Over the weekend, OPEC+ unexpectedly announced a production cut of 1.16 million bpd. Separately, Russia extended its voluntary cut by 0.5 million barrels from March to the end of the year.

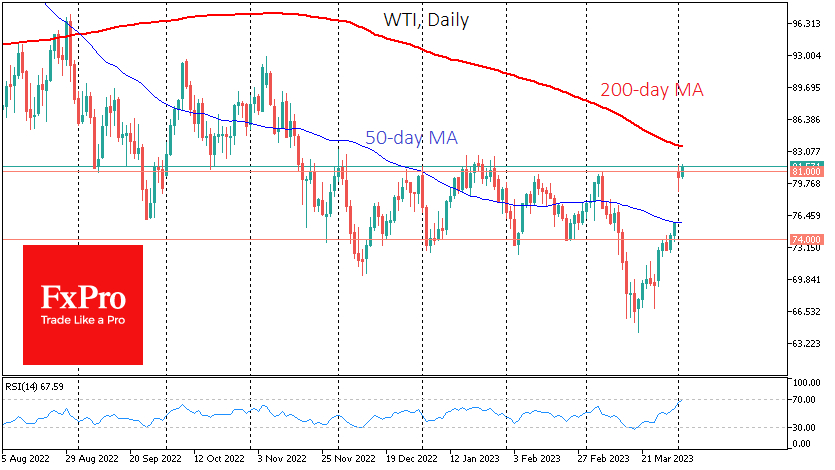

The unexpected decision caused oil to jump at the week's opening, bringing the price back to the upper end of the trading range it had been in since December before breaking through its lower boundary.

The cartel presents the decision as an attempt to balance supply and demand in the market. And this is an interesting passage, given that the developed economies are actually performing noticeably better than expected of them a couple of quarters ago. The US has not increased production, and OPEC+ has changed its original plan to restore production.

It is more accurate to call the latest decision an attempt to support the price, which briefly moved below the $65/bbl WTI level last month, with Brent testing support at $70.

It was not so much the size of the cut as its suddenness and the expectation that further similar moves might follow. It is in the cartel's interest to do so, as it gives greater amplitude to the market movement. This move has brought to memory the oil crisis of 50 years ago, with a price war between Arab countries and Israel's allies.

Looking at the price dynamics from the side of tech analysis, it is worth being cautious about further purchases. The price stabilised at the upper boundary of the trading range, approaching the overbought area on the RSI on the daily charts. The 200-day moving average (now $83.58) also points into the same area. One dollar lower is the reversal area for oil from December.

Short-term selling strength should be expected in the $82.50-83.5 area. If that happens, you should be prepared for oil to close the gap at the start of this week.

In our view, traders should be prepared for the US trying to put pressure back on oil quotations, as it is an important tool to keep inflation and inflation expectations in check.

Nevertheless, a quicker development cannot be ruled out with another short squeeze in oil and a capitulation of the bears. After the price consolidates at the 200-day average, this scenario is worth considering, which would open a direct path to the $85-90 area.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil’s Bullish Momentum Pauses, but Upside Potential Remains

Published 04/04/2023, 10:44 AM

Crude Oil’s Bullish Momentum Pauses, but Upside Potential Remains

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.