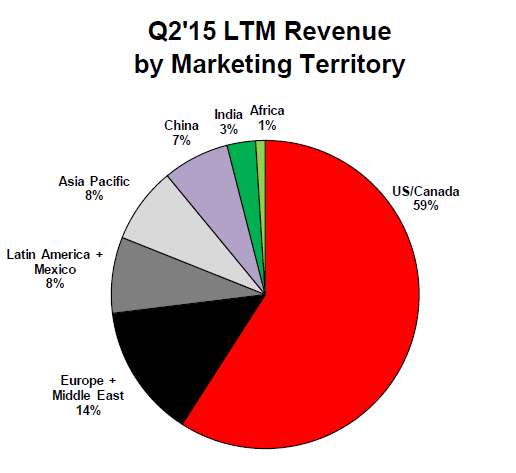

Cummins generated 59% of its revenues in the United States and Canada over the last 12 months. The company gets the rest of its revenue from international markets. The image below shows breaks down the company’s revenues geographically:

Dividend Yield & History

Cummins currently has a dividend yield of 3.1%. The company has paid steady or increasing dividends since 1991, making 2015 the 25th consecutive year of dividend payments without a reduction.

Over the last decade, Cummins has seen rapid dividend growth. The company has compounded dividends per share at an absurd 28.2% a year over the last decade. Dividend growth will (obviously) not maintain this break-neck pace forever.

With that said, the company’s most recent increase was for 25%. Cummins currently has a payout ratio of 32.7%. With a fairly low payout ratio, Cummins can continue to raise its dividend faster than overall company growth for several more years.

In addition to a shareholder friendly management, Cummins also has a very conservative balance sheet. The company has $1.76 billion in cash on hand, and just $1.6 billion in debt. Cummins could wipe out the entirety of its debt with cash on hand, if it chose to. As an added bonus, the company’s pension is currently over funded – the pension fund has $4.4 billion in assets versus $4.1 billion in obligations.

Growth Prospects

Cummins has grown earnings-per-share at 14.3% a year over the last decade. The company’s solid growth is a result of continued demand for the company’s diesel products.

Cummins has focused on international expansion in recent years. The company continues to expand in Brazil and China. In the short-term, this will cause growth to slow as these economies slow down. In the long run, emerging economies will very likely outpace the growth of the United States economy.

In addition to its international strategy, Cummins has a compelling domestic strategy. The company is fully acquiring its partially-owned joint venture distributors in the United States. These acquisitions added an extra 3% to sales growth in the 2nd quarter. Cummins will continue to acquire its distributors in the United States to take advantage of synergies. The company’s president and COO Rich Freeland had this to say about the synergies resulting from acquiring distributors:

“The synergies are significant and Tom outlined several of them and you can expect redundant ADCs, call centers, our whole purchasing which as you’ve seen we’re pretty good at as a company. We will be able to centralize the purchasing and take advantage of that, so we’ve yet to quantify that. The numbers will be significant kind of our next step and we’ve consciously delayed from that other than the back office.”

In addition to organic growth, growth from distributor acquisitions, and further growth in emerging markets, Cummins will also continue to repurchase shares. The company has repurchased 1.7% of shares outstanding a year over the last decade.

Valuation & Recent Results

Cummins’ stock price has struggled this year. The stock is down over 10% year-to-date, while the S&P 500% is up 2.4% over the same period.

The decline is due primarily to weakness in the transportation industry. The Dow Jones Transportation Index is down 8.9% year-to-date. As an engine manufacturer, this has impacted Cummins’ share price.

You will note that Cummins’ stock has slid more than the Dow Jones Transportation Index year-to-date. This implies that Cummins is struggling… Which is not the case.

The company’s recent 2nd quarter earnings showed earnings-per-share growth of 7.8%. The company’s guidance shows revenue for full fiscal 2015 is expected to grow 2% to 4%.

Cummins has compounded earnings-per-share at 14.3% a year over the last decade. This is excellent growth. Somehow, the company hasn’t had an average annual price-to-earnings ratio above 16 during this time period. It is rare to find a fast growing stock with a low price-to-earnings ratio.

Recent weakness has made Cummins even cheaper. The stock currently trades at a price-to-earnings multiple of just 13.4. The company appears deeply undervalued given its historical growth rate and future growth prospects.

Final Thoughts

Cummins is an industry leading business with an attractive yield, low valuation, and long dividend growth history. The company ranks in the top 20% of stocks with 25+ year dividend histories using The 8 Rules of Dividend Investing.