Bend Over or Hard ForkQuick Recap

In May 2016, the Slock.it team dreamed up a genius way to raise money for their project without prostrating themselves before VC firms. They created a Decentralised Autonomous Organisation (DAO) that raised money from investors in the form of ethereum. Each investor became a limited partner (LP) of the DAO. An ethereum smart contract governed the DAO whereby LPs voted on which projects to fund. Conveniently the first and most popular project was Slock.it.

The DAO raised $150 million of ETH, and at the time was the largest crowdfunding project in human history. Unfortunately the DAO’s smart contract was written poorly, and an individual was able to siphon off a third of the AUM by exploiting a flaw in the code.

"Code is Law" - the mantra of DAO cheerleaders, which included Vitalik and his acolytes at the Ethereum Foundation. Their blind faith in shoddy smart contract code landed them in a bind.

Should the foundation use its political capital to persuade exchanges, miners, and holders to accept an ethereum hard fork to bail out greedy punters? The foundation chose Yes, breaking the first commandment of DAOs: hard forking ethereum so that the DAO never happened.

Many in the community, especially exchanges, were not pleased that the ethereum Foundation bailed out DAO investors. The foundation naively assumed no one would want to want the own the chain that contained the tainted DAO. Poloniex saw an opportunity, and listed ethereum Classic (ETC). The rest is history.

The Present Day

This week the SEC ruled that the DAO was a collective investment scheme, and thus a security. They did not bring any enforcement action against the promoters or exchanges that allowed trading of the DAO, they just issued caution.

The SEC displayed a great deal of restraint by not perp-walking principals at Slock.it and or the ethereum Foundation.

Shortly after the hard fork, rumours began circulating that the SEC pressured the Foundation to rewrite history via a hard fork. The threat was clear: face a civil or criminal action for sponsoring and selling unlicensed securities, or hard fork. Given the recent inaction by the SEC, there is serious weight to these allegations.

Step back and think about it. The SEC may have created ETC. How ironic.

Many of the truly innovative and disruptive applications built on the ethereum protocol will challenge the supremacy of governments in various industries. However, going on one year since the bending over, is ethereum decentralised enough now to weather concerted action against it by a concerned government regulator? Would the foundation, under government pressure, attempt another hard fork to remove an application that is subversive to a powerful agency.

For those who invest heavily in “disruptive” ethereum based projects, this chain of events should give them pause. Their new and shiny token might be obliterated by an alphabet letter agency dangling the prospect of government sanctioned rape in front of scared founders. Bend over, or hard fork.

What's Next for ICOs?

The SEC did not pass judgement on all ICOs. Rather they clarified that if your token is clearly a security, don’t play in the US. Most ICO projects go to great length to avoid this scarlet letter.

This action will certainly dampen investor enthusiasm for a time; however, the underlying premise of selling usage rights in an application is unchallenged. The world will see fewer ICOs with equity like features, but after the DAO those types of deals were never the most popular anyway.

Tezos, Eos, and Bancor are the top three ICOs of 2017 in terms of money raised. All of them are protocols to perform a set of tasks. None of these tokens are collective investment schemes, or provide the owner with rights in a privately listed company. Keep calm, and party like it’s 1999.

First DCO, Then ETF

Congratulations to Paul and Juthica at LedgerX for reaching the promised land!

There are 16 registered Derivatives Clearing Organisations (DCO) in America. This week the CFTC approved LedgerX’s application to become the 17th active DCO. LedgerX specifically focuses on bitcoin related derivatives. This is a monumental shift in attitude of US regulators towards bitcoin and the digital currency industry as a whole.

The CFTC deems LedgerX capable of safely storing significant amounts of bitcoin on behalf of exchange members. One of the biggest concerns that any regulator has is how a regulated entity will handle bitcoin storage. The various exchange hacks over the years proves that bitcoin custody is a dangerous endeavour. Should this happen, the loss of face will surely end the career of the bureaucrat in charge.

Only large trading accounts can become authorised participants on LedgerX. To trade on LedgerX, participants must have several millions of dollars in cash. That restricts the universe of traders to large financial institutions. The popularity of the exchange come launch will provide clues as to the appetite of banks and large trading houses towards bitcoin.

The regulatory stamp of approval does not mean LedgerX won't get hacked; it provides convenient cover in case they do. If a financial institution trades on LedgerX and bitcoins are lost, they can wash their hands of the loss because they traded with a regulated institution.

