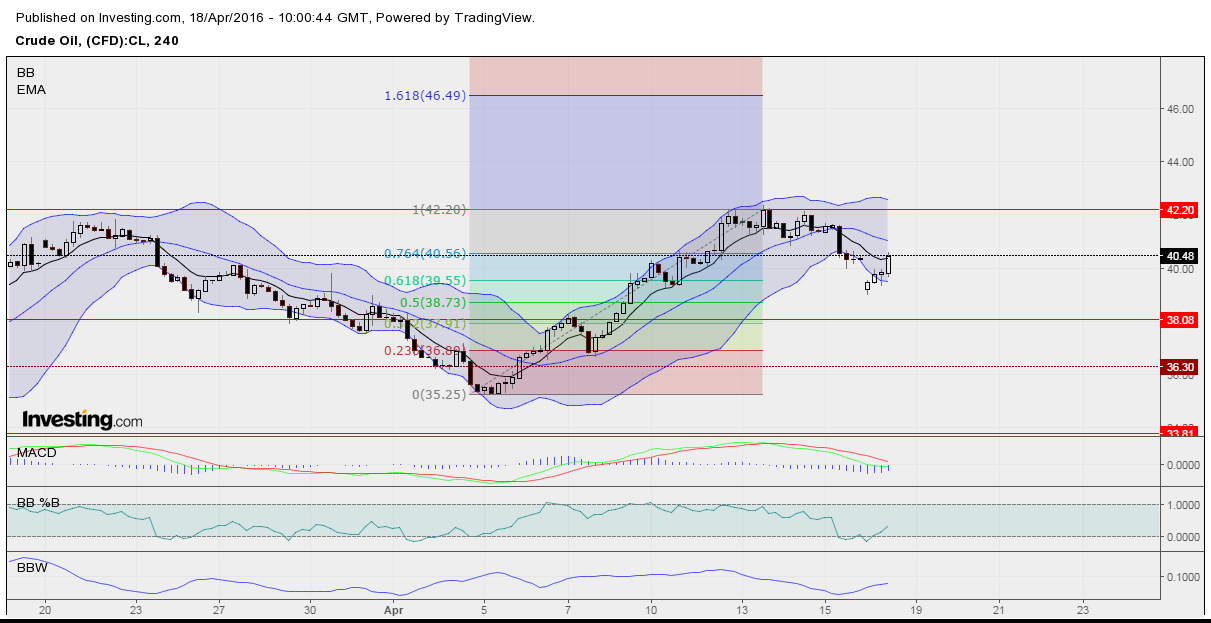

Crude oil has opened the current week with a strong gap down, despite contract rollover, because of the failure of OPEC/non-OPEC to meet an agreement about a production freeze. Crude oil hit $39 per barrel, down from the $40.28 close on friday, before retracing up over $40.

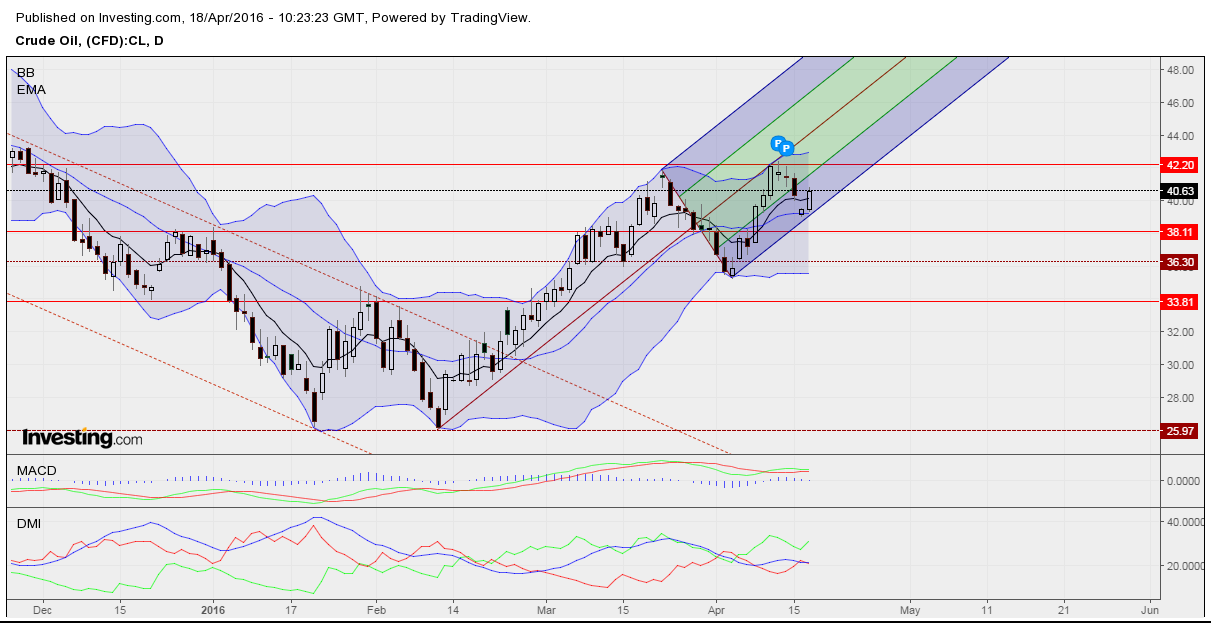

On the daily time frame crude oil is creating an Elliott Impulse Wave pattern, started from the second retracement on the double bottom created in the first 2 months of 2016. However, Elliott Wave 4 (correction) shouldn't be over, because ADX is giving strength loss signals on the current trend, confirmed by MACD. RSI is still high although it isn't in overbought zone.

RSI reached the oversold zone on the 4H time frame two times, the first one before closing on Friday and the second one after opening on Monday, while BBW still indicates low volatility. MACD is approaching to give a buy signal on short-term. Previous chart indicates Fibonacci retracements and extensions on 4H.

Next resistances are 41.00, 41.64 and 42.22.

Supports are 40.20, 39.20 and 38.12.

The bullish trend confirmation on short-term will arrive if oil price breaks resistance at 42.20, while if price breaks Andrew's Pitchfork drawn on the daily chart, trend will be bearish and should retrace almost to 38.12.