For the 24 hours to 23:00 GMT, the EUR declined 0.13% against the USD and closed at 1.0571.

In the US, the second estimate of annualised gross domestic product showed that the US economy expanded less-than-expected by 1.9% in 4Q 2016, unchanged from the prior estimate, amid lower government spending and weaker business investment. Market participants had expected GDP to grow by 2.1%, after advancing by 3.5% in the prior quarter. Meanwhile, the nation’s CB consumer confidence index surprisingly climbed to a fifteen-year high level of 114.8 in February, as consumers remained upbeat about the nation’s current business and labour market conditions. Investors had envisaged for a drop to a level of 111.0, compared to a revised level of 111.6 in the prior month. On the other hand, the nation’s advance goods trade deficit widened more-than-anticipated to a level of $69.2 billion, compared to market consensus for the nation to post a deficit of $66.0 billion and after recording a revised deficit of $64.4 billion in the previous month. Moreover, the nation’s flash wholesale inventories unexpectedly fell 0.1% in January, compared to market expectations for a rise of 0.4% and following a gain of 1.0% in the previous month.

Separately, the Federal Reserve (Fed) Bank of San Francisco President, John Williams, stated that a March interest rate hike “is on the table for serious consideration” at the central bank’s upcoming monetary policy meeting later this month.

In the Asian session, at GMT0400, the pair is trading at 1.0559, with the EUR trading 0.11% lower against the USD from yesterday’s close.

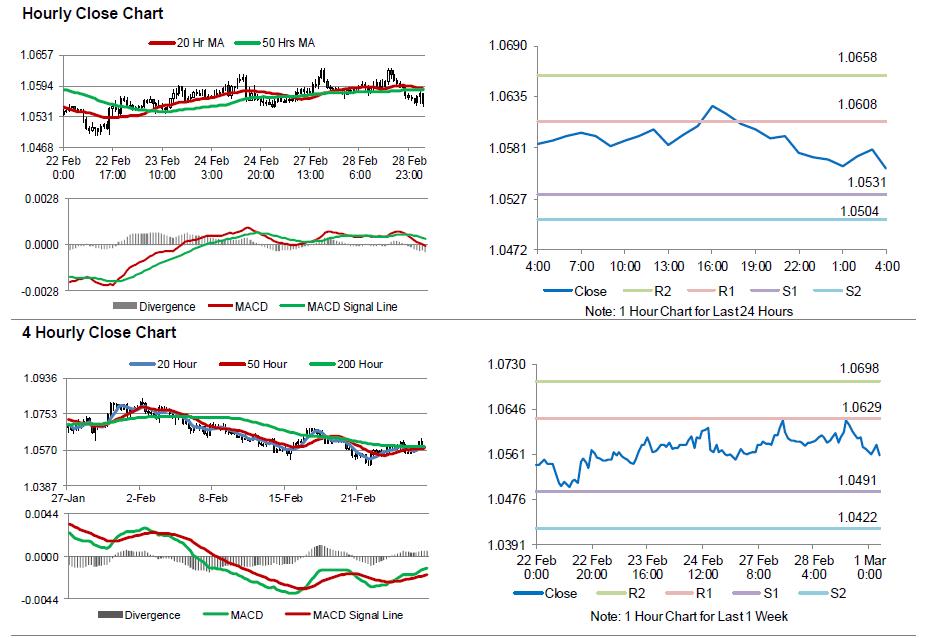

The pair is expected to find support at 1.0531, and a fall through could take it to the next support level of 1.0504. The pair is expected to find its first resistance at 1.0608, and a rise through could take it to the next resistance level of 1.0658.

Going ahead, traders will focus on the final Markit manufacturing PMI for February, across the Euro-zone along with Germany’s unemployment rate and flash consumer price index, both for February, scheduled to release in a few hours. Also, the US Fed’s Beige book report along with the ISM manufacturing and Markit manufacturing PMIs, both for February and the nation’s construction spending for January, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.