As the second quarter of 2017 comes to a close, markets have once again been dominated by the Federal Open Market Committee (FOMC) and its decision to raise the short-term interest-rate target another 25bps, to 1.00–1.25%. While this most recent rate hike was priced into the market, the decision to raise rates after a less-than-desirable CPI print made for a somewhat dovish hike.

Additional incoming data has helped confirm the Fed’s outlook, however. Information received since the FOMC last met in May indicates that the labor market has continued to strengthen and that economic activity has grown moderately. The unemployment rate has declined while job gains have fluctuated but remained stable. Given this information, monetary policy remains accommodative, and the median path for the federal funds rate remains unchanged for the rest of 2017.

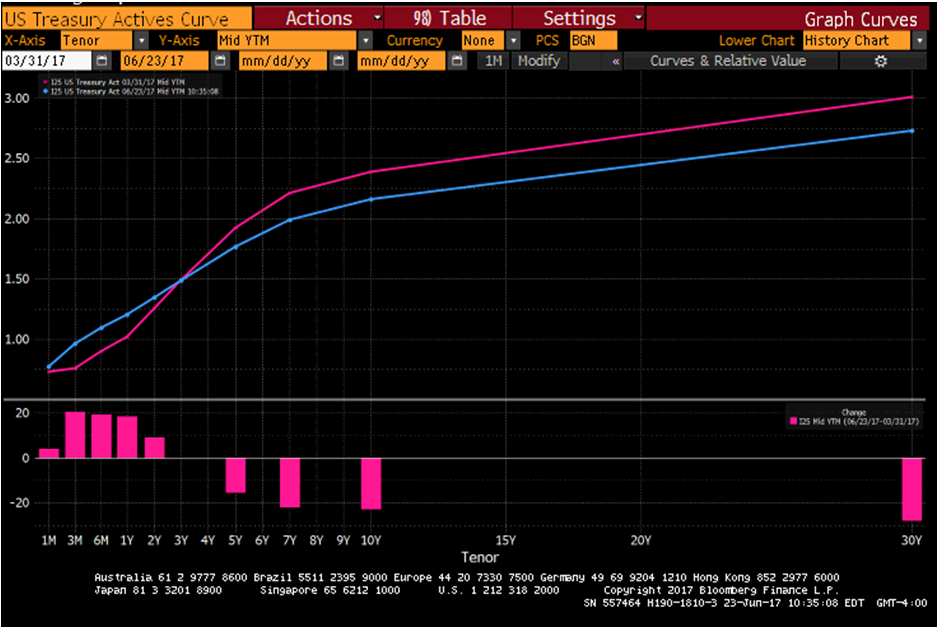

Throughout the second quarter of 2017, the long end of the Treasuries market provided outperformance over shorter-dated Treasury securities. This outperformance was accompanied by continued flattening of the yield curve as the FOMC continues to maintain a bias toward raising short-term interest rates. The largest increase in yields was in the 3-month T-bill, with a 21 bps move higher to 0.945%. The largest decrease in yields was on the long end of the curve, with the 10-year and 30-year Treasuries declining 23 and 28 bps respectively to 2.159% and 2.730%.

The following table shows the US Treasury actives curve, outlining the flattening in the yield curve from the beginning of the second quarter (blue) to 6/23/17 (red).

The flattening of the yield curve is nothing new during Fed hiking cycles and has actually become an outcome expected by many. That is one of the reasons Cumberland Advisors feels confident about managing portfolios via a barbell approach and actively managing durations to interest-rate projections.

While we focused on shortening duration leading into the record lows in the US Treasuries market seen after Brexit, we still maintained a small weighting in longer-dated securities with short call dates that offer higher levels of yield versus shorter-dated securities. We also looked to take advantage of the overselling of fixed-income securities centered around the market euphoria that took place after the November 2016 election, when Donald Trump became the president-elect.

