Yesterday's oil session was indeed heavy on action. The initial upswing gave way to a reversal lower, leaving black gold to close almost unchanged. Well, it finished a bit lower than it opened the day actually. Does this signify something important? That important that it would make us act? You bet - let's dive in to the juicy details.

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ).

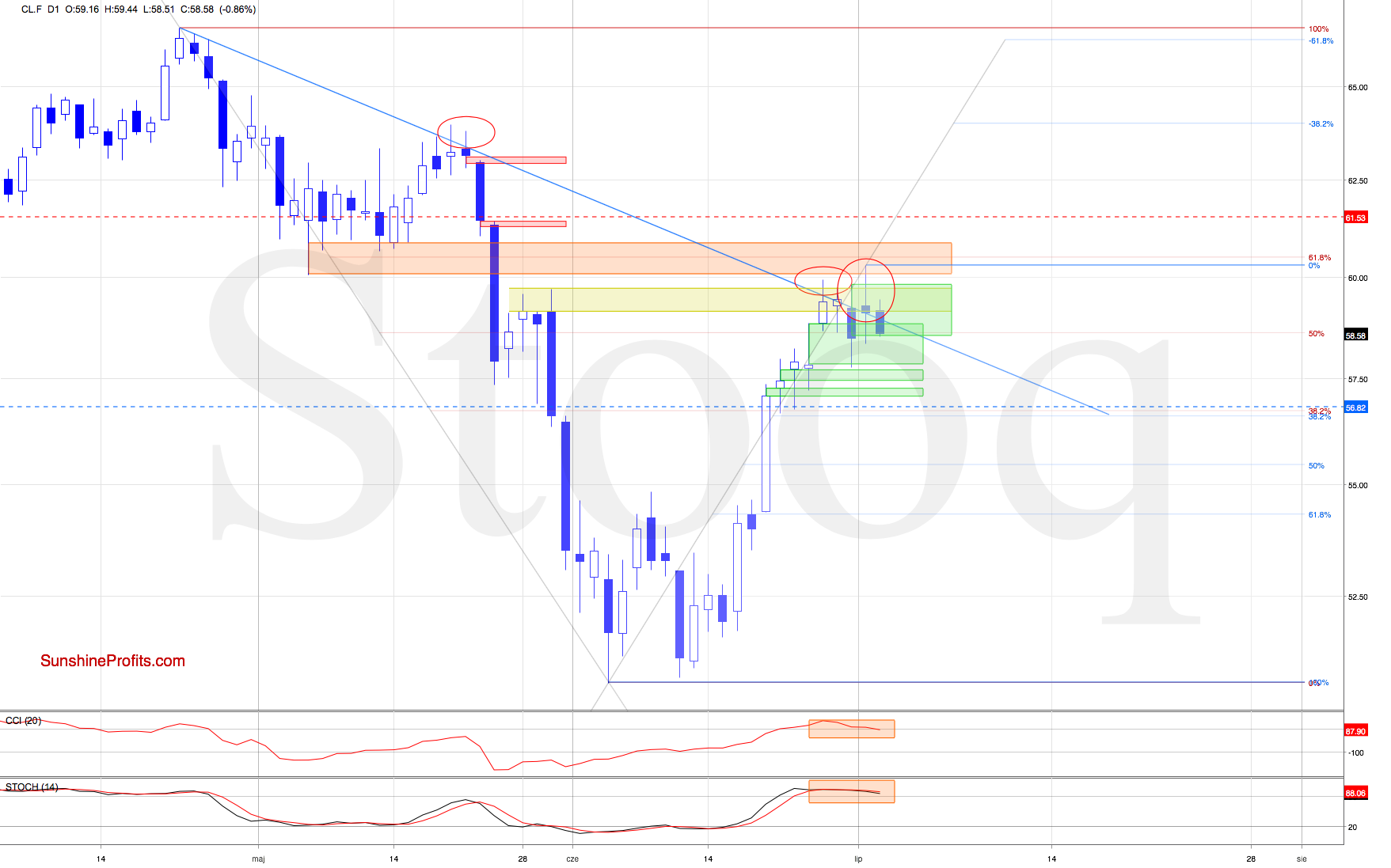

The oil bulls took black gold all the way to the orange resistance zone yesterday, just a bit shy of the 61.8% Fibonacci retracement. They didn't hold on to the gained ground, however, and oil closed the day slightly below the declining blue resistance line.

This is certainly similar to what we have seen recently. Let's recall these words of our June 27th Alert - back then, crude oil futures have first hit the declining blue resistance line:

(...) Crude oil went on to test not only the late-May peak, but also the declining blue resistance line. Nevertheless, there was no daily close above the blue line. Instead, the bulls gave up half of their gains, and oil closed well below this resistance.

We have already seen a similar price action on May 20 and also the following day. Back then, such moves preceded a sizable downswing, which increases the likelihood of at least a brief reversal from current levels.

This suggests we could see further declines in the coming days, just like back then. Indeed, crude oil is trading at around $58.20 as we speak. It looks like OPEC+ oil production cuts ratification didn't bring much reprieve to the market. Has that been a case of "buy the rumor, sell the news"?

Earlier today, the bulls have failed to bring light crude prices higher for a fifth time in a row already. That also increases the probability of reversal's sustainability and lower prices down the road.

Additionally, the CCI and the Stochastic Oscillator just generated their sell signals, lending support to the bears. Connecting the dots, opening short positions is justified from the risk-reward perspective.

Summing up, after yesterday's session that ended almost in a draw, the bears are making themselves heard. The technical posture has deteriorated as crude oil has been rejected at the orange resistance zone yesterday and went on to trade solidly below the declining blue resistance line. The daily indicators went on their sell signals and opening a short position is justified.