Frost Investment Advisors, LLC, an indirect subsidiary of Cullen/Frost Bankers, Inc. (NYSE:CFR) , announced considerable reduction of management fees in quite a few mutual funds that it manages. Frost's Value, Growth and Mid Cap Equity funds lowered fees to 0.50%, a reduction of 15 basis points (bps). Frost’s Credit Fund dropped its fees 10 bps to 0.50%. This change was effective from Sep 1, 2017. The move was the result of a decision passed in 2015 to remove sales charges or front-end loads on its Investor Class shares.

According to Tom Stringfellow, president and chief investment officer of Frost Investment Advisors, the decline in fees was in line with its “effort to offer excellence at a fair price.” The reduction was also done with the aim to attract investors.

As of Jun 30, 2017, Frost Investment Advisors managed mutual fund assets worth $3.47 billion. In April 2008, it started offering mutual funds to institutional investors and then stretched out its offer of retail shares in June 2008. It now offers 10 different managed strategies as mutual funds to both institutional and retail investors.

A key strength at Cullen/Frost, the parent company of Frost Investment Advisors, is organic growth as reflected by the company’s revenue growth story. Revenues witnessed a compound annual growth rate of 5.9% over the last five years (2012-2016), with the trend continuing in first six months of 2017 as well. Moreover, we believe that lowering of fees by the subsidiary will attract more clients, pushing the total volume higher. This is expected to boost the non-interest income and margin. Hence, we believe the company is well positioned to maintain its increasing revenue trend going forward.

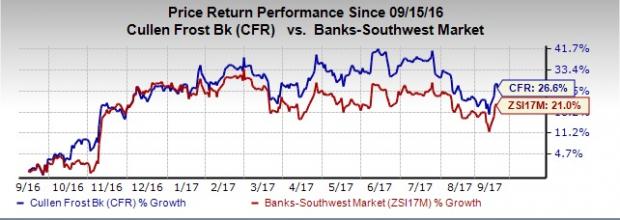

Shares of Cullen/Frost have gained 26.6% over the last 12 months compared with the industry’s rally of 21%.

Zacks Rank & Stocks to Consider

Currently, Cullen/Frost carries a Zack Rank #4 (Sell).

Some better-ranked stocks from the finance space are E*TRADE Financial Corporation (NASDAQ:ETFC) , AeroCentury Corp. (NYSE:ACY) and KB Financial Group Inc. (NYSE:KB) , each sporting a Zacks #1 Rank (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

E*TRADE Financial witnessed an upward earnings estimate revision of 14.2% for the current year, in the last 60 days. Its share price increased 43.7% in the past 12 months.

Shares of AeroCentury have gained 55.9% in a year. The Zacks Consensus Estimate for current-year earnings has been revised 9.9% upward over the last 60 days for this leasing company.

KB Financial Group has witnessed 18.9% upward earnings estimate revision for the current year, in the past 60 days. Moreover, its shares have gained 36.5% over the past 12 months.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

KB Financial Group Inc (KB): Free Stock Analysis Report

Cullen/Frost Bankers, Inc. (CFR): Free Stock Analysis Report

E*TRADE Financial Corporation (ETFC): Free Stock Analysis Report

AeroCentury Corp. (ACY): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Cullen/Frost's (CFR) Unit Lowers Management Fees For Funds

Published 09/14/2017, 10:00 PM

Updated 07/09/2023, 06:31 AM

Cullen/Frost's (CFR) Unit Lowers Management Fees For Funds

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.