CFTC raises one bitcoin DCO, action to the SEC

If the CFTC is looking towards the future of finance, what conversations are big dogs at the SEC having? Can they sit back and continue to deny applications for ETFs? They can't claim bitcoin is unsafe, for their sister regulator body has deemed them so. They can't claim that bitcoin provenance presents an issue for a retail traded product, for a regulated DCO holds bitcoin.

It is naive to assume the CFTC and SEC heads do not break bread. Traditional equity, fixed income, and commodity listed products' trading volumes are declining. Banks' quarterly earnings reports point to a secular decline in equity, fixed income, and commodity trading volumes. As I have repeatedly said, bitcoin and digital currency trading represents the fastest growing fee pool globally.

The regulatory bodies are slaves of the TBTF financial institutions. One way or another they will earn fees from digital currency trading. The disdain previously shown by bank chieftains is purely for public consumption.

2017 proves without a doubt that facilitating trading and providing financial services for digital currencies is a viable long term business. Hundreds of millions of dollars in fees earned on an industry with a sub-$100B market cap is truly astounding. The demand for a subset of non-correlated assets will force banks to play ball.

Mere retail mortals cannot trade on LedgerX. However, we should be excited for the messiah, an ETF. The SEC cannot continue to be a prude rose. I predict that one or more applications for an ETF will be approved within the next 18 months.

Old Folks' Home

Those who can afford a plane flight are amongst the richest globally. The most avid travellers are the middle aged to geriatric. They have the most disposable income and time.

Private banks cater to the middle aged and elderly because they have the most cash. The advertisements of private banks in airports provide a clear glimpse into which age cohorts bank desire. Usually the advertisement features a elderly couple with young grandchildren. The message is clear: invest for the future. You might be dead, but your progeny deserves the fruits of your labor.

Due to the target market, private banks are conservative and stuffy. Impressive bank edifices subtly suggest a solid, stable, and responsible financial institution. Once accepted into the the high net worth (HNW) members club, you can expect impeccable service and egregious transaction fees.

Your banker / babysitter will present him or herself as the epitome of class and sophistication. The costume jewellery worn: Hermes ties, Louboutin heels, Chanel totes etc., assure you that this person is professional, classy, and can relate to your life experiences.

After handing over your minimum low digit millions of USD to a venerable institution, a plethora of “suitable” investment opportunities are presented to you. Given the age demographic of clients, the search for low risk, greater than inflation yielding assets is the name of the game.

The money printing orgy since 2009 has decimated returns for elderly fixed income investors. The dash for trash in search of yield necessitated buying junk debt at lower and lower yields, and equities at higher and higher P/E ratios. No investors believe the market is undervalued. Investors of all ages and styles are now alternative investors looking for the next uncorrelated hot thing.

Bitcoin and digital currencies in general are finally a tiny fixture of the investment universe. Anything that asset managers can sell to their clients at high fees will be adopted. The question is what is the general perception of the said asset class.

Up until this year, bitcoin and altcoins were playthings of anarchists and drug users. When the digital currency complex reached $100 billion market cap, they became alternative investments. Private bankers, with a straight face, can push their stuffy, conservative, geriatric clients into digital currency investments. The best part is, because the asset class is so new, yuge fees can be charged.

Falcon Private Bank in Switzerland received the green light to offer a bitcoin investment product to its clients. Banks want to be a close second. Falcon is under duress due to a loss of its banking license in Singapore relating to the 1MDB scandal. They have nothing to lose in order to repair their damaged brand. Going full crypto in the hopes of differentiating their product offering is prudent at this stage.

Singapore is the Switzerland of Asia. The Monetary Authority of Singapore (MAS) will certainly feel pressure to allow one or more private banks to offer similar products. The MAS has a strong government mandate to make Singapore a FinTech hub globally. A properly sanctioned roadmap to offering bitcoin and other digital currency products will materialise.

Other FinTech and private banking friendly jurisdictions will adopt similar frameworks to encourage domestic private banks to offer similar products. Investment advice surrounding digital currencies presents a juicy fee pool. Regulators cannot ignore the requests of their member banks for a way to skim more money from their clients. The current traditional product offering is boring and yields little.

As more banks and asset managers become comfortable with wallet security, a trickle, then a flood of money will find a home in crypto. The chain-split / hard fork drama is a minor distraction to traders with a time horizon greater than 6 months. Political, regulatory, and media capital invested in promoting a new asset class portends to a bright future.

