This article was written exclusively for Investing.com

- The NY Attorney General challenges Tether

- Case settled in February

- More transparency needed, but is it possible?

- Government-issued digital currencies on the horizon

- The asset class will divide between cryptos and digitals

The term stablecoin, refers to a cryptocurrency whose price is pegged to either another cryptocurrency, fiat money, or exchange-traded commodities, like precious metals or other raw materials.

Tether is a stablecoin cryptocurrency issued by Tether Limited and controlled by the owners of Bitfinex. According to Tether’s white paper on its website:

“We propose a method to maintain a one-to-one reserve ratio between a cryptocurrency token, called tethers, and its associated, real-world asset, fiat currency. This method uses the Bitcoin blockchain, Proof of Reserves, and other audit methods to prove that issued tokens are fully backed and reserved at all times.”

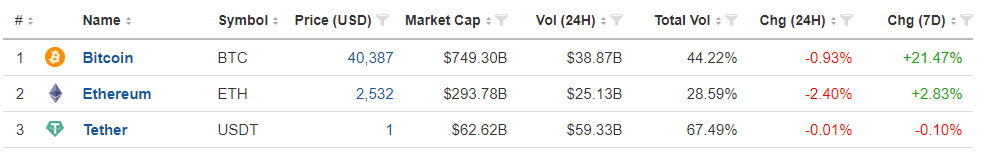

Tether is the third leading cryptocurrency. It is tied to the US dollar, so it trades at $1 per token.

Source: Investing.com

On June 15, Tether (USDT) had a market cap of $62.61 billion, which had a 3.62% share of the overall asset classes’ $1.729 trillion market cap. Tether is a cryptocurrency leader, but the NYS Attorney General had a problem with the successful token.

NY Attorney General Challenges Tether

The New York AG alleged Tether and Bitfinex misrepresented their reserves in 2018 and 2019. An investigation uncovered the companies moved hundreds of millions of dollars to cover up a loss of $850 million of commingled client and corporate funds.

The legal battle began in 2019. The government intervention in Tether runs contrary to the cryptocurrency asset classes’ libertarian ideology that removes regulators, government officials, and central banks from the equation.

Case Settled In February

In late February 2021, Tether and Bitfinex came to an arrangement with the NY AG, wherein the companies would pay an $18.5 million fine to settle the dispute. The terms require Tether and Bitfinex to cease trading activity in New York—a global financial capital—and submit quarterly transparency reports.

However, Tether wrote that:

“Under the terms of the settlement, we admit no wrongdoing.”

The first report, issued in March, revealed opaque uses of funds invested in Tether, the cryptocurrency. Tether held 13% of its assets in secured loans and 50% in commercial paper or short-term unsecured debt. The details of the loans were scarce.

More Transparency Needed, But Is It Possible?

The Commodity Futures Trading Commission (CFTC) is the US regulator that oversees cryptocurrencies. In a recent interview on CNBC, former CFTC Chairman Timothy Massad said, "We need a better framework of regulation for tether and other stablecoins.” He went on to call for more disclosure and challenged the recent March report saying:

“We have no idea what kinds of loans those are or who they are to, and we don’t know what kind of paper they’re buying. It’s all a concern, so I think we need more disclosure here.”

The former CFTC Chairman felt the settlement with the AG fell short from a regulatory perspective. Meanwhile, the market’s evolution could cause Tether and other cryptos “pegged” to fiat currencies to become a moot point.

Government-Issued Digital Currencies On The Horizon

China is about to roll out its digital yuan. The Chinese government recently cracked down on crypto trading in anticipation of its digital yuan in what is likely a move to limit competition.

Meanwhile, it will not be long before the US, EU, and other countries worldwide, roll out digital dollars, euros, and other foreign exchange instruments using blockchain technology. Blockchain and digital currencies will improve efficiency, speed, and record-keeping, pushing the foreign exchange arena into the new technological age.

Stablecoins like Tether, that reflect the values of fiat currencies, would not be necessary when digital fiat currencies burst on the scene. Regulators will be far more comfortable with treasuries, government monetary authorities, and central banks managing digital currencies than companies like Tether and Bitfinex.

However, the attraction of libertarian money will continue to challenge the status quo.

The Asset Class Will Ultimately Divide Between Cryptos And Digitals

I believe we will see the new technology divide between two forms of money—digital currencies and cryptocurrencies.

Digital currencies will augment, and likely eventually replace, fiat currencies and come under government control. Cryptocurrencies will continue to reflect the libertarian ideology that takes power away from the official sector.

Meanwhile, since the cryptos challenge the control of the money supply, we could see a regulatory wave that bans, limits, or requires a far higher level of transparency for Bitcoin, Ethereum, and the over 10,00 other cryptos.

Government officials like the NY AG, CTFC, Congress, the EU, and others in the public sector, will use protecting national populations as a reason to put pressure on the cryptocurrency asset class. However, the underlying and overwhelming reason for their interest is to preserve control, as money is a crucial factor when it comes to retaining power.

El Salvador recently became the first country to make Bitcoin legal tender. The move was more of a political statement than a move towards technological advances. El Salvador does not have a currency; it has embraced the US dollar since 2001.

The leadership in the Central American country decided to make a statement to US and European financial institutions and supranational institutions, like the IMF and World Bank, that provide loans and financing for emerging countries. China has been expanding its sphere of influence in emerging markets for decades. Making Bitcoin legal tender was likely more of a political, than an economic, decision.

As the market cap of cryptocurrencies rises, expect more pushback from governments. Controlling the purse strings is not something they will surrender without an epic battle.