Bitcoin

Has broken short-term resistance trend line and is challenging the 11700 resistance that was once support. A break above it could push price back towards 13500$. Price structure still seen as corrective. Target of 8500$ remains.

Ripple

Testing the medium-term downward sloping trend line. This trend line is very important as price has so far confirmed, because although the line was touched, so far no breakout…only rejections.

Will this time be any different or will we have a breakout? Bounce could see Ripple back to 1.80$

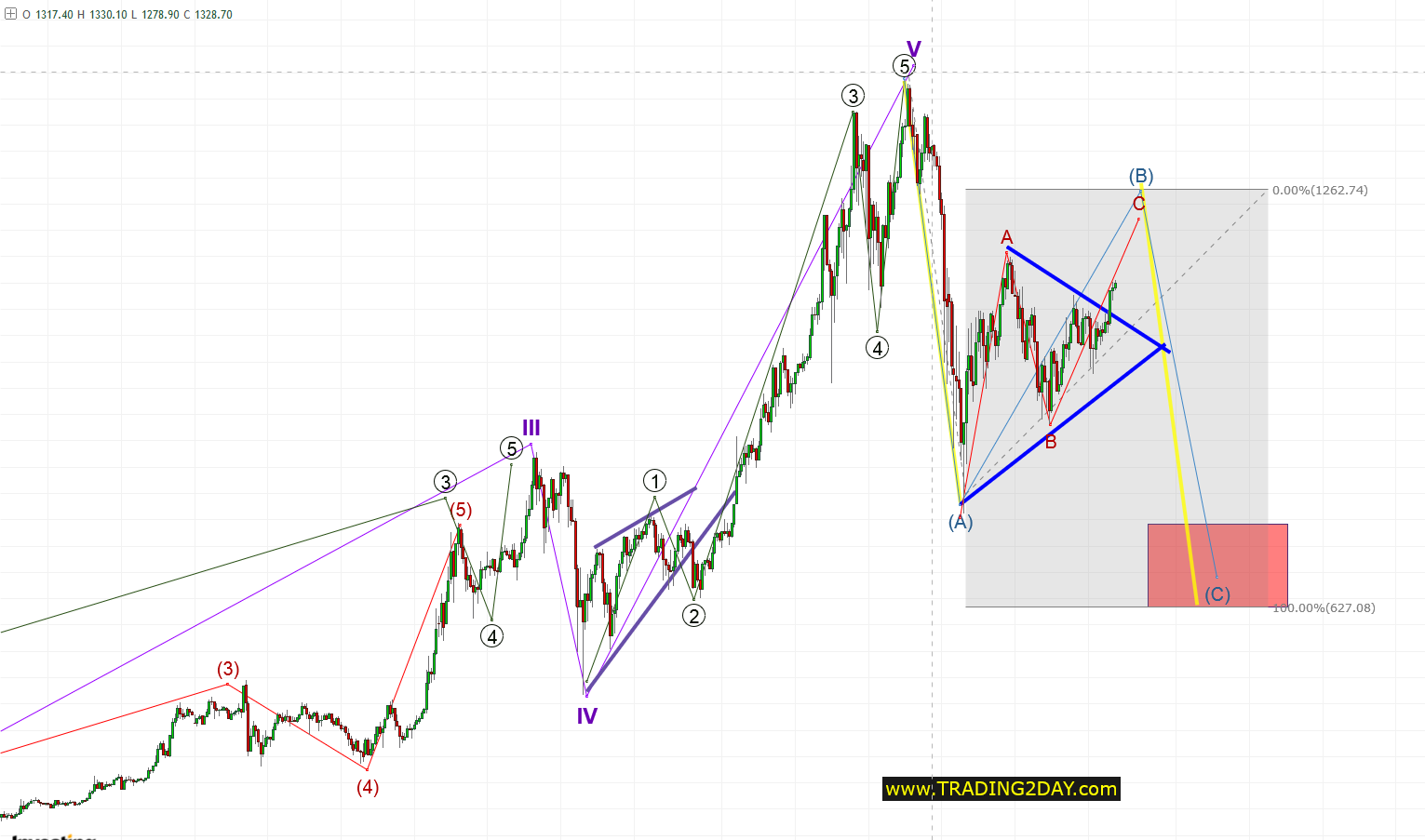

The breakout above the triangle pattern makes me alter my most probable wave count. Overall bigger picture remains bearish. However technically trend is bullish as long as price is above 980$

Litecoin

Preferred cryptocurrency from the other four. Shows that the corrective phase is most probably over. Trying to confirm breakout above the red TL. Break the black TL and buyers will be over it for new all time highs…

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.