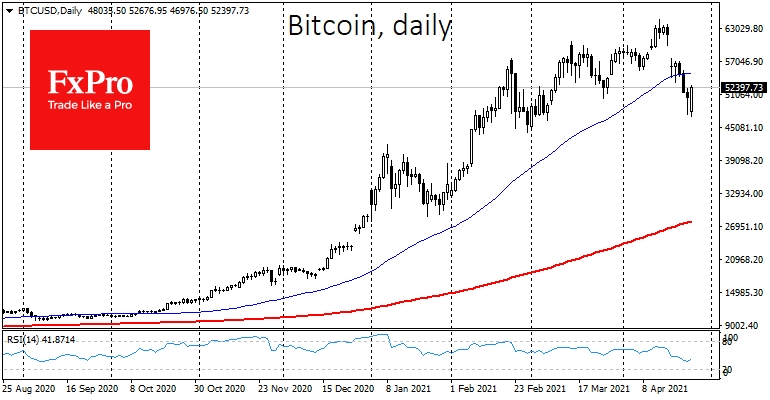

The weekend showed that the crypto market in general and Bitcoin, in particular, are not ready to give up. Market participants were waiting for the weekend results to see how the retail sector would react. At one point, Bitcoin reached a local bottom at $47,250, but this drop significantly increased the demand for the first cryptocurrency as the asset began to be bought by investors who were waiting for a discount.

An additional positive is that with the price rebound, the trading volume also increased by 28%, strengthening the positive sentiment. A rebound in the stock market could be a supportive factor for the crypto market in general.

It seems the current rally in crypto is largely due to money from big institutions, who have only recently turned their attention to this market and have much deeper pockets and lobbying power in politics and regulation. In this case, the growth potential of cryptocurrencies is far from exhausted.

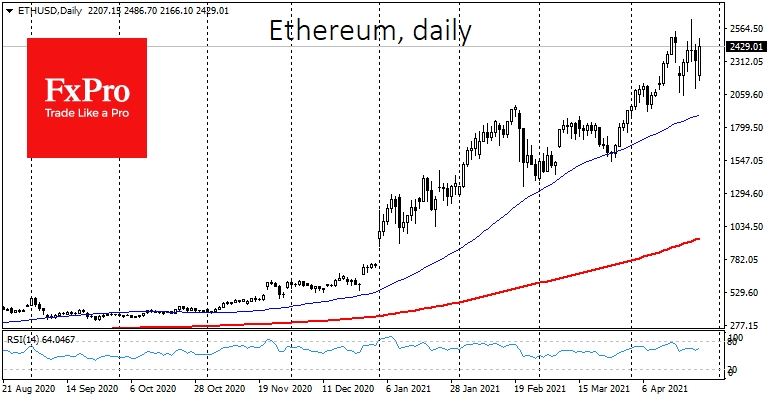

Elsewhere, the leading altcoin, Ethereum (ETH), spiked by more than 12% in the past 24 hours and is trading around $2,500. A robust momentum will occur if the asset surpasses its previous all-time high of $2,600. Ethereum has soared 1,150% in one year, which is an incredible success story for any asset. On this background, local corrections we have seen recently are negligible compared to the scale of growth.

The news of PayPal (NASDAQ:PYPL) adding the ability to buy, sell and send BTC and several leading altcoins starting from $1 or more in the Venmo app was also a likely factor in supporting digital currencies. Also contributing to the positive backdrop was a report that Time, one of the most recognizable media networks globally, will accept cryptocurrency payments.

The services of the co-working network WeWork will also be able to be paid in cryptocurrency, albeit through the BitPay service. All this does not have a significant impact on capitalization. However, it has a severe effect on the public image of cryptocurrencies, as more and more people perceive them as a means of payment.

The FxPro Analyst Team