Crude oil prices rose further this week, trading up to fresh seven-year highs, before retracing slightly in response to developments with Saudi Arabian output and the latest US inventory data.

Speaking mid-week, Khalid al-Falih, the Saudi Energy Minister said confirmed that the kingdom had increased its oil output over October so far to 10.7 million barrels per day. This level is now just below the record high level of 10.72 million barrels per day seen in November of 2016.

Trump Sounding Off

Saudi Arabia has been under increasing pressure recently to raise its output after seeing stark increases in drawdown levels over recent months. As well as facing internal pressure from OPEC, Trump has openly criticized the kingdom following official comments which expressed the kingdom’s comfort with oil above $80 per barrel.

Saudi Arabian output was a key topic at the recent OPEC meeting and although the kingdom failed to agree to anything formally (merely pledging to increase production if demand increased) the market is relieved to hear that output has been stepped up.

Private Deal

The decision is reportedly part of a private deal agreed between Saudi Arabia and Russia which was revealed to the United States which has been constant in its demand for Saudi Arabia and OPEC as a whole to increase oil production. However, it is worth noting that while Trump is protesting against the rise in oil prices on one hand, with the other, his policy decisions are directly driving higher oil prices.

Oil prices have been rising steadily recently as the US sanctions on Iran, due to go live on November 4th, draw ever closer. The sanctions are expected to take over 1 million barrels per day off the market which, along with decreased production in crucial OPEC producing nations such as Saudi Arabia and Venezuela, has been fuelling speculative buying.

Alongside the news of increased output in Saudi Arabia, the market was also buoyed this week by the latest US crude oil inventories data which saw stockpiles rising by 8 million barrels in the week ending September 28th.

Gasoline Stocks Down

The data, which is released weekly by the Energy Information Administration, did also show that gasoline stocks were down 459k barrels over the week, sharply missing the market consensus which was for a 1.3 million barrel gain. Furthermore, stockpiles of distillates which includes diesel and heating oil, fell a further 1.8 million barrels over the week, again underperforming expectations of a 1.3 million barrel gain.

The rise in US crude oil inventories is likely linked to the reduction in oil shipments to China which, according to the president of China Merchants Energy Shipping have “totally stopped” since the trade war began.

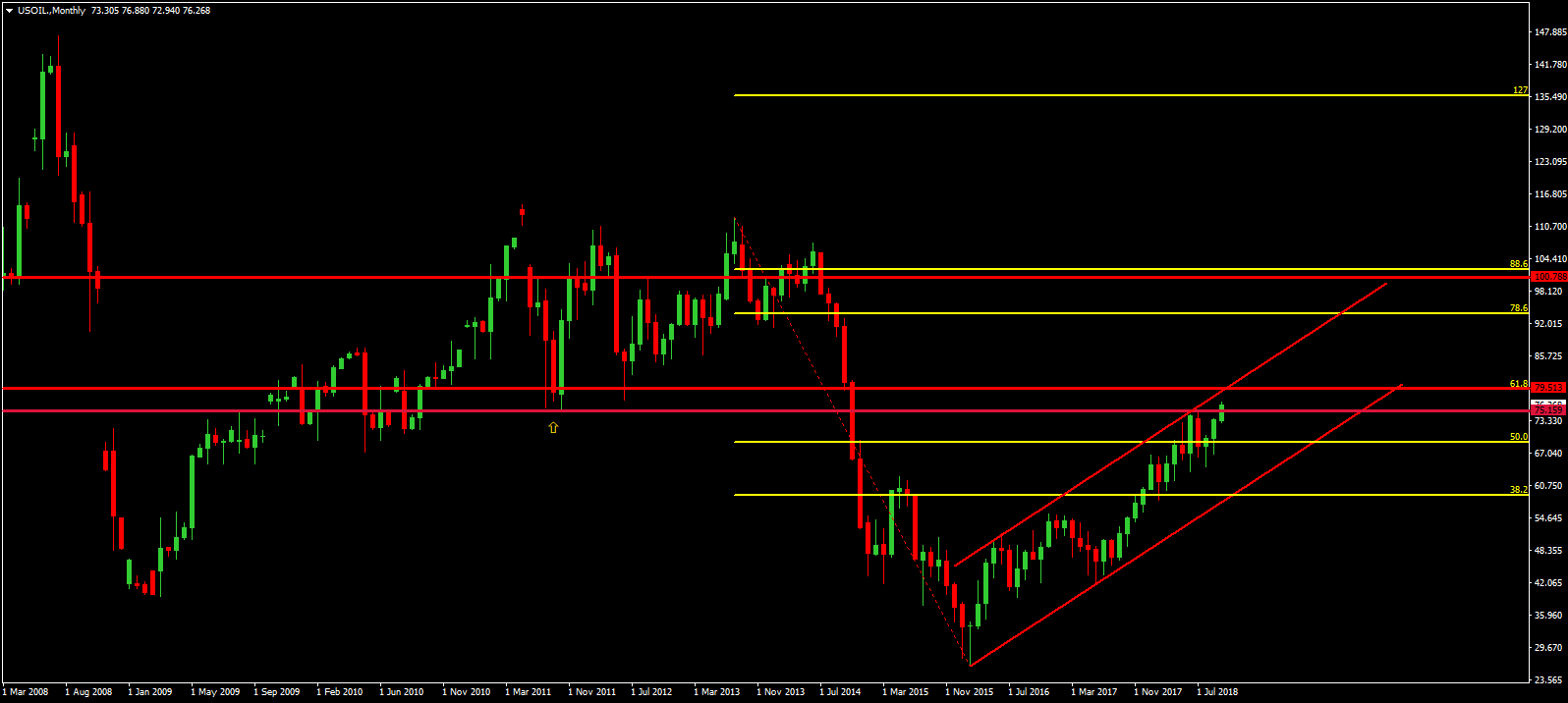

Technical Perspective

The higher time frame chart shows the magnitude of the rally in oil prices over the last two years having moved from low $20s to mid $70s within a clear bullish channel. Price is now once again testing the big 2011 broken low of 75.15. If price can close above here on a monthly basis, we are likely to see a run higher up to the .7951 level which is the 61.8% retracement from 2014 highs.