The crypto market remains a difficult beast to tame. After the meteoric rise and fall of Bitcoin over the past 18 months, 2019 has gone some way in restoring a level of industry optimism.

With big hitters like Bitcoin and Ethereum experiencing growth of almost 200% between January and June, you may feel there’s enough evidence on hand to make a foray into the dynamic world of cryptocurrencies - or perhaps you’ve found yourself willing to revisit the market after a testing 2018.

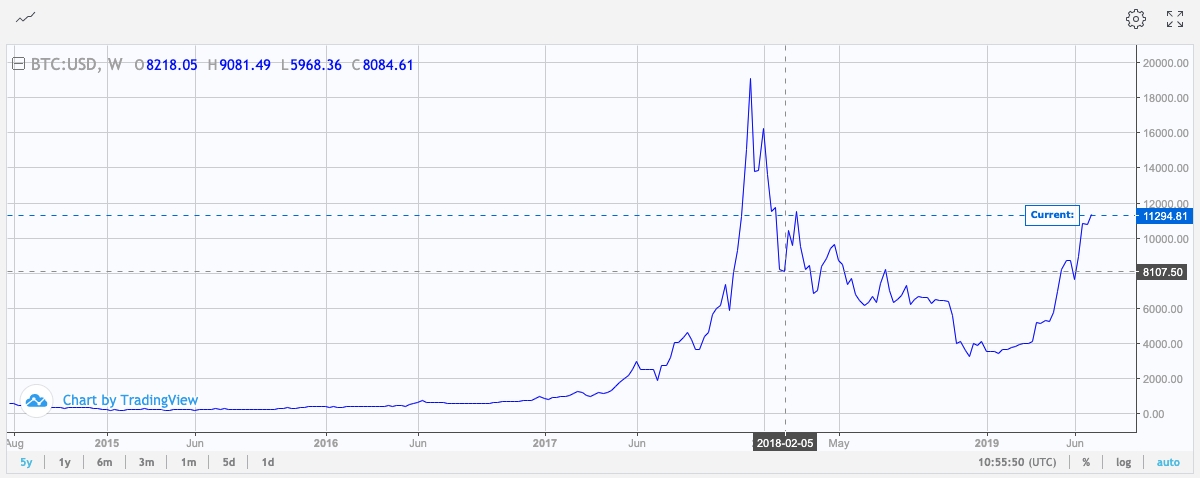

(Image showing BTC/USD price. Image Source: Investing)

(Image showing ETH/USD price. Image Source: Investing.com)

The world of crypto is ever-changing, and it’s never been easier to look after your investments both online and offline. But there are still plenty of challenges and risks associated with digital currencies today. Here’s a brief look into the ways you can invest in cryptocurrencies with confidence:

Prepare for choppy waters

Before we begin to look at the finer details of investing in cryptocurrencies, it’s imperative to reiterate that the market is significantly more volatile than, say, corporate bonds. For example, Bitcoin may have attained a value of almost $20,000 within a decade of its inception, but it took only 16 days for its price to fall 50% on 5th February 2018.

Image Source: Bitcoin

Writing for Forbes, Eric Ervin advises investors to train their minds to look beyond wild price fluctuations: “By mentally preparing for these unfavourable, and occasionally terrifying, investment performances, the intelligent crypto investor will be able to act rationally instead of emotionally in times of unexpected price drops.”

There are precious few calm days out on the high-seas of crypto-investing. It’s vital that you know the value of your investment, and avoid panic selling your stakes when there’s little reason to sell up.

Keep your assets safe

Cryptocurrencies have become increasingly hot property. While crypto’s rise in popularity is great news for digital currency values, it’s also contributed to a rise in cyber attacks on unwitting investors.

Your currency is best stored in digital wallets. These wallets can either be kept online as a ‘hot wallet’ or offline as a ‘cold wallet.’ Given that they’re perpetually connected to the internet, hot wallets have proved popular among beginner investors, however, they’re much more susceptible to getting hacked.

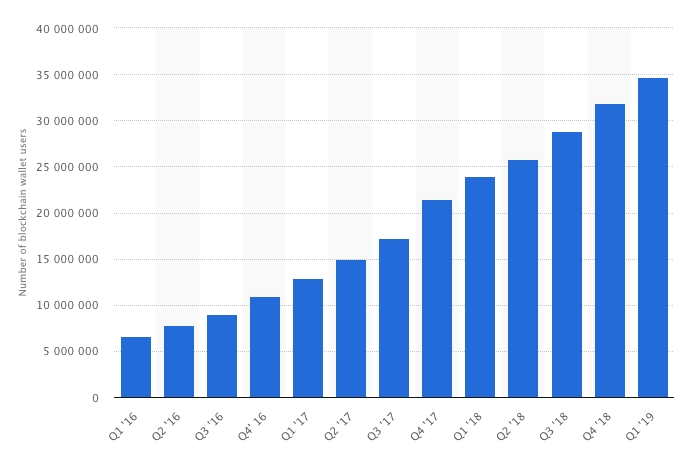

Currently, there’re almost 35,000,000 blockchain users worldwide.

