Crude Oil’s Bull Run Hides Deeper Risk

Crude oil has experienced a strong rally in recent days, touching 2015’s peak, after US crude inventory data showed significant improvement. Despite the commodities climb back above the $60.00 mark (WTI June), world demand for the product still wanes, showing a significant disconnect between the futures market and physical demand.

Despite the positive US Crude Oil Inventory figure this week, oil producers in Africa, Europe, and the North Sea are struggling to find buyers for tens of millions of barrels of oil. A lack of global demand for the commodity is the culprit and demonstrates that there is a very real disconnect between physical demand and oil futures.

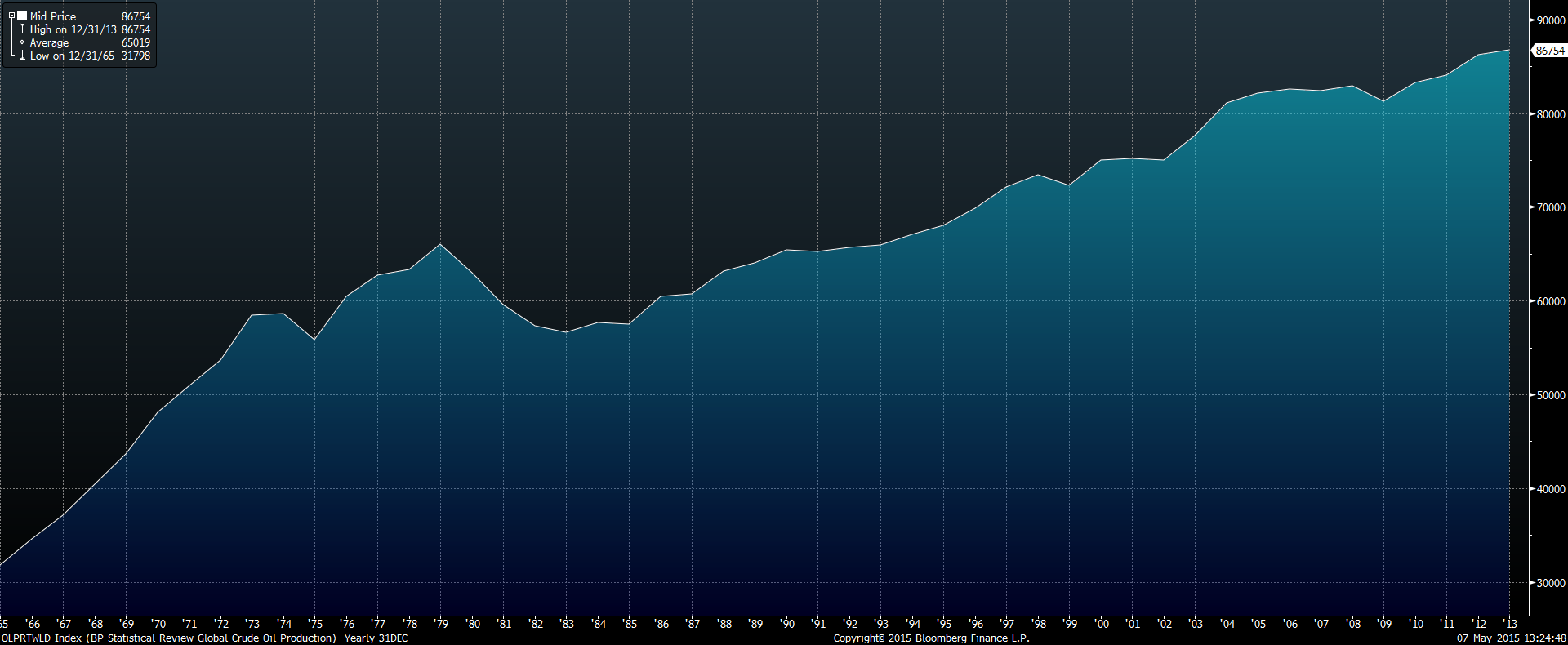

Crude Supply OPEC

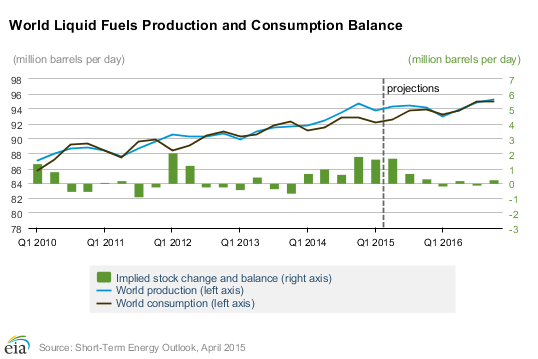

The clearest evidence of a supply/demand mismatch appears to be reports from OPEC showing that the world is currently producing over 1.5mb/d above demand. This is further evident in the fact that Azari light crude is struggling to find a home for over 10 cargo tanker loads of May production. Oil production in the North Sea has also seen a downgrade in demand with Norwegian Crude prices declining to its lowest levels since 2014. The worst supply imbalance is currently occurring with Nigerian and Angolan oil, where traders have suggested that over 80 million barrels currently sit on the market awaiting loading dates.

Obviously, the market fundamentals for the physical crude industry are looking poor with diminished global demand causing an uptick in crude inventories awaiting delivery dates. This is especially prescient as major nations struggle with slack industrial demand and excess capacity within their economies. The poor fundamentals set crude on a collision course similar to that experienced in the 2014 oil price crash.

Despite the problems within crude fundamentals, there is no guarantee that the futures and derivatives markets will follow suit, and come under pressure. The Futures market, in particular, can be quite impervious to fundamentals, especially considering the rampant volume of speculation. However, if history provides any clues to trend direction, we could see a very real reversal and decline, which mirrors what occurred in 2014.

Currently, China and whether they recommence building their strategic oil stockpile in 2016, is the big variable within crude markets. Considering that much of the previous supply excess headed that direction, any downgrade in Chinese growth is likely to pose a serious risk to physical crude prices.

Ultimately, without a serious decline in worldwide production, which currently seems unlikely, the disparity between physical crude supplies and futures prices is likely to widen. The data suggests that the commodity may be in for a bumpy ride in the latter part of 2015 and the potential risk of a strong correction remains a real one.