Crude prices climbed this week, recovering from initial weakness by an unexpected drawdown in stockpiles. The EIA report showed that in the week ending February 22nd, US crude inventories fell 8.6 million barrels. This reading caught the market by surprise. This, of course, given the recent build which lasted five consecutive weeks, as well as the expectations for a 2.8 million-barrel increase.

The drawdown came despite news that stocks for delivery at the Cushing hub in Oklahoma rose 1.6 million barrels over the week. They now stand at their highest level since December 2017 (46.7 million barrels). Crude production also continued to surge higher, rising 100k barrels per day from the prior week. Production soared until it hit fresh all-time highs of 12.1 million barrels per day.

Imports At Lowest Levels Since 2012

Notably, however, the report showed that crude imports declined 1.4 million barrels from the prior week, reaching 2.6 million barrels per day. This is the lowest reading on record. And it explains the dramatic fall in inventories.

Data in the report also showed that refinery crude runs increased by 179k barrels per day. And utilization rates rose to 87.1% of total capacity. However, on the Easy Coast, utilization rates at refiners fell to their lowest levels since 2012 at just 60%.

Gasoline stockpiles also saw a drawdown over the week, plunging 1.9 million barrel per day. This reading was worse than the expected 1.7 million barrels drop forecast by the market. Distillate stockpiles, including diesel and heating oil, also experienced a drawdown of 304k barrels. However, this was far less than the expected 2 million barrel drop the market was looking for.

OPEC Cuts Continue

In all, the report was bullish for oil prices. OPEC will certainly welcome this, as they are currently in the midst of a production cut programme to boost ailing oil prices. OPEC’s general secretary General Mohammad Barkinado told reporters this week that the group’s production cuts had helped prevent “major, major chaos.”

He added that “OPEC has been doing a great service,” and told CNBC that “the decisions that OPEC took, together with […] non-OPEC partners, literally rescued this industry from total collapse.”Trump Criticises OPEC

However, not all players are happy with the oil-producing cartel’s initiative. President Trump, who has consistently criticized OPEC over the last year once again took to Twitter a few days ago to address OPEC saying:

“Oil prices are getting too high. OPEC, please relax and take it easy. World cannot take a price hike – fragile!”.

OPEC Responds

In response to Trump’s comments, Saudi Arabian energy minister Khalid Al-Falih said that OPEC is “taking it easy.” He explained:

“The 25 countries are taking a very slow and measured approach. Just as the second half last year proved, we are interested in market stability first and foremost…We listen to the honorable President, and hear his concern about consumers and assure everybody, whether it’s him or developing country leaders, that we are as focused on the interests of the global economy and consumers around the world as we are focused on the interests of producers.”

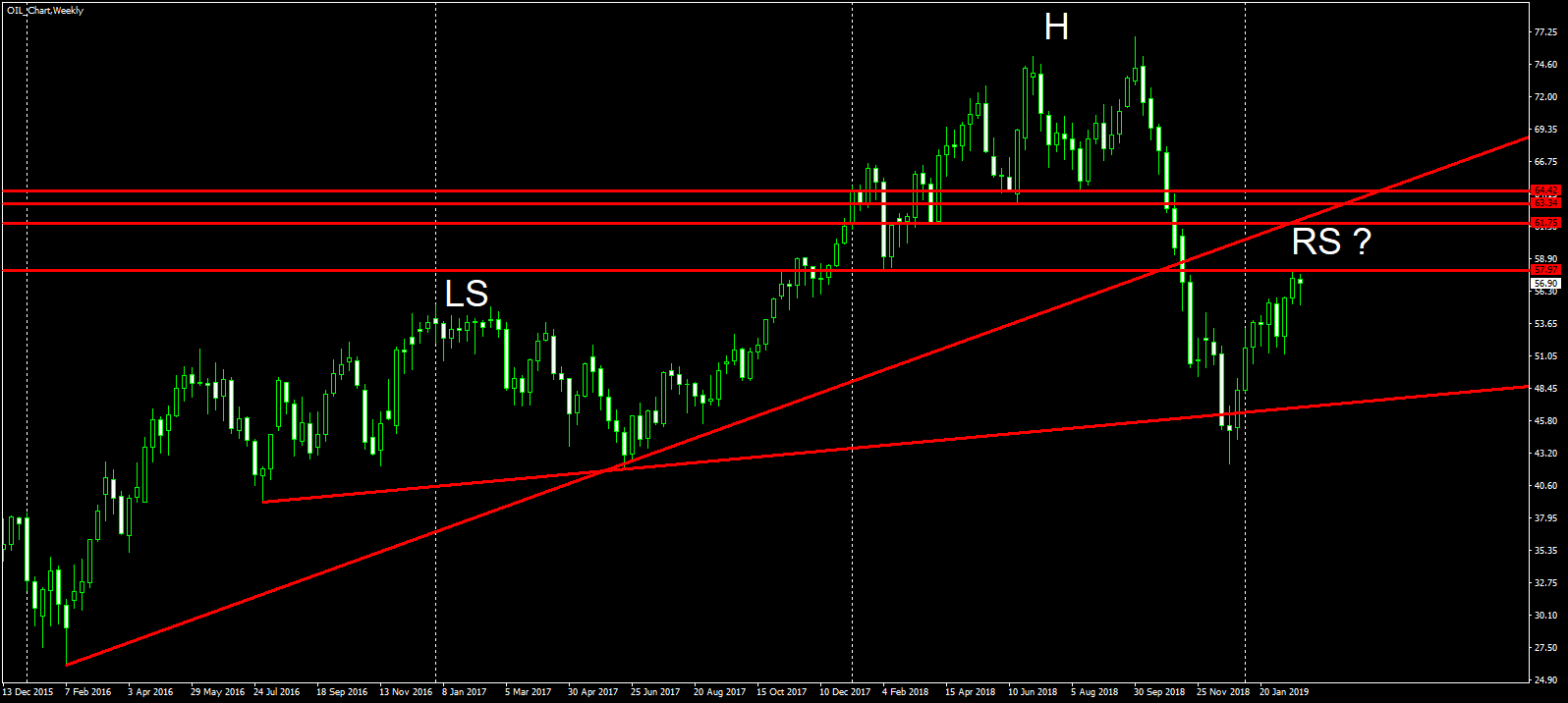

The rise in oil prices saw crude trading up to test the 57.97 level (Feb 2018 low) where price is stalled. The current structure is particularly interesting as we might be seeing the formation of a head and shoulders pattern here. This suggests the potential for another leg lower in oil over the year ahead.

I will be monitoring price in this area if we continue to consolidate. Particularly, I will be looking for selling opportunities in anticipation of this structure developing. Alternatively, a break above the 57.97 level opens the way for a run up to test further structural resistance above at the levels highlighted (61.75 next). That, along with a retest of the broken rising trend line from 2016 highs above also.