Key Takeaways

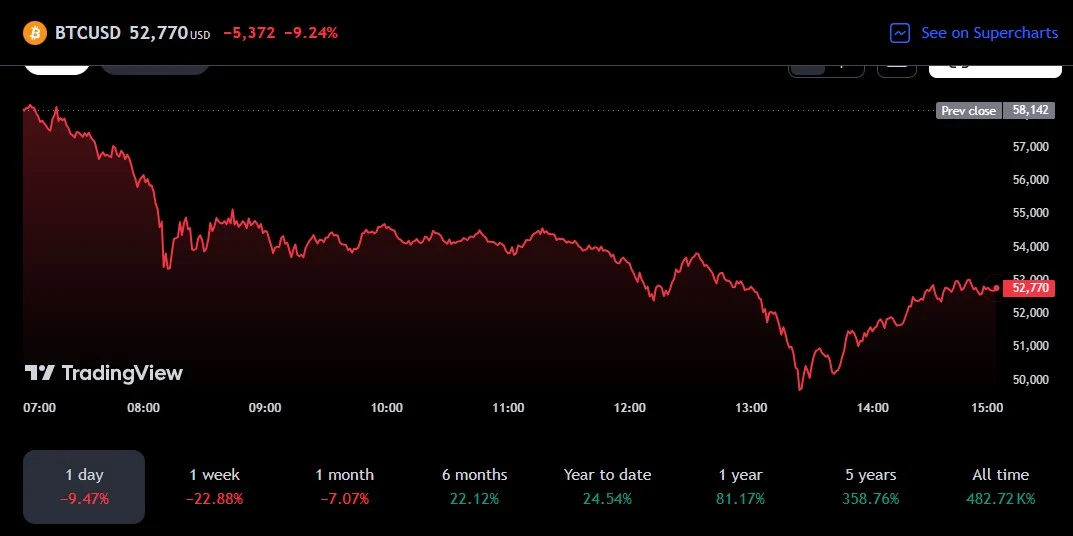

- Bitcoin's value dropped by 17%, reaching a five-month low of about $49,700.

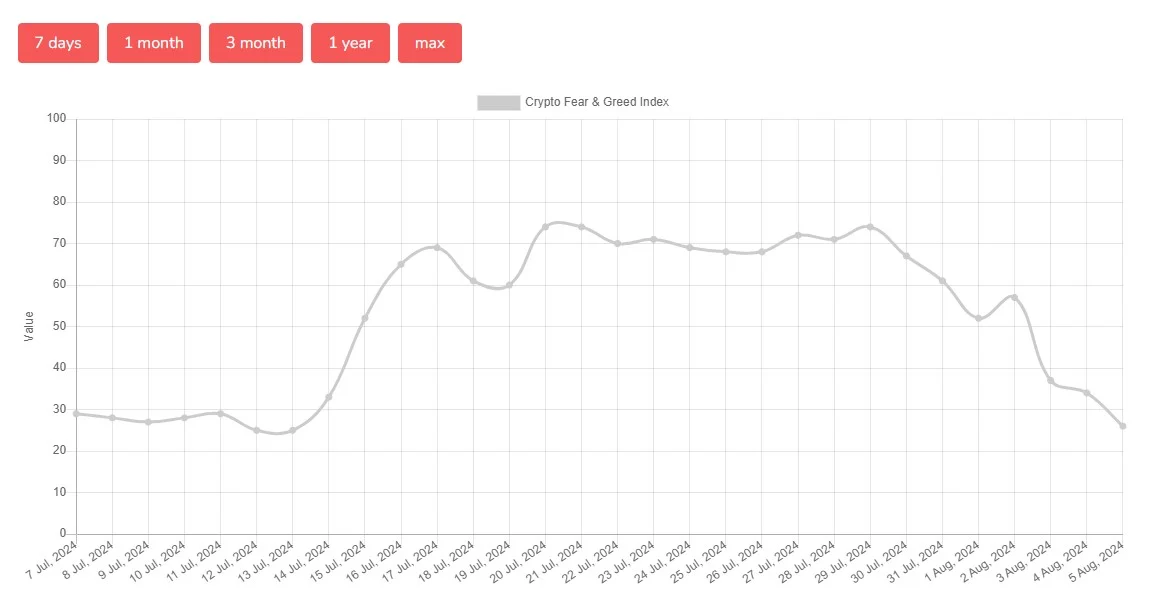

- The Crypto Fear and Greed index reached its lowest level since early July, indicating widespread market fear.

The crypto market has suffered a severe downturn over the past 24 hours, with Bitcoin plunging 17% to a five-month low of approximately $49,700, TradingView’s data shows.

The panic sell resulted in over $1 billion in liquidations, according to data from Coinglass.

Bitcoin, the largest crypto asset, fell to its lowest point since late February before recovering slightly to trade near $53,000. The sell-off triggered a wave of liquidations, with around $900 million in long positions eliminated. Bitcoin traders bore the brunt of the losses, accounting for $360 million in liquidations, followed by Ethereum with $344 million.

The sell-off affected over 278,000 traders, including a single liquidation order on Huobi worth $27 million for a BTC/USD trade.

The broader financial market is also experiencing turbulence due to a combination of global economic and geopolitical factors, including the decision of Japan to raise interest rates, disappointing nonfarm payroll data in the US, the escalating conflict between Israel and Iran, and reports of speculative crypto sales by Jump Trading.

“The nonfarm payroll data released in the US last week stoked fears among investors about a recession in the US economy,” Ben El-Baz, Managing Director of HashKey Global, commented on the recent market downturn.

“However, these fears may be premature, as rational thinking is expected to return once the initial emotional response subsides. After all, interest rate cuts must start in September, and monetary easing will improve significantly thereafter,” he added.

Market sentiment has turned sharply negative, with the Crypto Fear and Greed Index plunging into “fear” territory—its lowest level since early July, reflecting heightened anxiety among investors.

The Crypto Fear and Greed Index hits 26 – Source: Alternative.me