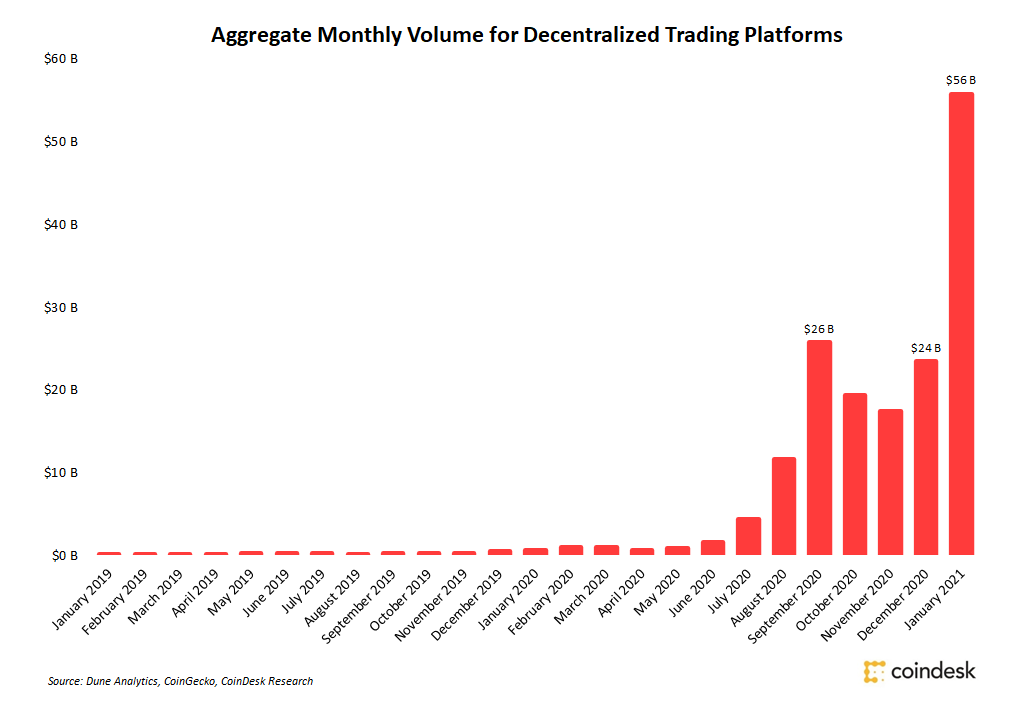

According to a recent report by Dune Analytics, trading volumes on decentralized exchanges grew by 136% in January 2021 alone, reaching $53.4 billion — this is half of the total volume for all the previous year and all-time highs for trading platforms of this type.

Image source: Coindesk

The first decentralized platforms appeared in 2013, but due to a lack of liquidity and technical complexity for average traders, they went unnoticed by a large part of the cryptocurrency community. Their centralized competitors, such as Binance, Huobi, Bittrex, OKEx, and Kukoin, found higher demand among users and have been more friendly towards less-experienced traders. In essence, decentralized exchanges powered by blockchain technology were too complex for crypto enthusiasts and traders.

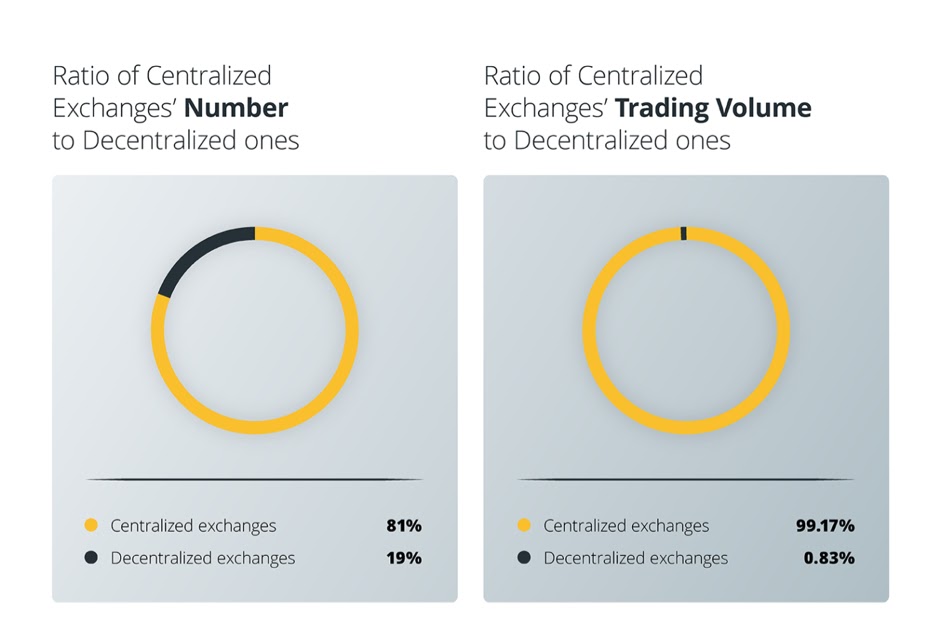

Until recently, decentralized exchanges had a 19% share market, while their trading volumes amounted to less than 1% of total crypto trading volumes.

Image source: Cointelegraph

In 2018, the situation began to change. As the popularization of cryptocurrencies grew, the legislative regulation of different countries improved, with new KYC and AML procedures developed, the exchanges were increasingly subjected to hacker attacks. The delisting of privacy coins like Monero (XMR-USD) and ZCash (ZEC-USD) from the largest cryptocurrency exchanges at the end of 2020 was the final impetus that pushed traders to change their preferences in terms of choosing trading platforms.

Meanwhile, new types of decentralized trading platforms started to appear, offering traders a better user experience and greater security. High transaction fees — a problem for daily trading that worsened with the surge of cryptocurrency prices — have been resolved by processing trading operations off-chain. The DMEX decentralized exchange has offered the use of a sidechain for reducing transaction fees to a near-zero level. It moved transactions from the Ethereum blockchain to the xDAI sidechain, making it possible to register the transactions themselves at considerably lower prices, an aspect of special importance against the background of periodic hikes in the cost of gas on the Ethereum network.

Previously, the high cost of transaction costs was a strong argument in the dispute between decentralized and centralized platforms. At the same time, the registration procedure on new generation decentralized platforms, such as DMEX, and the number of steps required from entering the exchange website to the start of trading was minimized in order to attract new users.

The growing popularity of decentralized finance (DeFi) has also contributed to an increase in trading volumes on DEXs, with Uniswap (UNIs-USD) alone accounting for 45% of total volume last year.

Today, decentralized exchanges operate based on the “come and trade” principle, as their centralized counterparts once did before the introduction of complex verification procedures and regulatory pressure. This may well explain such a sharp increase in the popularity of decentralized platforms among traders.

Given the growing demand for DeFi coins and the popularization of decentralized exchanges among retail and institutional investors, their trading volumes will set new highs in 2021. One of the most important factors that will allow DEXs to expand their market share will be increased liquidity and improved user interface.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crypto Traders Are Moving From Classical Exchanges to Decentralized Platforms

Published 02/06/2021, 12:41 PM

Updated 07/09/2023, 06:31 AM

Crypto Traders Are Moving From Classical Exchanges to Decentralized Platforms

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.