Bed Bath & Beyond Inc (NASDAQ:BBBY) reported 1Q earnings that were drastically below what were already low expectations heading into the quarter. The company reported EPS of $0.53, which was well-below consensus of $0.66, and the stock declined 12% on Friday.

There have been some contrarians that have come out in defense of the company, arguing that Bed Bath & Beyond (NASDAQ:BBBY) generates significant free cash flow and returns much of that in the form of share buybacks and dividends.

But here's why that argument is misguided. This sort of defense works for a company like Staples, where profitability is stable, and net income is flat. This is not the case for Bed Bath & Beyond, which has deteriorating fundamentals across the board. Free cash flow will eventually follow, meaning that share buybacks and repurchases are not sustainable.

To show this, I'll first walk through the deterioration in fundamentals. I'll then connect this to free cash flow and show how that hurts the free cash flow outlook going forward. Finally I'll address what I see as the bull case is for the stock.

Comps Struggling Amid Competition

The argument that I laid out several years ago is still largely the same - competition is taking share from Bed Bath and Beyond.

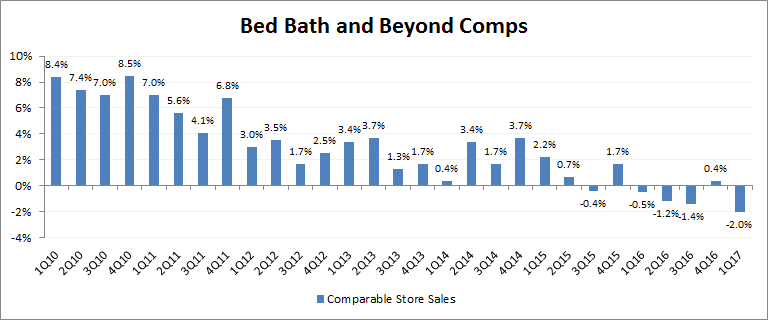

1Q17 comps came in at -2%, which was well-below expectations for roughly flat comps. Outside of 2008, this was the worst comp in the data that we have going back to 1992, and the 5th negative comp in the last 6 quarters.

Source: Company filings

Sales were flat as Bed Bath and Beyond opened more stores. But comps are the thing to key in on as they show the underlying trends at their stores.

Within the comp, digital channels grew north of 20%, while store comps declined by mid-single digits. While digital was a bright spot, it's important to note that margins are lower in the digital channel (as I'll detail later), and they appear to be coming at the expense of their stores, where store comps deteriorated further.

Management has a number of initiatives to get trends back in order. The company continues to test a membership program and is strengthening its digital properties. Additionally, the company is expanding its online assortment.

Importantly, management noted that trends so far in June were slightly better and were tracking more in line with management's prior guidance of flat to slightly positive.

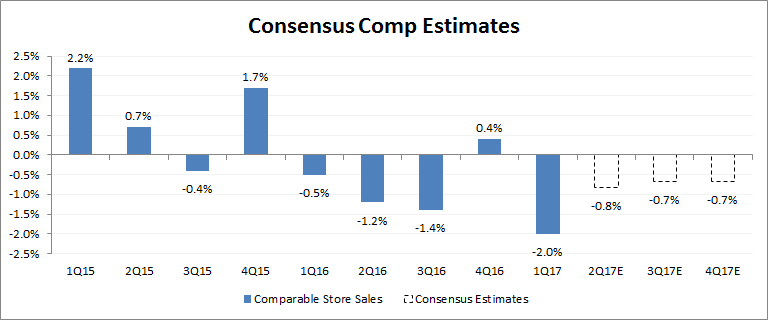

So what does this mean for the outlook? It's difficult to see what will improve comps from here. The company has clearly been losing share to competitors for some time now, and I'm skeptical of their initiatives getting customers back to the brand. Consensus expectations are for comps to remain negative, and I would not be surprised if this turned more sharply negative in the coming quarters.