Image Source: Statista

Luckily, as an investor, it’s likely that you’ll be solely interested in storing your crypto-assets over longer passages of time - and thus have less need for keeping your finances connected to the internet.

Cold wallets are virtually impenetrable if prepared properly, meaning your money should be safest when stored offline. Remember, that while it’s great to keep your finger on the pulse, it’s essential to keep your money safe at all times.

If you want to keep store your money online for ease of access, it’s highly advisable that you use a secure server. For smartphone users, there’re network providers like SafeCalls and Mobilink specialise in blockchain-based, decentralised systems that ensure secure internet connections.

Diversify your investments

Never put all your eggs in one basket. Diversifying your investments means that if some of your shares begin to struggle, others should be on-hand to keep you supported.

You could split your investments beyond the realm of crypto, placing a portion of your money on real estate, or on actions as well as digital currency. Or, you could split your allocated budget across numerous cryptocurrencies.

If, say, tomorrow your shares in Ethereum fell by 30%, you can be safe in the knowledge that 80% of your portfolio is made up of separate cryptocurrencies that can help to mitigate this drop.

Research goes a long way

In the challenging and ever-changing cryptocurrency landscape, it really pays to have some idea of what you’re doing.

Many new investors look to latch onto self-styled ‘crypto gurus’ who promise to provide tips on where your money should go and when. Remember that the only person you know you can trust is yourself - so it pays to investigate where your money should be invested.

It helps to identify trends, and if you’re adept at analysing data, a little bit of technical analysis can really help you to get on your way when it comes to spotting investment opportunities.

Know your market caps

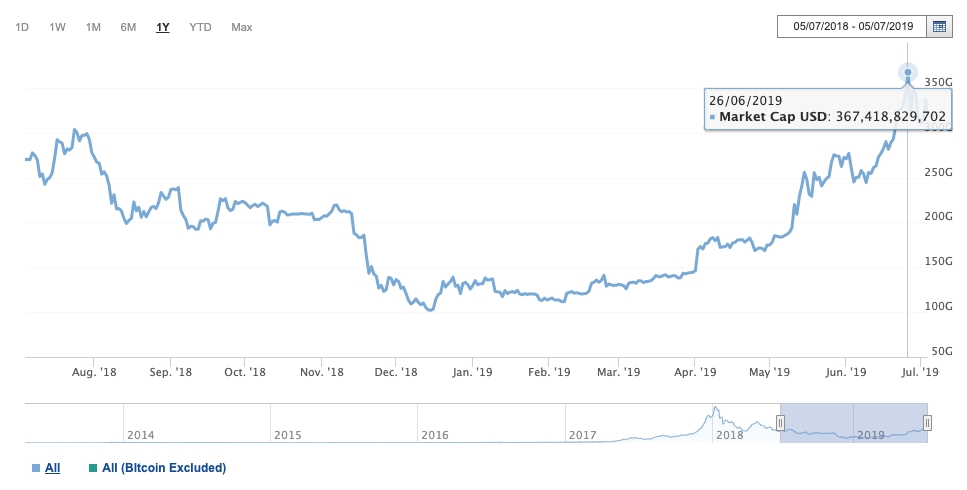

The last point here is a pertinent one. Many new crypto investors tend to focus on the trading price of the coins they’re looking at. While coin value is a valid way of determining their worth, a much greater insight can be provided by looking into a coin’s market cap.

Image Source: Investing.com

A currency’s market cap represents its total capitalization, and is calculated by multiplying the unit value of a token by the total number of tokens in circulation.

Understanding market caps can be key for investors in buying into new tokens. If a coin’s price is suspiciously high alongside its total market cap, it could point towards a scam, or indicate that developers are yet to undertake a marketing campaign to promote their currency. Again, here it pays to conduct a healthy level of research before taking a plunge into the deep world of crypto.

Author's Disclosure: Trading cryptocurrencies or investing in ICOs or related products involves risk. This is not an endorsement to invest in or trade any of the cryptocurrencies, stocks or companies mentioned in this article.