Omicron did a bit of a mess at the end of 2021, with oil too. Will crude oil break new price records in 2022?

Market Updates

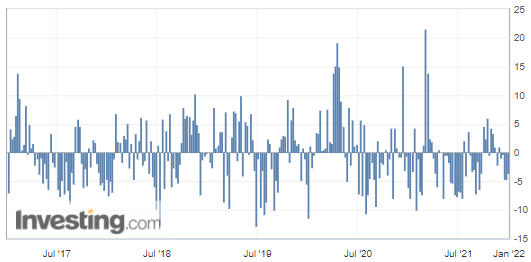

Yesterday, crude oil prices ended modestly higher after a volatile session with amplitudes increased by closing trades, as U.S. crude inventories fell by 3.6 million barrels – more than expected – which is a positive sign for demand.

Commercial crude oil reserves in the United States fell more than expected last week, recording the third consecutive significant decline on the back of strong demand, according to figures released yesterday by the U.S. Energy Information Agency (EIA).

On the other hand, the overall volatility is mainly due to the possible impact of the Omicron variant on demand; projects, commutations, as well as trips are cancelled, and more severe restrictions are put in place in Europe and China.

The oil market continues to be tight due to the increased demand for heating oil to replace natural gas, which has become very expensive, especially in Europe; the Dutch TTF (Title Transfer Facility) benchmark dropped almost 8% to €89 there.

As you may know, one-third of European gas supplies come from Russia. This explains why the energy market is also keeping an eye on the Russo-Western crisis around Ukraine. Russian gas exports could be affected if tensions rise, as Russian President Vladimir Putin is due to speak on the phone with his American counterpart Joe Biden later today. I bet they won’t talk about Russian caviar (which might also be considered Russia’s original black gold).

RBOB Gasoline (RBF22) Futures (Continuous contract, daily chart, logarithmic scale)

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart, logarithmic scale)

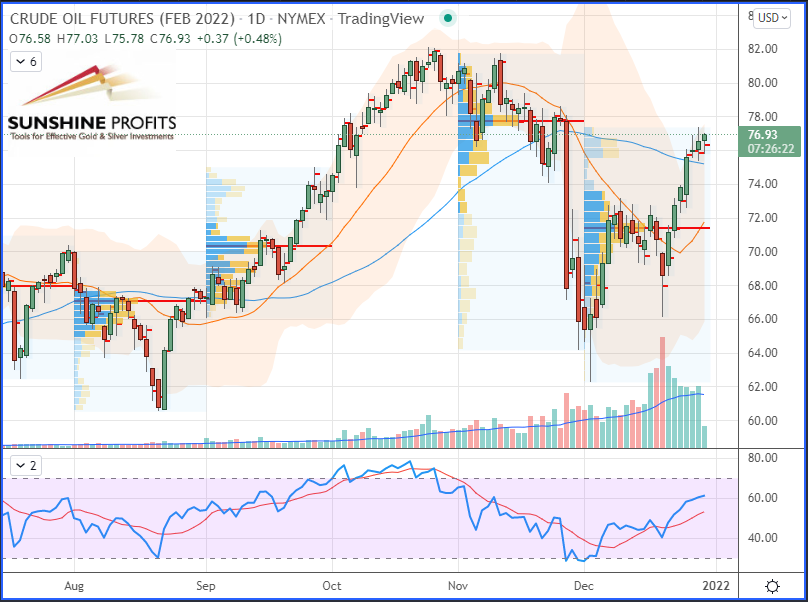

WTI Crude Oil (CLG22) Futures (February contract, daily chart, logarithmic scale)