Source: Company filings, brokerage estimates

Margins continue to erode

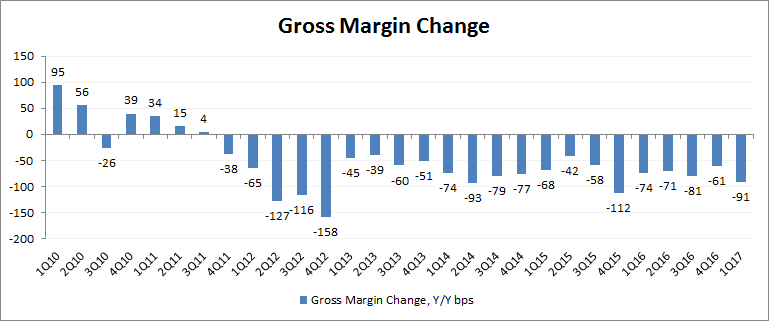

The margin picture is also similar to the case I outlined back in 2015 - the company is investing heavily to drive growth, and margins will continue to deteriorate. going forward Gross margins have declined by roughly 60-90 basis points fairly consistently for the last several years, and 1Q17 continued that trend with a 91 basis point decline (100 basis points on an adjusted basis).

Source: Company filings

Management noted that the declines were driven by 1) increased e-commerce shipping expense as a result of their $29 minimum free shipping policy, and 2) increased coupon redemptions (those big Bed Bath and Beyond coupons you get in the mail).

It's difficult to see either of these two headwinds alleviating any time soon, and very concerning to think that comps were still below expectations despite favorable discounts to the consumer. One might consider the idea that the company would slow discounts or eliminate the shipping policy, but comps would then likely turn even more negative. Bulls can take some comfort from the fact that the company will lap its $29 shipping policy in 2Q, which should help somewhat, but this will likely only make the decline less severe.

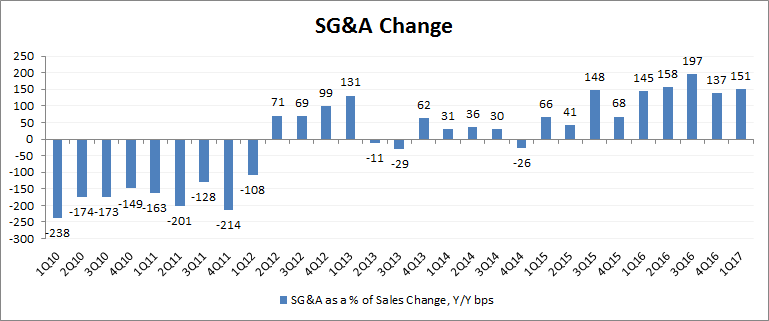

On the SG&A front, the company continues to see significant deleverage. SG&A deleveraged 150 basis points, which was 70 basis points worse than where expectations were.

Source: Company filings

The primary drivers were increased advertising expense, payroll and payroll-related expenses, and tech-related expenses. The company has stated that they will continue to invest in the business to get customers back to the brand, so these expenses don't appear to be improving any time soon. And with comps potentially negative going forward, this makes SG&A leverage even more difficult.

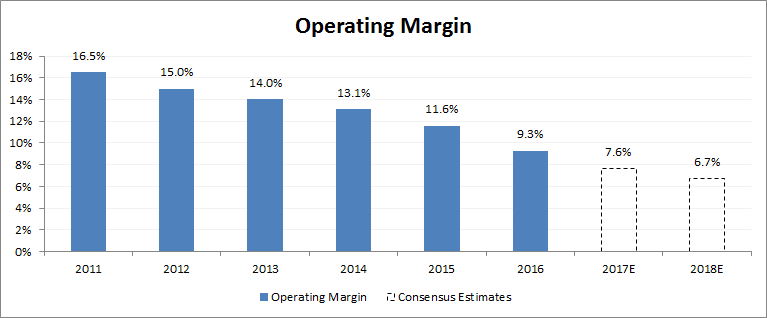

With a dire outlook on both gross margin and SG&A expense, analysts are expecting total operating margin to continue to decline over the next two years:

Source: Company filings, brokerage estimates

Deteriorating fundamentals a bad sign for free cash flow

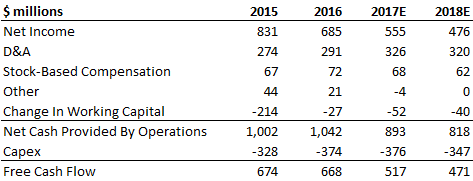

Here's where the above argument connects with the free cash flow argument. Deterioration in comps and operating margins are the primary inputs that are going to negatively impact net income. Analysts are currently modeling a 19% decline in net income in 2017 and a further 14% decline in 2018. And net income is the primary input into free cash flow, shown below.

