Crude oil moved significantly lower after topping at long-term retracement levels and since the monthly decline took place on big volume (biggest in almost a year), the black gold should move lower. But instead of moving lower this week, it seems to be forming a weekly bullish reversal. The individual daily volume levels were not low this week, so if the bullish reversal does indeed form, we’ll have a quite reliable bullish signal. Will the monthly bearish sign be invalidated? Will crude oil rally shortly?

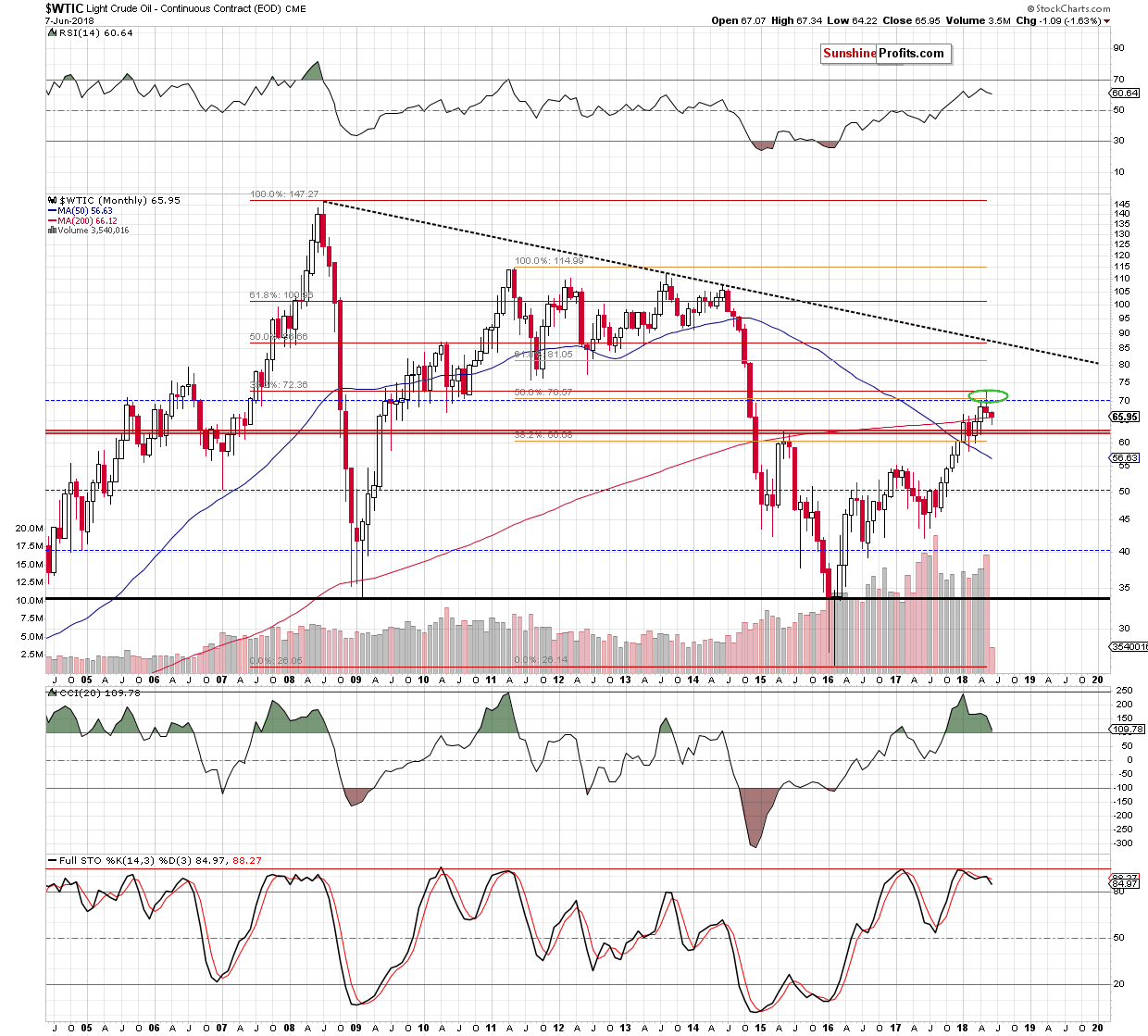

Let’s start by taking a closer look at the long-term crude oil chart.

Crude oil’s May reversal is not a 100% text-book example as crude has erased some of the late-month declines, but it’s clear enough for the implications to be bearish. This is especially the case since the price reversed after reaching two important, long-term resistance levels: 50% Fibonacci retracement based on the 2011-2016 decline and (even more importantly) the 38.2% Fibonacci retracement based on the 2008-2016 decline.

Therefore, crude oil is likely to move lower not only in terms of days, but in terms of weeks, and perhaps even months.

Lower Prices Ahead

The above implications are already playing out – despite this week’s comeback, crude oil is still over $1 below the May close and the odds are that it’s going to be much lower before June is over.

The CCI indicator in the lower part of the above chart shows why the implications could extend well beyond this month. Earlier this year, the indicator moved above 200 and now it’s moving lower is about to break below the 100 level.

There were only two similar cases to the current one in the past decade. The first was in mid 2008 and the second was in mid 2011. The former was followed by many tens of dollars of declines and the latter by a decline of “just” over $35. The May top was formed at about $72 and it’s now at about $66, which means it’s not even close to being as big as any of the previous declines that were similar to the CCI.

This means that crude oil is likely to fall further before the decline is over and the time factor adds credibility to this prediction. After all, both above-mentioned declines started in the middle of the year and that’s approximately where we are right now.

