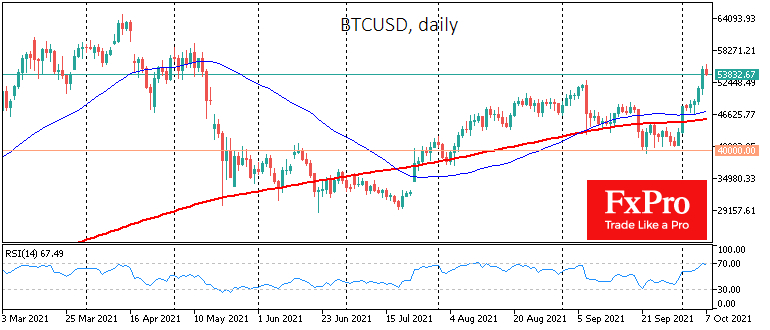

Bitcoin has passed the major psychological and technical level of $50K and continues to grow. In the last 24 hours alone, BTC has shown a growth of 6% and is trading around $55K. Over the week, Bitcoin spiked by 26%. Another psychological milestone is that Bitcoin’s capitalisation has overcome $1 trillion. Of course, this figure has a symbolic value, but for many retail investors, it is important to see the ability of the asset to overcome the psychological resistance.

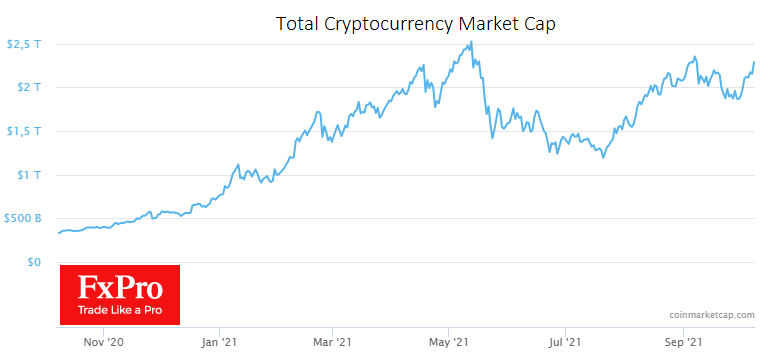

The total capitalisation of the crypto market at the moment is almost $2.3 trillion. In this case, we also see a confident overcoming of the round value and continuing growth. At this stage of the Bitcoin rally, alternative cryptocurrencies are showing less significant positive dynamics.

However, altcoins will likely catch up with the first cryptocurrency given some time. Demand for alternative cryptocurrencies often increases shortly after Bitcoin’s rise has stopped. The more expensive Bitcoin is, the more psychologically comfortable altcoins become for purchase, especially for retail investors.

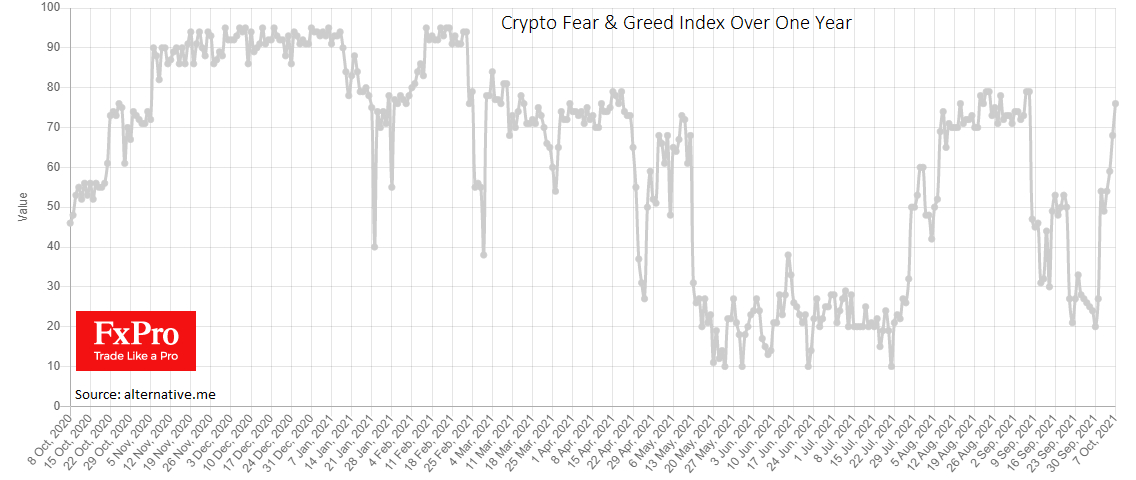

So far, Bitcoin’s dominance index has increased to 44.5%. The Crypto Fear & Greed Index has jumped 56 points since last week to 76 and is in “extreme greed” mode, fully reflecting the sentiment in this market. The community has growing fears that the $55K-$60K range could slam the door on bulls and investors who have already been buying Bitcoin at the top of the rally. Should such a scenario materialise, we could see a sharp reversal as large investors who entered the market at the $30K-$40K range will take profits.

Among the main reasons often highlighted is the statement by SEC head Gary Gensler that his agency does not intend to ban cryptocurrencies. In addition, Soros Fund Management has confirmed its investment in Bitcoin. It seems that at this stage, such statements are enough to launch a rally. It also cannot be ruled out that the current price surge may be the result of manipulation.

After Bitcoin reached its all-time high, many crypto market participants predicted a possible reversal into a broad correction. However, the bears’ attacks were repelled time after time by those willing to buy the dip of Bitcoin. As a result, it became clear that the broad growth impulse is not exhausted, and there may be another stage of the rally, which will bring the asset, if not above the historical maximum, then close to it.

In the medium term, it will become clear how fundamentally sustainable the current stage of the rally is. No matter how bright the current price dynamics may seem, there is a probability that Bitcoin is now going through an essential phase of the crossroads, and there is no certainty that the reached price levels can be maintained.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crypto: From Extreme Fear To Extreme Greed In One Week

Published 10/07/2021, 09:10 AM

Updated 03/21/2024, 07:45 AM

Crypto: From Extreme Fear To Extreme Greed In One Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.