Investing.com’s stocks of the week

One year ago, crude oil was falling hard, plummeting nearly 50% over the prior 12 months. How things have changed a year later as crude is now up more than 50% from the 2016 lows.

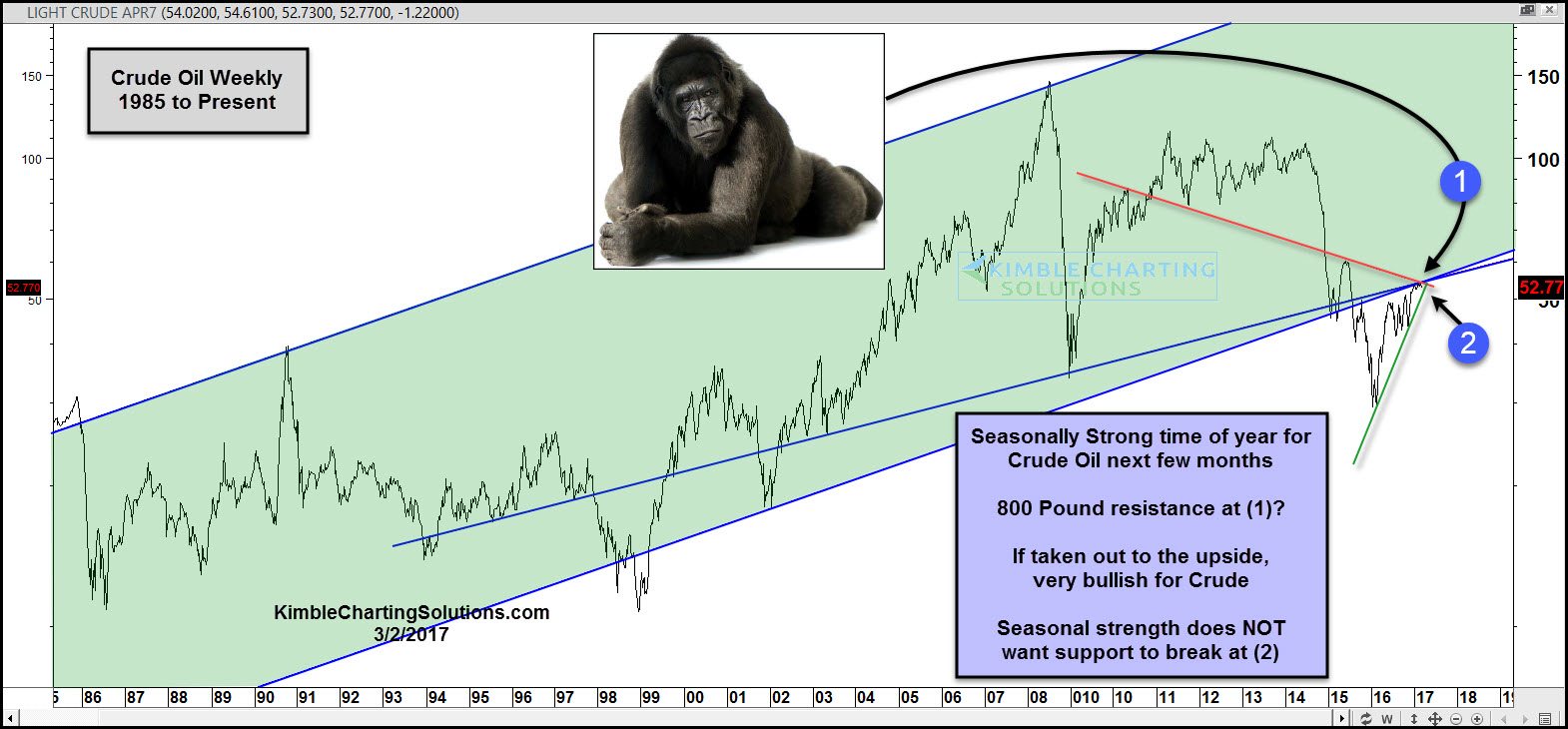

Now, crude oil is entering a positive seasonal time of year, with the average gain over the next 6 months being around 10%. Will it keep pushing higher, like it has over the past 12 months? Will it rise on seasonal strength? Below looks at crude oil over the past 30 years.

Crude has spent most of the last 30 years inside of the green shaded rising channel. Last year's decline took oil below support and the past year's rally has it testing the underside of this 30-year rising channel at (1). This is a triple, which if taken out, would be VERY bullish crude.

Rising support is being tested at (2). Crude oil's risk-on trade does not want to see support give way at (2).

At this time, traders are very confident that crude-oil prices will rise, reflecting confidence levels last seen in mid 2014, just before the big decline began. With crude reflecting the most crowded trade in its history, it is important that support holds at (2). This crowded trade wants to push the 800 pound gorilla out of the way.