Most analysts use either fundamental or technical analysis or a combination of both in order to make up their mind about when a trend has changed and when to enter a position. Classically, fundamental data are used to figure out the main trends and technical tools to confirm the trend and pinpoint entry and exit levels.

One of the problem with cryptocurrencies is that fundamental data are quite scarce and not easily available for the average trader. So most of them are left with only one source of information to trade: technical analysis.

But there is another way, Probability analysis. This can be a good substitute to fundamental analysis in order to figure out what is the trend and when it might turn.

The only problem is that Probabilities can seem a little complicated for the lay person to be applied to financial market and specifically to cryptocurrencies.

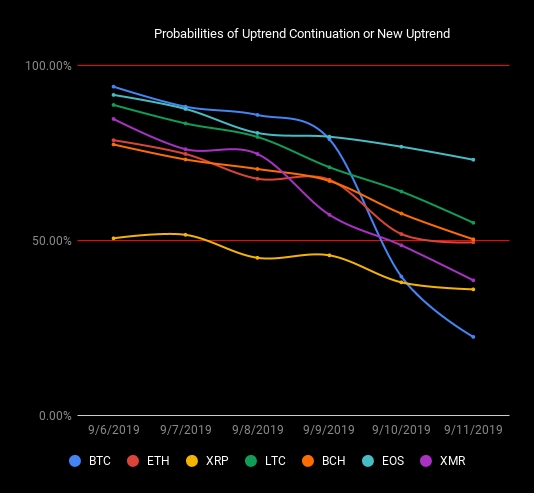

Here is our Probability analysis for today:

For the past few days, we can see that the probabilities of an uptrend continuation is falling. A drop below 50% is sending a signal that there is a high probability of a new downtrend or a recent downtrend continuation.

So with this type of data, a trader can now move to his favorite chart setup and look for key reversal signals in order to be ready for an eventual downtrend.

Most traders are looking for high probability trades and they are trying to find answers using fundamental and/or technical analysis, but why not try to go directly at the source: using probability to find those answers.

good trading.