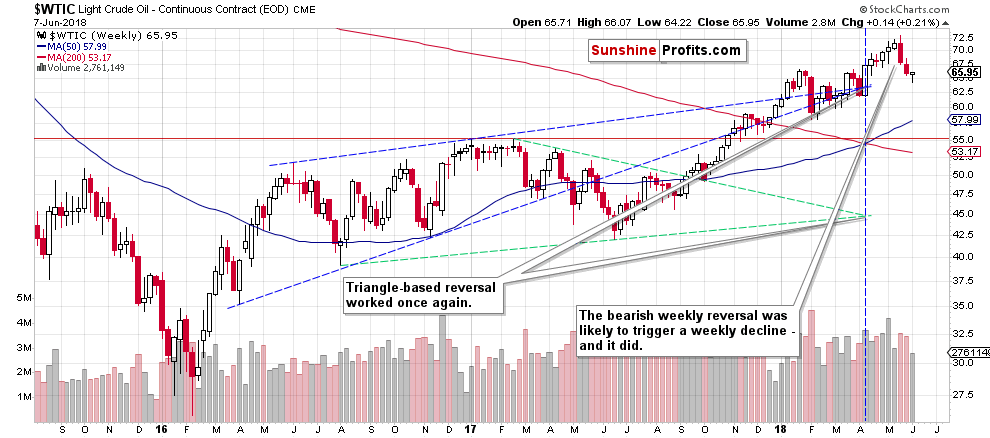

Having said that, let’s take a look at the weekly price changes.

As we indicated earlier, crude oil has almost formed a bullish reversal candlestick. It’s clearly visible on the above chart. At the time of writing, crude oil was down by 33 cents, which means that if it closed at these prices, we would still have a weekly bullish reversal. The week would actually end in the red, but the reversal would have bullish implications anyway.

Will we see the bullish signal and will the oil end up rallying on this bullish divergence? Let’s take a look at the daily price changes for details.

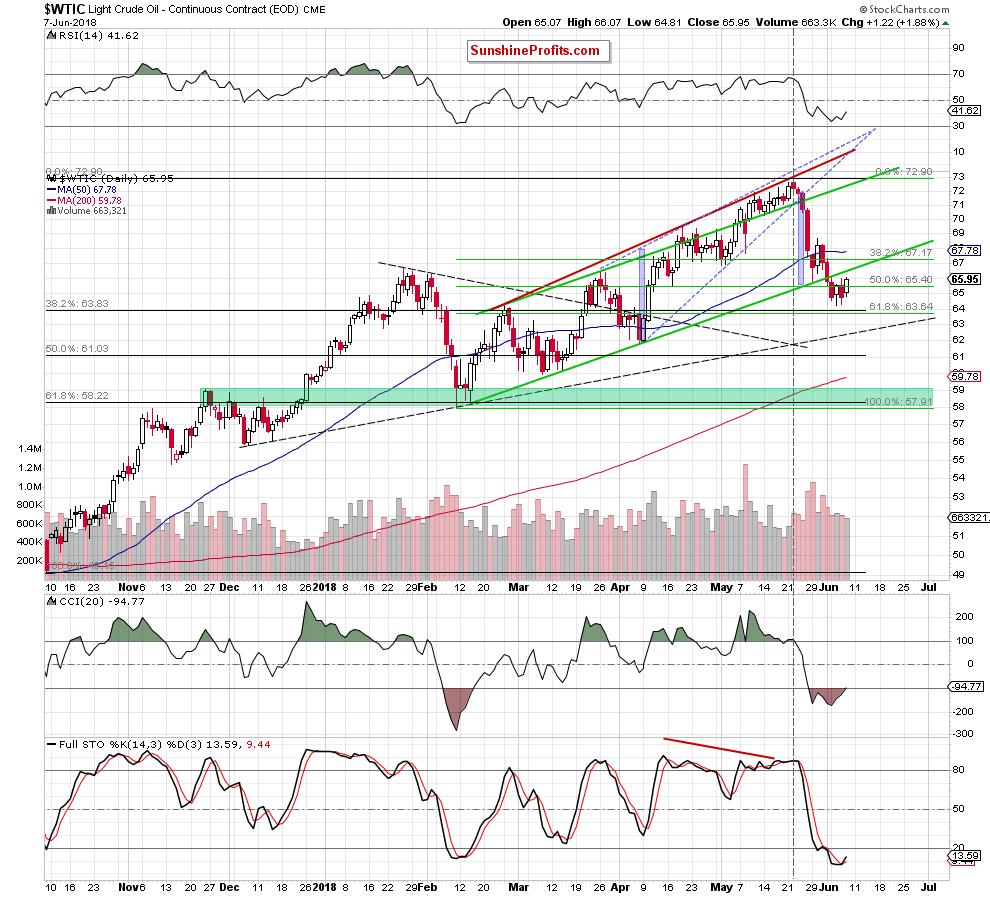

Unfortunately, the daily chart doesn’t give us any coherent explanation. The CCI and Stochastic provide us with bullish indications, especially the latter as its buy signal is clearer.

On the other hand, there are also bearish factors. Namely, crude oil may rally, but since it just broke below the rising green support/resistance line, it could now simply move to it and verify the breakdown. In this case, the upside would be limited to about $66.60 – just about a dollar above crude oil’s current price.

Bottom Line

The overall immediate-term outlook is unclear and based on what happens, we may or may not see additional strength next week before the big decline resumes. The latter seems likely to be in the cards based on the long-term analogies and monthly reversal candlestick that we saw in May. The big move seems to be the thing that both investors and traders should focus on. But it might be best to wait to enter trading positions until we see additional confirmations, similar to what we said on May 25. Indeed, the position we entered early that day became profitable quickly and we were able to take profits in a couple of days.

This time, though, it may be better to wait a little longer for the trade to fully run its course, but the need to wait for confirmations remains the same.

Thank you.