It appears as if recently Russia and Saudi Arabia have been taking lessons from Janet Yellen’s school of `Jaw Boning and Market Manipulation’. Clearly, as a part of the practical component of their course, yesterday’s announcement of an oil production freeze was masterful in its application of double speak. However, I am only able to provide a barely passing grade, as it appears that the market has recognised it for what it was…a sucker's bet.

The Doha meeting of Russia, Saudi Arabia, Qatar, and Venezuela was always going to produce something of interest for the market. However, the possibility of substantial production cuts was always likely to be a significant outside chance without the participation of Iran and Iraq in the deliberations. Subsequently, it comes as no surprise that the only `decisive’ action to be agreed upon is to freeze Saudi/Russian crude production at January’s levels.

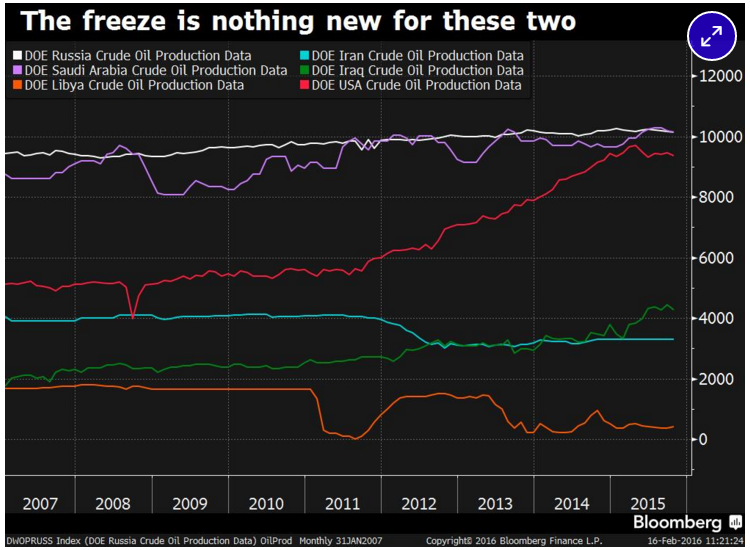

The reality is that the meeting was always going to be largely symbolic and any decisions were likely to be absent any enforceability or teeth. The proffered decision for production freezes is likely to make little in the way of a difference to the growing global supply glut. In fact, worse than that, it’s potentially misleading in that both Russian and Saudi Arabian production have both been relatively static throughout much of 2015.

Thankfully, the market saw this distraction tactic for what it was and crude oil prices only temporarily rose on the headline before being sold back towards $29.39 a barrel. It’s clear that the coming weeks are likely to see crude prices ranging between $28.50 and $30.00 despite the pending manipulations that are likely to emanate from OPEC members. In the medium term, market forces will need to clear the excess supply, and this can only be completed through lower prices, especially given the diminishing global growth outlook for 2016.

In addition, it is clear that OPEC has a problem on their hands as Iran seeks to maximise their production output in light of their return to crude oil markets. Also, given the dwindling foreign currency reserves that many OPEC nations are suffering from, gaining any consensus on quotas is rapidly becoming impossible. I’m not sure how many times I need to repeat the adage that market forces will determine the price in the new world order of oil (maybe OPEC doesn’t read me).

Subsequently, lower oil prices are largely here to stay, and my downside forecast, around the low $20.00s, remains in place, especially given slipping global demand. So disregard the `sucker's bet' and play the ranges as you await a lower equilibrium price.

Disclaimer: The report provided by Blackwell Global Investments Limited, New Zealand entity, is meant for informative reading and should not be relied upon as a substitute for extensive independent research. This information is not considered as investment advice or investment recommendation for a purchase or sale of any foreign currency, CFD, precious metals or any other products offered by Blackwell Global but instead a marketing communication. The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes.

The Research Analyst Opinion Articles have not been prepared in accordance with legal requirements meant to encourage the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, branches and affiliates.

Any projections or views of the market provided by Blackwell Global may not prove to be accurate.

Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any loss arising from ant information herein contained.

Blackwell Global Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought.

This report is prepared for the use of Blackwell Global clients. The reproduction and redistribution of this material is strictly prohibited.

Risk Warning: Forex and CFDs are leveraged products and involve a high level of risk. You may lose all your capital. Seek independent advice if necessary. Please read and understand our risk disclosure policy before entering any transaction with Blackwell Global Investments