There can be no denying that the cryptocurrency market is a volatile one. It’s the nature of speculative markets, particularly when you consider that it’s largely unregulated. Couple this with the fact that there is still a huge amount of uncertainty surrounding how China and South Korea will regulate their markets, and it’s hard to make any solid predictions about how specific investments will move. In order to gain some more accurate insights, several companies have recently developed and/or launched platforms and technologies to try and predict cryptocurrency markets. In this article we’ll cover some of the most prominent names and delve into what they offer.

Cindicator

What They Do

Cindicator combines user-predictions and machine learning to make cryptocurrency trading a more data-driven process. It’s a really interesting proposition, and their Hybrid Intelligence system is showing promising early signs. The app that they use to gather their data is really intuitive and user friendly. Users are asked to make predictions about certain market movements, with those correctly forecasting the result being given a reward in points and cryptocurrency. User data is then processed, and Cindicator’s machine learning algorithm suggests opportunities in both traditional and cryptocurrency markets.

Cindicator Tokens

The company launched their ICO back in September of 2017 and raised around $11,250,000, selling off 75% of their token, CND. Since then the digital currency has seen mixed results. The coin was initially valued at $0.01 USD, and it rose as high as $0.306 in mid-January. However, it has plummeted in value recently, and is down to $0.083 at the time of writing. The tokens themselves are used to access Cindicator’s services. Different levels of access are granted depending on the amount of CND held and how active the holder is.

Santiment

What They Do

Santiment works on a similar premise to Cindicator. It is a platform that gathers data from various sources, including user-sentiment, to make predictions about market trends. It gives users a clear insight into how cryptocurrency markets are performing, drawing on blockchain analytics from a variety of exchanges. They pull together information on all major blockchains, as well as customer feedback and curated content feeds to give a detail picture of the state of the market. This allows users to make informed investment decisions. The user-sentiment data is especially useful, as this emotional factor can often influence the price of digital currencies.

Santiment Tokens

In July of 2017, Santiment launched their token sale. The token, SAN, reached its market cap of 45,000 ETH. This was an encouraging start for the company, and they saw a wide and fair distribution of SAN as they intended. Much like Cindicator, SAN tokens give users access to the features of Santiment. The more a user holds the more detailed and widespread the insight is that they gain. The hope is that the value of the token and the analytics will increase, creating more of a market demand.

CoinFi

What They Do

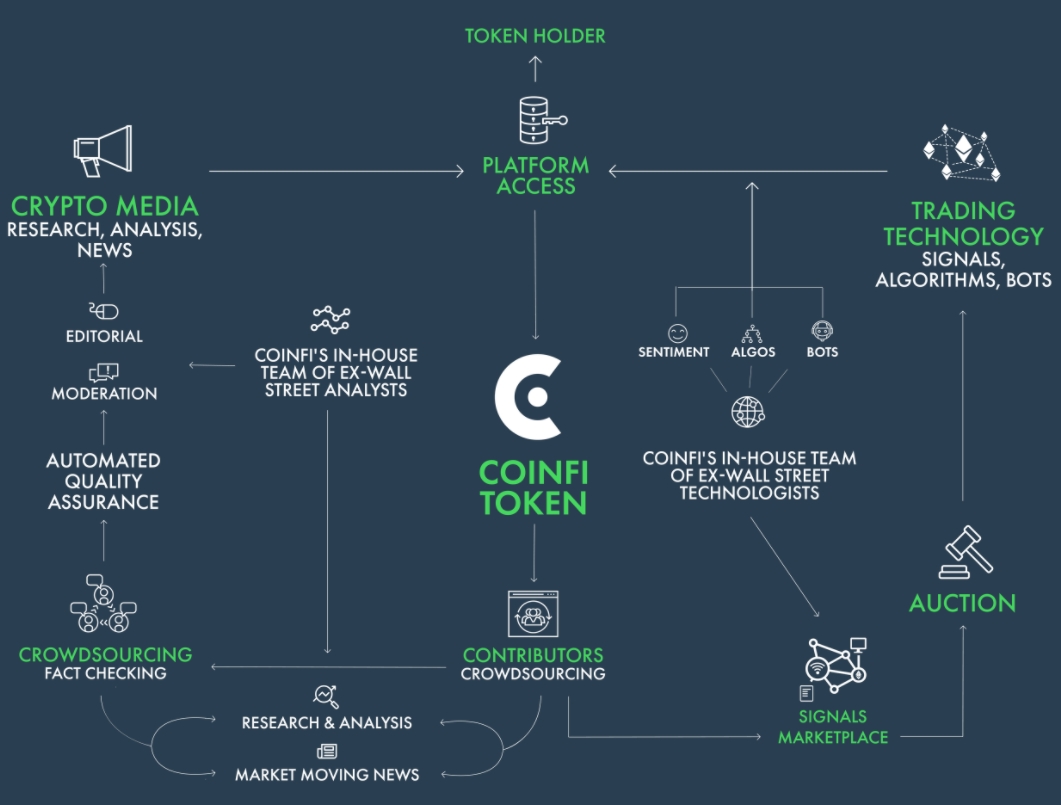

CoinFi bill their company as the first centralized market intelligence platform, and the most powerful crypto trading tool. These are grand claims indeed, particularly given the context of this article. The company’s plan is to introduce trading signals, trading algorithms, crowdsourced analytics and insights, and peer reviewed content. Their aim is to be an all-encompassing platform for cryptocurrency investors. Users will be given access to tools that allow them to choose the best investments, and will in turn be given the chance to contribute their own analysis to the network. Perhaps the best way to see how CoinFi is intended to work is by this graphic from their website:

CoinFi Tokens

The common theme among these platforms is that the companies’ own tokens are what power their services. CoinFi is no different in this respect, and their coin, COFI, ran its ICO in February 2018. COFI’s supply is 300,000,000, and the market cap at the time of offering was $15 million USD. Market movement has been fairly flat since launch, sitting around $0.075 at the time of writing.

Enigma Catalyst

Enigma offers a privacy protocol that enables truly decentralized applications and unlocks the value of blockchains. Catalyst is an Enigma-powered application that provides data-driven analytics on crypto investments. According to their website, their aim is to empower users to share and curate in order to build profitable, data-driven investment strategies. Essentially Enigma Catalyst hopes to empower users to create their own cryptocurrency hedge fund.

Enigma Catalyst Tokens

The tokens that power the ecosystem of Enigma Catalyst, ENG, had their ICO in September 2017 with a $45 million USD market cap. As with the other platforms mentioned, ENG will be used to reward users who perform well, as well as be used as payment for access to various data sources.

Conclusion

Each of these four companies offers intriguing and potentially market-changing technologies. It’s clear that there is a high demand for detailed and data-driven market insights in the cryptocurrency world. The push for user feedback is an important step in terms of making projections for the activity of such a volatile market. We could be on the verge of entering a new era for digital currency trading, with increasingly powerful ways of understanding it. It’s hard to pick a clear winner or stand out choice, but Cindicator certainly does make its presence felt having already launched their platform.