Analysis of the movements of (BTC/USD), WTI crude, and Copper futures in the weekly chart indicate a crash is likely to materialize before this year ends as the momentum of the slide is constantly maintained since mid-October.

Bitcoin

On the weekly chart, Bitcoin started to slide after the formation of a lifetime peak in November 2021. This slide turned steeper since March 2022 after the formation of a ‘bearish crossover’ in the weekly chart in January 2022.

Undoubtedly, Bitcoin price has already reached bearish territory after a breakdown below the 200 DMA since June 2022.

I find that this slide could continue to push the bitcoin toward the lows of March 2020 when it tested a low at $4000.

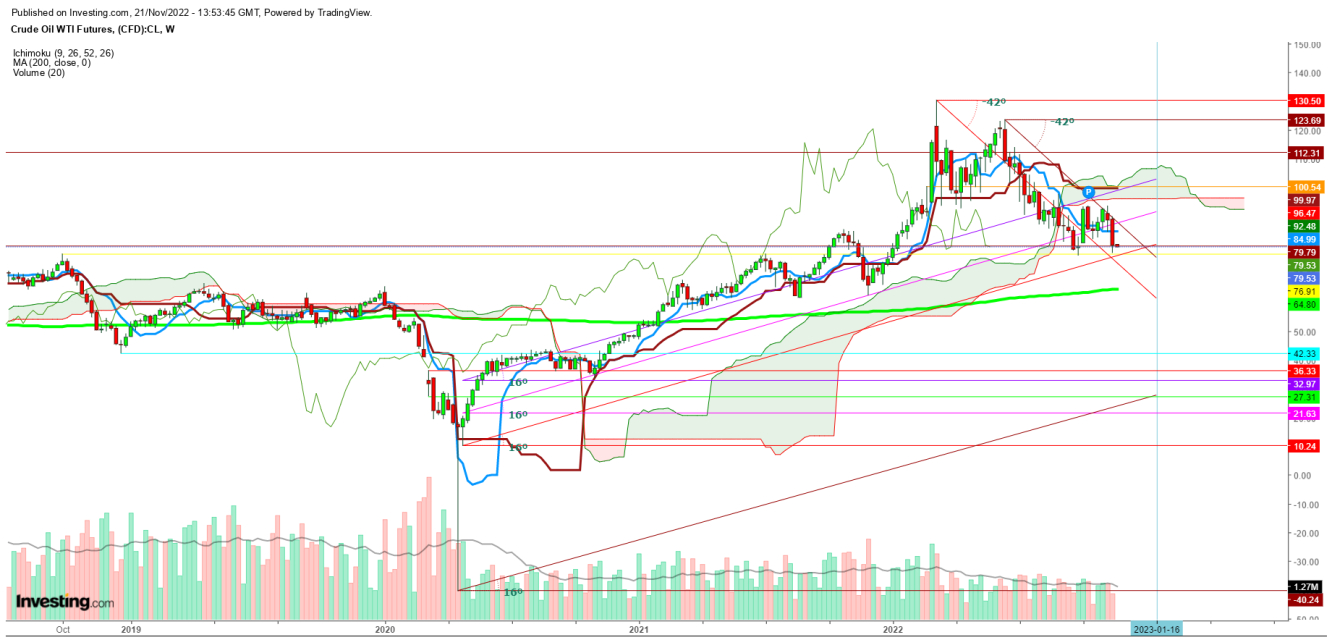

Crude Oil

On the weekly chart, WTI maintains a slide slope after testing recent peaks at $130 in March and $123 in June this year.

This sliding looks turned steeper since July after the formation of a ‘bearish crossover’, and the last week’s candle pushed the price below the 9 DMA in the weekly chart could be the initial signal.

Undoubtedly, the current week’s candle is likely to be a bigger one as China's COVID crisis has severely weighed on oil prices in recent weeks.

I find that this slide could turn into a nightmare if the WTI Crude Oil Futures find a breakdown below the immediate support at $76.90. In that case, the next target will be 200 DMA which is currently at $64.79, and a sustainable move below this will be the next confirmation of the crash.

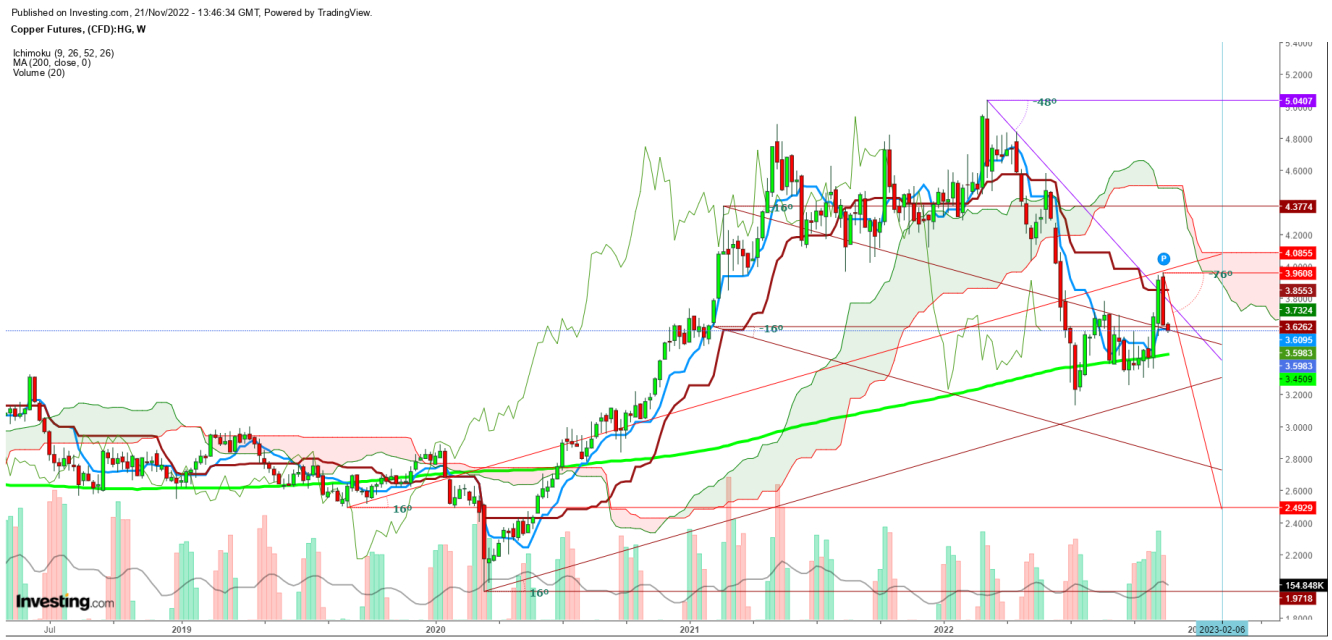

Copper

Copper futures are sliding on the weekly chart after hitting a lifetime peak in March 2022 at $5.0407.

This slide turned steeper in May 2022 after the formation of a ‘bearish crossover’.

Undoubtedly, Copper futures tried to find support at 200 DMA in July after hitting a low at $3.1357 but face stiff resistance at 26 DMA during the last week, followed by a steep fall.

Undoubtedly this week could be decisive for Copper as this week’s economic data and the fed’s announcement could turn the commodities towards a bearish territory and the Copper Futures will lead this falling spree if a breakdown below the recent support below 200 DMA.

In that cast, the Copper Futures could head to test $2.4929 before moving further down a crash zone.

Disclaimer: The author of this analysis does not have any position in Bitcoins, crude and copper futures. Readers are advised to take any position at their own risk.