- OPEC+ is struggling to reach an agreement to extend production cuts, leaving the oil market in flux.

- Assuming we see an agreement this week, WTI and Brent prices could rally above $80 and $83 respectively.

- While not the most likely scenario, a collapse in talks could take oil prices to multi-month lows.

The crude oil market is in flux. Of course, the outlook for every market is always uncertain, but the current backdrop for oil is particularly perplexing.

Against a backdrop of falling prices and fears about demand next year, the Organization of the Petroleum Exporting Countries and allies led by Russia (OPEC+) were poised to meet last weekend and discuss the potential for production cuts. However, the group was forced to delay the meeting to this Thursday to allow more time to resolve disagreements over output levels for African producers.

The signs of discontent extended this morning, with Reuters sources mentioning that the negotiations are difficult and that a further delay was possible, sending crude oil prices back below $75 despite general weakness in the US dollar.

Ultimately, the OPEC+’s power derives from its ability to act as a single bloc, increasing or decreasing production in unison to manage prices, so we would expect the group to reach an agreement to extend (if not outright expand) its recent production cuts to support prices later this week or the next. That said, the tail risks of a failure to reach an agreement is on the rise, presenting an underappreciated potential for even more volatility in the oil market.

Crude Oil Technical Analysis – WTI Daily Chart

Source: TradingView, StoneX

Turning our attention to the chart of West Texas Intermediate (WTI) crude oil, the US benchmark is testing the top of a 6-week bearish channel near 76.00 as we go to press. Oil prices appear to have found some semblance of support at previous-resistance-turned-support near 74.00, and if OPEC+ extends its production cuts this week, WTI could break out of its bearish channel and rally toward the 50-day EMA near $80.00 next.

Meanwhile, a break below 74.00 support would open the door for a continuation below $70.00 before encountering the next level of previous support near $67.00.

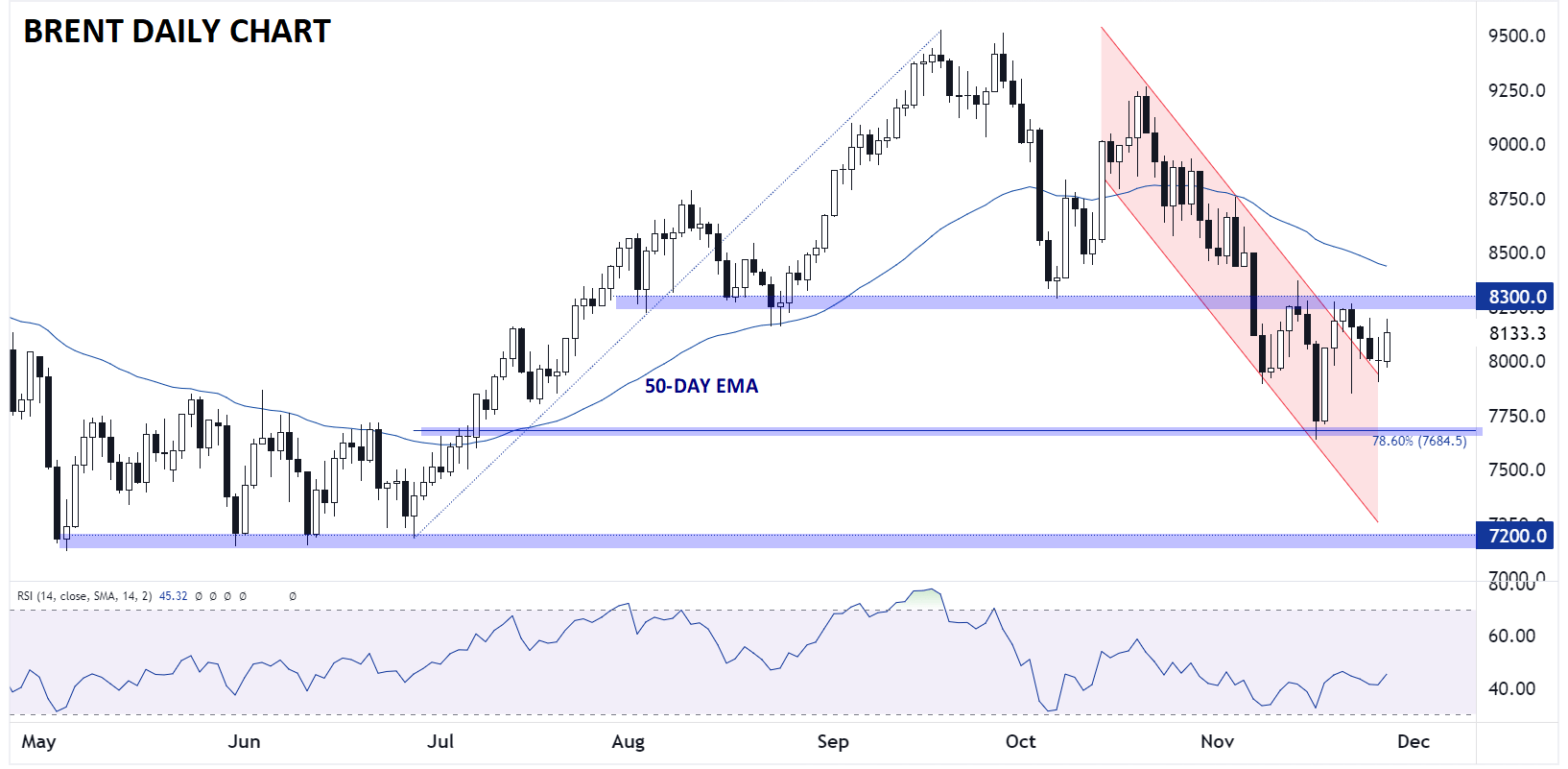

Crude Oil Technical Analysis – Brent Daily Chart

Source: TradingView, StoneX

Not surprisingly, the technical picture is similar for Brent crude oil, the global benchmark. Brent has already broken out of its equivalent bearish channel, though prices have spent most of the last week consolidating in the lower-$80s. Looking ahead, any efforts to further restrict supply from OPEC+ could take Brent up through previous-support-turned-resistance at $83.00, whereas a failure to reach an agreement would be a bearish development that could drive prices to 5-month lows under $77.00.