In the last six weeks, Crude Oil futures have traded lower by nearly $10/barrel. September futures have retraced just better than 50%, trading currently under $98.

While I cannot rule out a 61.8% Fibonacci retracement dragging this contract back near $95.85, prices appear to be finding buying interest at current levels consolidating over the last 9 sessions to around $97/barrel. Stochastics are oversold, but to confirm an interim low I would like to see a settlement above the 8 day MA (orange line). What I am looking for is a return to the 50 day MA (green line) in the next 30 days. This represents an appreciation of 4.4%.

I like the idea of long futures with some sort of options protection for risk mitigation whether that be buying a put or selling a call. Also, I will be employing other strategies such as buying WTI and selling Brent 1:1; I've also started to price out bullish trade in Heating Oil.

Crude oil daily chart:

Source: www.computervoice.com

Let's touch on the fundamentals and why I believe we could see a 4-5% appreciation in WTI around the bend.

Over the course of the last two months, globally we have seen softer economic data which, big picture, has contributed to the depreciation in a number of commodities including oil; That's also helped contain figures from Asia, Europe and domestically.

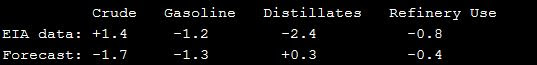

The fact that we experienced an unexpected draw in inventories yesterday likely also kept a cap on the price action with futures treading water after the number was released. This is a change as we had previously seen six consecutive weeks of inventory draws.

The build in inventory was likely in part due to supplies in Cushing, OK growing because of the the refinery at Coffeyville being offline. There is also a headwind with OPEC reducing production with the climbing output. The IEA also continues to downwardly revise global oil demand figures.

In my opinion, all details just mentioned are already factored into current trade and explains why futures are nearly $10 off their highs, made on June 25. Throw into the mix geopolitical tensions looking a bit brighter which also contributes to a negative bias. We call this “futures” for a reason and because I'm a contrarian, if tensions heat back up causing supply disruptions, demand returns; Also consider seasonal hurricane activity, and I think bulls could get back in the driver’s seat even if just temporarily. That said, I think the market is vulnerable to a $4-6 bounce in the next 30 days.