Source: Company filings, brokerage estimates

Some bulls might point to 2016 when net income declined by 18% and yet free cash flow actually grew by $26 million. One can see that this was primarily due to changes in working capital, which became significantly less negative in that year. That's fine and dandy, but changes in working capital cannot offset net income declines of $150 million forever.

So what we're left with is (consensus) free cash flow year-over-year declines of ~$150 million and ~$50 million in 2017 and 2018, respectively. Could the company continue to buy back shares and return dividends to shareholders? Yes, but the key questions are:

1) At what level will they continue when free cash flow is declining, and

2) Will those returns to you as a shareholder offset what is likely to be continued stock declines should fundamentals continue to deteriorate?

On the first question, I would argue that share buybacks have already begun to slow. In 1Q17 Bed Bath & Beyond repurchased $127M of stock in 1Q17, a decline from the $171M in 4Q16. As free cash flow generation declines, the company can afford less share repurchases and dividends.

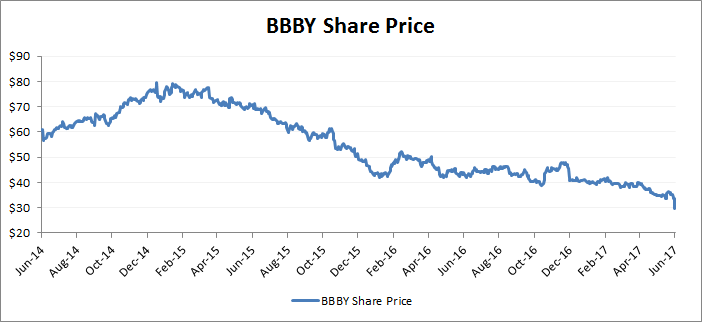

On the second point, let's not forget that while Bed Bath & Beyond has returned capital to shareholders over the last several years, the stock has done this:

Source: Google Finance

Generally, stocks don't react well to deteriorating fundamentals due to what I've highlighted above. Since the beginning of 2015, Bed Bath & Beyond stock is now down 61% vs FCF deterioration of 1% between 2015 and 2016 (or a 23% decline off of forecasted FCF declines in 2017).

The message from all of this: be careful with free cash flow arguments, especially when fundamentals are declining across the board.

A different bull argument: resurging interest in retail

There's other bull arguments for the stock finding support, and potentially going up from here, though:

- With the company struggling and the stock valuation now strongly anticipating further fundamental declines, it is possible that private equity or another buyer (potentially another company in the home furnishings space) may become interested in Bed Bath and Beyond. We have already seen this occur with several other retailers that have similarly struggled. The obvious example is of Amazon (NASDAQ:AMZN)'s recent announced acquisition of Whole Foods Market Inc (NASDAQ:WFM). Additionally, there has been rumored interest from private equity in Staples and Nordstrom (NYSE:JWN), and investors are likely beginning to look at Dick’s Sporting Goods Inc (NYSE:DKS) as well. Furthermore, we've seen this occur with numerous other retailers in the past, including PetSmart and Aeropostale. In such a scenario, the buyer would purchase shares at a premium to today's prices and send the stock up.

- Management's numerous initiatives could prove effective and stem share losses, and at least help the company maintain share within the space. With the stock now anticipating further sales declines, signs of stability would send the stock significantly higher.

These arguments, especially the former, make me a bit more hesitant to forecast such a dire outlook for the stock. But one should be careful of the free cash/returning capital to shareholders argument, as that doesn't appear sustainable.