This drastic overselling was then met with the reality of Donald Trump as president and the realization that new policies are much harder to pass and implement than market participants might have believed. As long-end yields began grinding lower after the post-election selloff, Cumberland’s taxable total-return portfolios benefited from the duration extension that was initiated at the end of 2016 and continued throughout the first and second quarters of 2017.

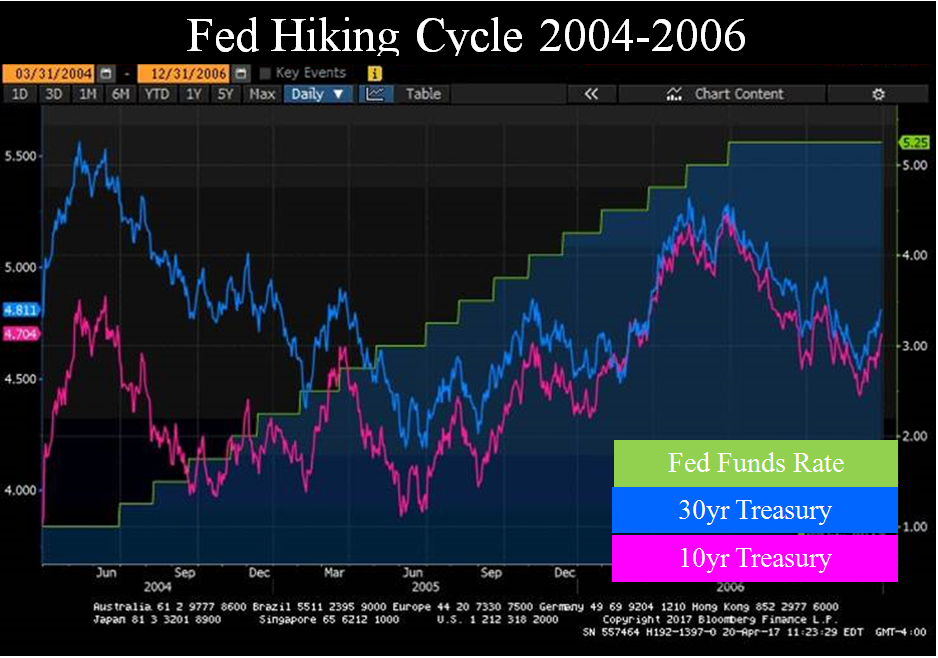

The following table shows the last Fed hiking cycle that took place from 2004–2006 and illustrates the flattening of the yield curve, illustrated by the narrowing of the spread between the 10- and 30-year Treasuries.

Along with the extension of durations, Cumberland’s portfolios have benefited from defensive assets on the short end in the form of Treasury floating-rate securities and Agency multi-step securities that protect against a rising-interest-rate environment. As short-end yields continued to go higher, these assets provided protection in the form of coupon adjustments.

The Treasury floating-rate securities protect against rising interest rates by adjusting the coupon weekly, based on the 13-week T-bill auctions. As short-term rates rise, the coupon of the Treasury floaters increases to help protect the principal value of the securities. The Agency multi-step coupons also protect against rising interest rates by featuring multiple coupon increases (step-ups) over the life of the security. If rates go lower or remain the same, the security is generally called and replaced to maintain the defensive structure of the portfolios. The inclusion of these securities has been beneficial on the short end due to their defensive nature and the continued rise in short-term yields.

As we enter the third quarter of 2017, Cumberland’s view is that short-term rates will continue moving upward over time. At the start of the year, our projection was for at least two and possibly three rate hikes in 2017, and this outlook has not changed. Our expectation is that the FOMC will remain extremely judicious with regard to raising short-term interest rates and will focus on economic data and overall market conditions to determine whether to continue raising rates.

Our goal is to remain defensive in our approach to investing, with a focus on preservation of capital. We will continue making our investment decisions conservatively while extending durations and picking up additional yield as opportunities in the market become available.