Back in April, we were seeing some weakness on the crude oil vs natural gas ratio. It was at 37. It is now at around 27, which is a drop of 27%. If we zoom out, 27 is still “high” historically.

In April we asked ourselves:

- Can the ratio stay above 25 for long?

- Can the ratio go way above 35, like it did in 2012 (up to 54)?

- Can all these observations lead to a WTI/NatGas ratio going back under 25?

Today, the second question is probably out of the way (for now). It seems the ratio wants to go home, where it belongs, which is below 25.

If we look at technicals, both RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) suggest that we’re in the beginning of a reversal, or at least that we have reached a top.

What now? Are we indeed going back under 25? Or will this level be the next support?

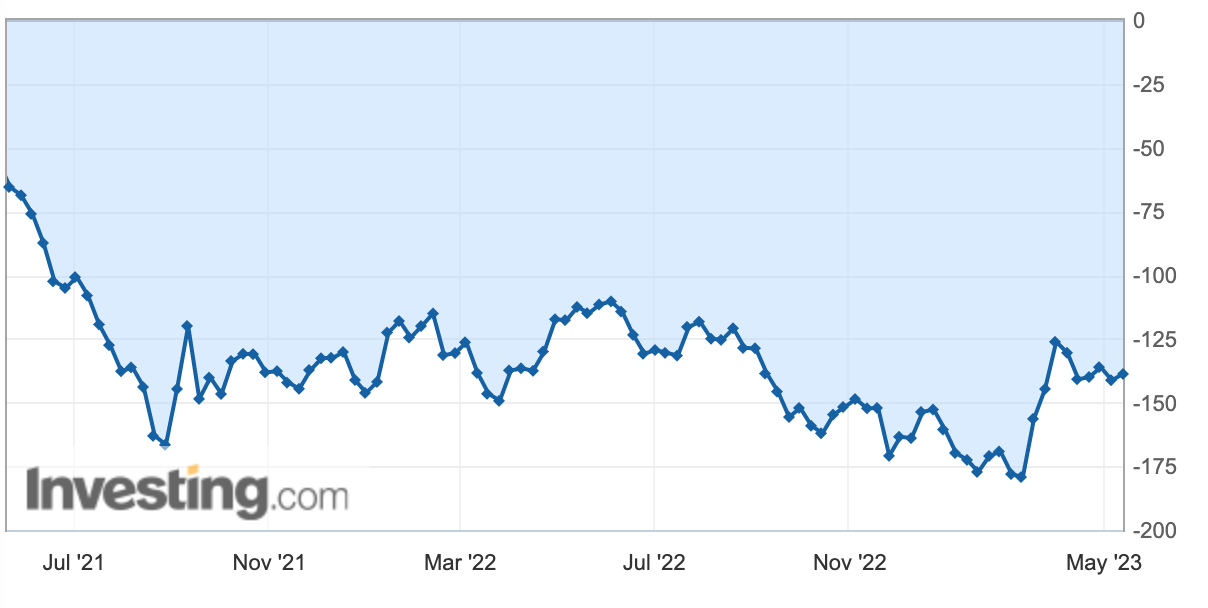

Here, the CFTC speculative net positions on both natural gas and crude oil don’t help much. It looks like spec traders are hesitating. A few weeks that the positions are more or less flat on natural gas.

Natural Gas speculative net positions:

Crude Oil speculative net positions:

About natural gas, Satendra Singh pointed in his article that “The bullish sentiment has ensured that any dip below $2.5 since the beginning of this week has received significant buying support,“ while Barani Krishnan says that “Recent dips in wind generation across the Continental United States have been supportive to prices while extensive maintenance across production sites has lifted feed demand for liquefied natural gas, or LNG.”

As for oil, “Recession fears continue to weigh on sentiment in oil markets“, according to Irina Slav, adding that traders “have ignored data about Chinese refinery throughputs and oil imports to focus on the latest PMI, which has shown a contraction in the country’s growth pace.“ That would explain in part the recent drop of the crude oil to natural gas ratio.

But in the medium term, a lot of experts, including Goldman Sachs analysts, think that oil is headed North. And that, in turn, would definitely support the crude oil to natural gas ratio.

***

Disclaimer: The content of this article is purely informational and does not in any way represent an investment advice or recommendation to buy or sell any commodity.

This article was originally published on the Trading & Investing newsletter, read by a community of traders, private investors and financial advisors. You can check it out here.