Silvergate Capital (NYSE:SI), one of the vital banking pillars in the crypto ecosystem, has reported 72.50% of the volume of its shares shorted to FINRA. This makes Silvergate the second most shorted stock in the US. How did that happen?

Silvergate Shorting Increases

Every two weeks, the Financial Industry Regulatory Authority (FINRA) collects data on publicly traded companies to issue a Short Interest Reporting. As of February 9th, the crypto bank’s parent company Silvergate Capital Corp. is the second most shorted US stock.

However, MarketWatch already ranks Silvergate first at 73.08% of float shorted. This is the total number of shares available for public trading, at ~20.2 million SI shorted out of 27.6 million float. FINRA’s Short Interest Reporting is important because a rise in short interest indicates investor confidence in the stock.

In the case of Silvergate, investors’ rising short positions indicate that the stock could decline further. Short sellers borrow such shares to sell them, making them ‘short’ because they don’t own what they sold. But, if the stock they shorted drops in value, they can repurchase it at a lower price to return to the lender, thus pocketing the profit between the buy and sell price.

Year-over-year, Silvergate stock has declined by 87%, as the daily short volume ramped up by the end of 2022.

The question is: why is Silvergate now the prime short-interest target?

Silvergate’s Decline Examined

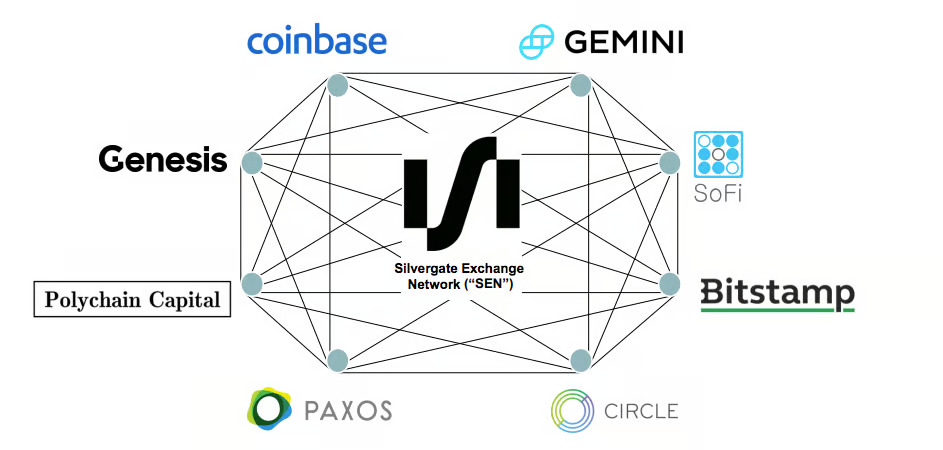

Regulated by the Federal Deposit Insurance Corp. (FDIC), the Federal Reserve, and the California Department of Financial Protection and Innovation, Silvergate bank has served as the payment pillar for the largest crypto exchanges.

Image credit: Silvergate Capital

The crypto bank’s business model owes its success to real-time payment rails, the Silvergate Exchange Network (SEN). This allows crypto exchanges to facilitate fiat-to-crypto trading 24/7, which wouldn’t have been possible in traditional banking. Silvergate was the first bank to make it happen, gaining a prominent first-mover edge.

Therefore, Silvergate’s business model depends on the overall volume of crypto trading. In addition to holding deposits like other banks, Silvergate’s SEN Leverage service allows institutional investors to take loans with Bitcoin as collateral. This way, borrowers can leverage their Bitcoin holdings.

Case in point, last March, Michael Saylor’s MicroStrategy took a $205 million BTC-backed loan to buy more bitcoin.

Following the FTX exchange crash, Silvergate reported a $1 billion net loss for Q4 2022. This was accompanied by a dramatic drain of deposits, from Q3’s $12 billion to $7.3 billion. To mitigate the ongoing bank run in Q4, which reached $8.1 billion by January, Silvergate borrowed $4.3 billion from the Federal Home Loan Bank (FHLB) of San Francisco.

Silvergate used its securities as collateral, which continues to depreciate. Year-to-date, SI stock is down by 10.54%. To further cut its losses, the bank fired 40% of its workforce on January 5. This was on top of selling $5.2 billion of debt securities in Q4 at a $718 million loss.

To exacerbate Silvergate’s financial position further, Moody’s Investors Service downgraded Silvergate Capital and the bank itself to ‘junk.’ Specifically, the bank’s long-term deposit rating from Baa2 (lower-medium) to Ba1, with a negative outlook.

Legal Woes on Top of Liabilities

On top of financial stress, Silvergate faces legal challenges as well. The bank was first hit with a class-action lawsuit on December 14 for having “directly aided and abetted FTX’s fraud and breaches of fiduciary duty via first-hand participation in the commingling of funds, improper transfers, and lending out of customer money.”

It is now widely known that Sam Bankman-Fried used FTX to funnel user funds to Alameda Research in breach of users’ agreement terms. In addition to the complaint, the Department of Justice began probing Silvergate’s FTX dealings in early February.

Silvergate to Become Wall Street-Backed?

The key market-making player in the GameStop/AMC short squeeze, Citadel Securities, revealed its interest in the crypto space last September. Backed by both Citadel Securities and Charles Schwab, they announced the EDX Markets crypto exchange.

A banking rail like Silvergate would go a long way in making the Wall Street-backed crypto exchange happen. In this light, Citadel securities revealed a 5.5% stake in Silvergate, consisting of ~1.7 million shares valued at $25 million.

The world’s largest asset manager, BlackRock, has also increased its stake in Silvergate Capital from 6.3% to 7.2% stake. BlackRock had previously partnered with Coinbase (NASDAQ:COIN) to open crypto investing to institutional players.

***

Disclaimer: This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.