Trader Interview - ETFdeniedbot

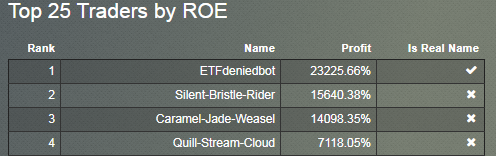

ETFdeniedbot has been BitMEX's top performing trader this year. Active since March, he has achieved a return on his capital at BitMEX of 23225.66%. He did not just have one lucky win at 100x - he has consistently hit it out of the park. It is rare to find such a trader. We reached out to him and he kindly agreed to an interview. Keep an eye out for him in the Trollbox as he is often active.

1. How did you get started in trading and on BitMEX?

I bought into bitcoin at the end of 2013, but only started actively trading it a bit over half a year ago. Moved over to BitMEX at the start of March right before the ETF decision since I needed a lag-free place to trade. I only started being a profitable trader after the ETF had blown over.

2. I notice that you did not start with a large amount when you first signed up with BitMEX. Do you think the size of your initial capital matters when you start out?

The initial capital size can change some of the strategies available to you. In general, having less means you can hold your positions open for a smaller time period and still make a good profit. However, it also comes down to how much capital you actually have. Even if the money is something you can afford to lose, as long as the sum is a non-trivial amount it'll be hard to cut your emotional ties to it. Especially since it's likely you will lose at least 50% of it before starting to make a consistent profit (I lost pretty much all of mine and had to invest more.) So in my mind, the initial capital is less like an investment and more like a cost for a lesson in trading.

3. What were your motivations to start trading?

Well obviously there's the money. I was already invested into bitcoin and figured it would be a cool idea to try to double or triple the amount. After passively watching the charts for years I thought I had a handle on bitcoin and could try to predict the price. Gave it a shot and lost quite a bit and then tried to win it all back like a true addict.

4. Why do you like trading on BitMEX?

Initially I picked BitMEX cause of the high leverage allowed and some comments on Reddit. Nowadays I'm not sure what there isn't to like. High volume, high liquidity, low fees all around, isolated leverage, secure wallet, good customer support, no nazi-mods in the trollbox. You even refunded those liquidations caused by the GDAX downtime and subsequent flash crash out of your own pockets. Plus the UI is nice.

5. What are the key things you look for when placing a trade?

Big moves downward and high volume combined with big long liquidations. Then I just market buy and either dump my position after a small retrace up within minutes or keep buying if the price isn't going up yet. Usually after many hours of dropping there's a double bottom combined with a retrace going higher than the previous high. If that happens I try to keep my position open and wait for a good top to sell within the next hour or two.

6. How do you manage your risk?

I start buying small and then increase the position as it goes deeper, but trying to always stay below 5x. I don't use stops and I only try to sell at a local top. Sometimes it gets pretty sweaty and I have a lot of unrealized losses but usually the trades end up at least breaking even. If things get really bad I might panic sell a bit of my position just to feel better, but I found that's usually right at the bottom. Barring any black swans, it's unlikely the price will tank more than 10% in one go without a retrace, and when the retrace happens I just dump it all regardless of losses.

7. What would be your advice to novice traders starting out on BitMEX?

a) Everyone has to find their own way to trade. Whether it's short-term or long-term, buying or selling. What indicators, risk-levels, and leverage to use. Experimenting with different strategies will help you find your style.

b) You have to know when to be bull-headed and when to eat the loss. I've made plenty of bad or questionable trades but got out unscathed by just holding them open. On the other hand, an early stop-loss can save you a lot of headache and minimize the losses, while also allowing you to enter at a better price.

c) Very often the best trade you make is the one you don't. If you have no clue what the market might do, then you may as well be flipping a coin by entering the market.

d) Any losses you take have to be accepted, and more importantly don't try to win it all back by taking more risks. Additionally, if you lose a lot and start to tilt, it's time to take a break.

e) Ignore your emotions. Don't FOMO, don't panic sell. There's always a local top or bottom to enter at if you really want to, but usually it's better to just sit it out if you missed the run.

f) Don't gamble with 10x+ leverage.

g) If you really do want to gamble all-in, stick to 25x with a manual panic close if it's not going your way. (This only works with position sizes up to 25k with XBTUSD though.)

Risk Disclaimer BitMEX is not a licensed financial advisor. The information presented in this newsletter is an opinion, and is not purported to be fact. bitcoin is a volatile instrument and can move quickly in any direction. BitMEX is not responsible for any trading loss incurred by following this advice.