October has been the best month for crypto for all of 2023, with Bitcoin’s price jumping from $26.5K to well beyond $37K.

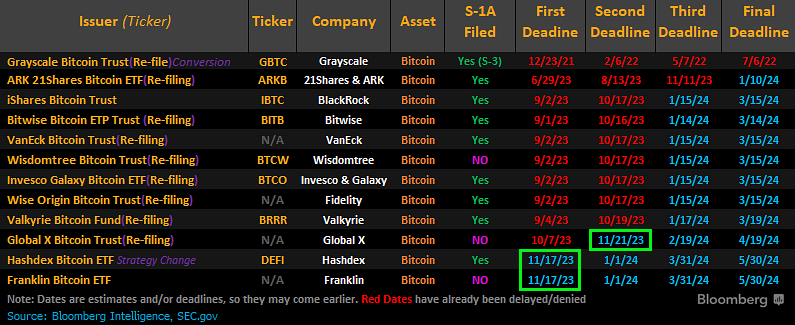

This renewed optimism, driven by the expectations of a spot Bitcoin ETF approval in the U.S., has injected fresh positivity into the market sentiment and into the overall crypto market.

-

The net change in supply of leading stablecoin entered positive territory over the past 90 days; this is the first time since Terra’s collapse in May 2022.

-

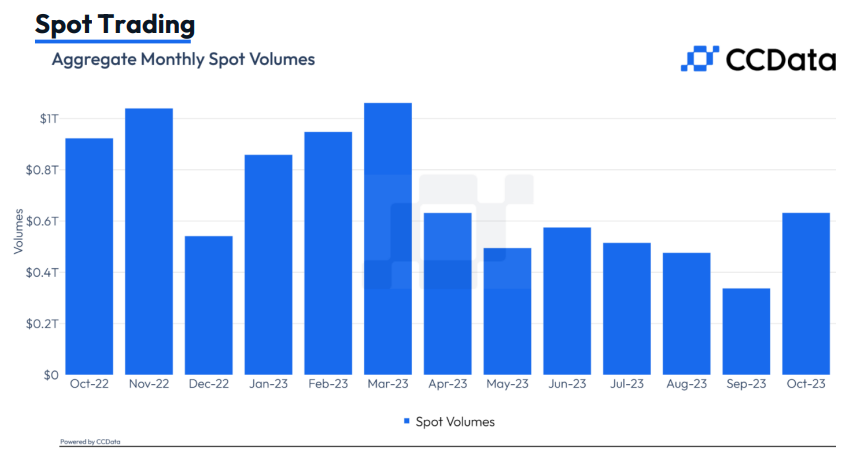

Spot trading volumes on centralized exchanges have broken a four-month streak of declining volumes and marked the highest level since March 2023.

Crypto ETF Updates

Below are a few of the things that caught my eye over the last week:

1. Grayscale’s Bitcoin Trust Discount is down to 13.38%: The GBTC discount is currently at its lowest level since July 2021, marking a significant drop compared to December 2022 when it hit highs of 48%.

2. Blackrock (NYSE:BLK) Files for a Spot ETH ETF: Last week, BlackRock doubled down on its crypto ETF applications, registering the iShares Ethereum Trust as a Delaware statutory trust. ETH price surged past $2,000 on this news.

3. XRP Surges Briefly After a Fake BlackRock Filing: The XRP token surged over 12% on a false report that Blackrock had also filed a “BlackRock iShares XRP Trust”. Clearly, there are some mischievous characters out to take advantage of the ETF hype.

4. JP Morgan Skeptical on Bullish ETF Momentum: While crypto natives have their hopes high for the positive effect a Bitcoin ETF approval will bring, JPMorgan recently published a report arguing that the rally looks 'overdone.'

The next decision day on the approval of a spot ETF is happening today, however, I find it highly unlikely that there will be any approvals before earliest 10th of January 2024 when ARK’s ETF will face its final deadline.

Currently, my thesis on the market is that we will continue to tread higher in anticipation of positive ETF news, which will do for a nice continuation of the upside into December.

What happens thereafter is anyone's guess - A survey by Nasdaq last year revealed that 72% of financial advisers would likely allocate some capital to crypto if the authorities were to approve an ETF.

Noteworthy Mentions

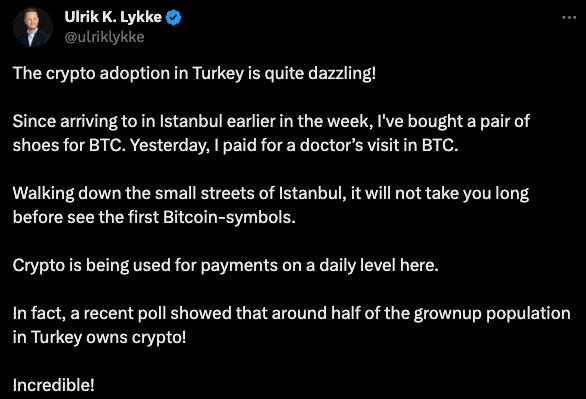

- Binance Blockchain Week in Istanbul: Last week, the Bitcoin Global Macro team had the opportunity to attend the Binance Blockchain Week in Istanbul. What particularly caught my attention is the crypto adoption levels in Turkey; over 52% of Turkish adults invest in crypto, and several stores accept BTC payments.

Industry Shakers

- JPMorgan rolls out programmable payments via JPM Coin: JPMorgan has initiated the implementation of programmable payments, which involve the automatic execution of payments, through its proprietary blockchain-based payment system known as JPM Coin. The testing phase for programmable payments began in 2021, with Siemens AG (OTC:SIEGY) being a key partner in this pioneering effort. Over the next few weeks, two additional companies, FedEx (NYSE:FDX) and Cargill, are anticipated to leverage this feature.

- Australia Updates Its CGT Guidance to Include Wrapped Tokens and DeFi: Australia's tax authority has reaffirmed its position that capital gains tax on crypto products applies to wrapped tokens and token interactions with decentralized lending protocols, as outlined in updated guidance. The recent update explicitly encompasses wrapped tokens, various "DeFi lending" and "borrowing arrangements," or any instance of transferring a crypto asset to an address, not under your control.