True enough as we projected in our February 28 article, oil price stabilized and climbed to as high as around $40.80 a barrel on March 18, as market was fueled with speculation that OPEC is going to break a deal with non-OPEC members to limit production by January output level.

Further talks that OPEC is going to proceed even without Iran participation have buoyed the commodity, as the commodity markets rallied after FOMC decided to hold rates in its March meeting, in view of global financial and economic risks and moderate increase in inflation. Further, Fed reduced its rate forecast for 2016 from 1.38% to 0.88% and from 2.38% to 1.88% for 2017; which implicitly suggest that Fed could raise rates twice this year.

Weird enough, not long after that, a few Fed Presidents started to talk the dollar up, as they projected the US economy is resilient enough to weather another rate hike as early as April. And as the final GDP number for 2015 Q4 proved last week, they were correct indeed. US economy grew 0.4% better than expected at 1.4%.

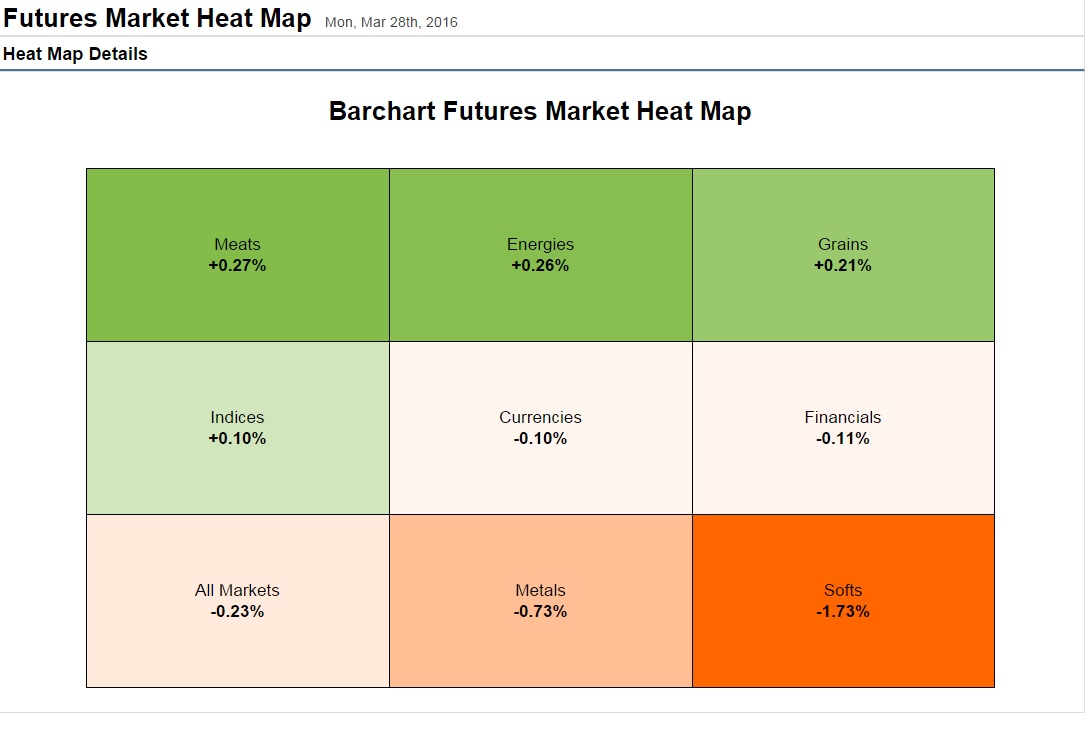

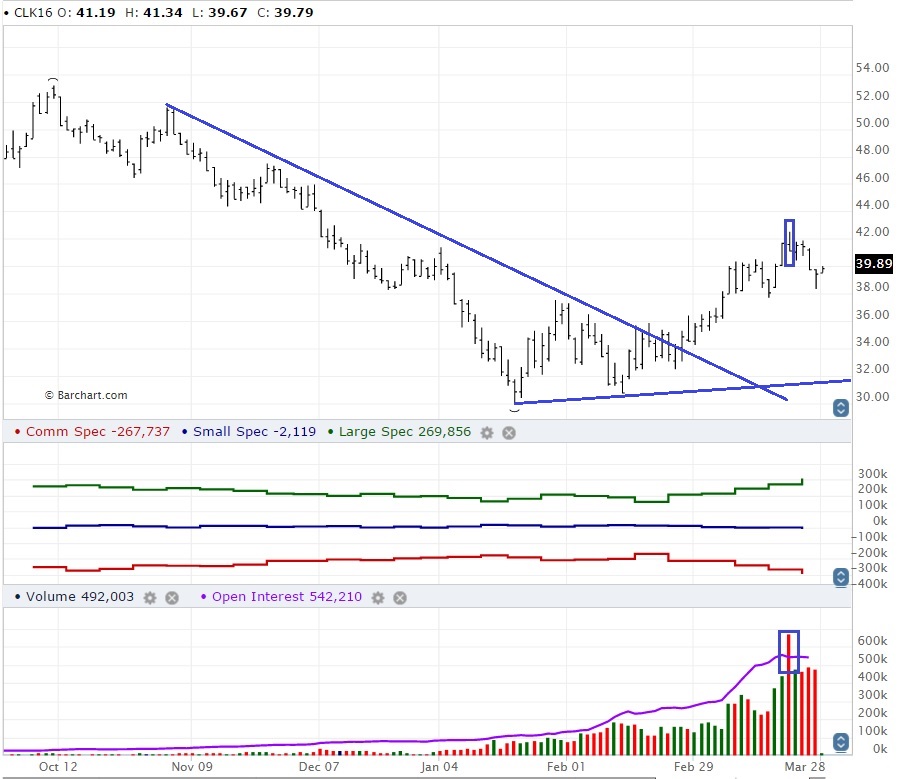

Looking at the futures market, risk sentiment is on with meats (+0.27%), energies (+0.26%), grains (+0.21%), and indices (+0.10%) gaining traction though all markets are down by 0.23%. Interesting enough, though speculators increased their net long in crude May contract, volume was also highest on March 18 when price hit its 3-month high, which resulted in a pin bar that may suggest fresh selling interest.

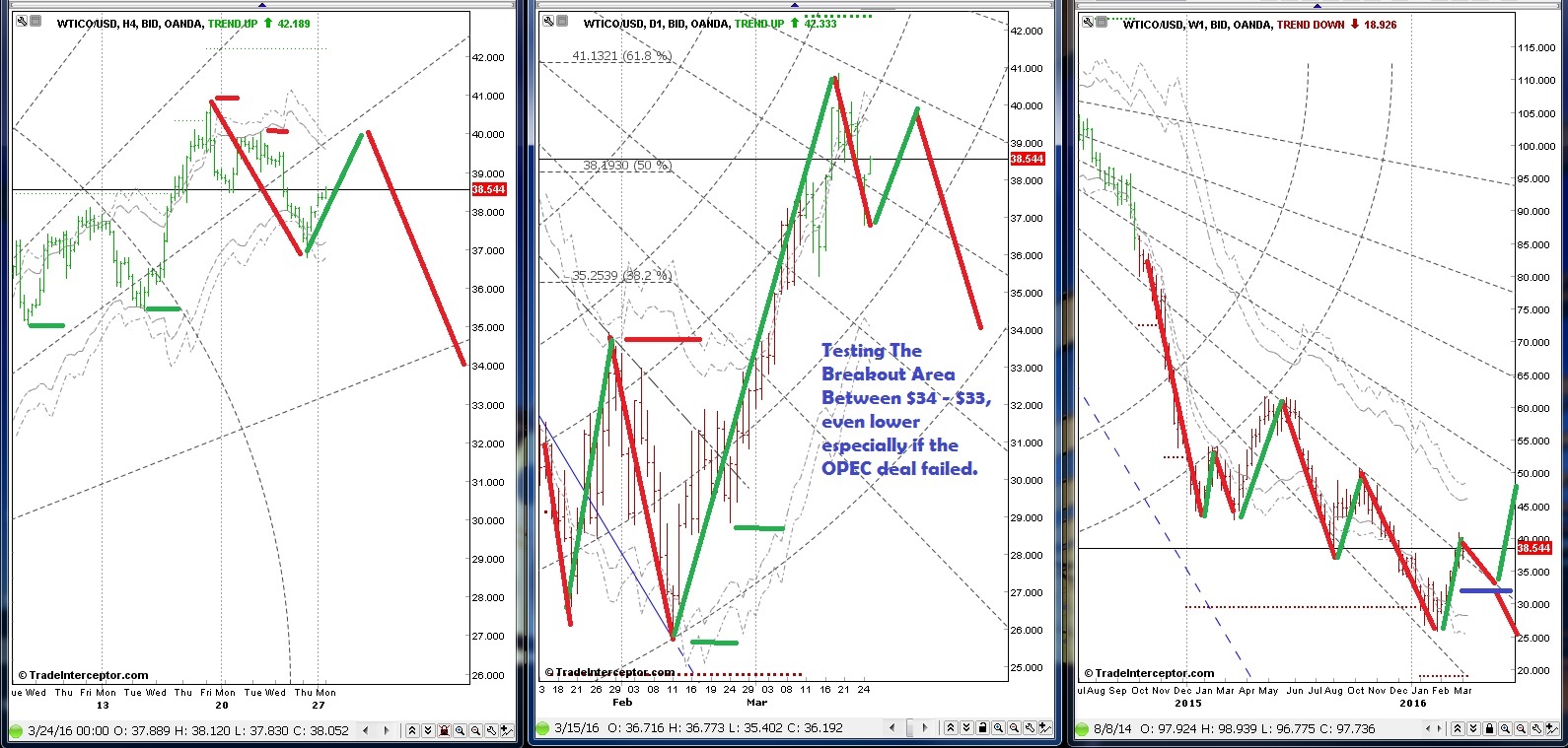

Looking back at the chart, with current market sentiment gearing for an April US rate hike, we believe crude is making a correction to test the breakout level around $33 - 34 a barrel, or even lower, especially if the OPEC deal on April 17th fails. On the other hand, if FOMC decides to hold rates at its April 27th meeting, that could push price back up. If rate is hiked then, we could see price dip further.

We are currently riding our short on a risk-free trade, targeting the breakout area for exit.

Please Read Our Risk Warning Disclaimer.