Crude Oil prices have started to move higher as investors are worried about the ongoing situation in the US. There is no doubt that the coronavirus situation has become bad once again, and the hospitalization rate has started to rise once gain. The hope is that that a coronavirus vaccine will get approved soon, and this can reverse the restrictive coronavirus measures in the US. However, for the time being, this event is leaving a bad influence on oil demand, and hence we see a correction in oil. It is important to keep in mind that the coronavirus situation isn’t going to influence the oil prices like before, and traders should acknowledge that the oil prices are unlikely to crash to the level that we saw earlier this year. This means that the current pullback could be the opportunity that traders have been waiting for a long time.

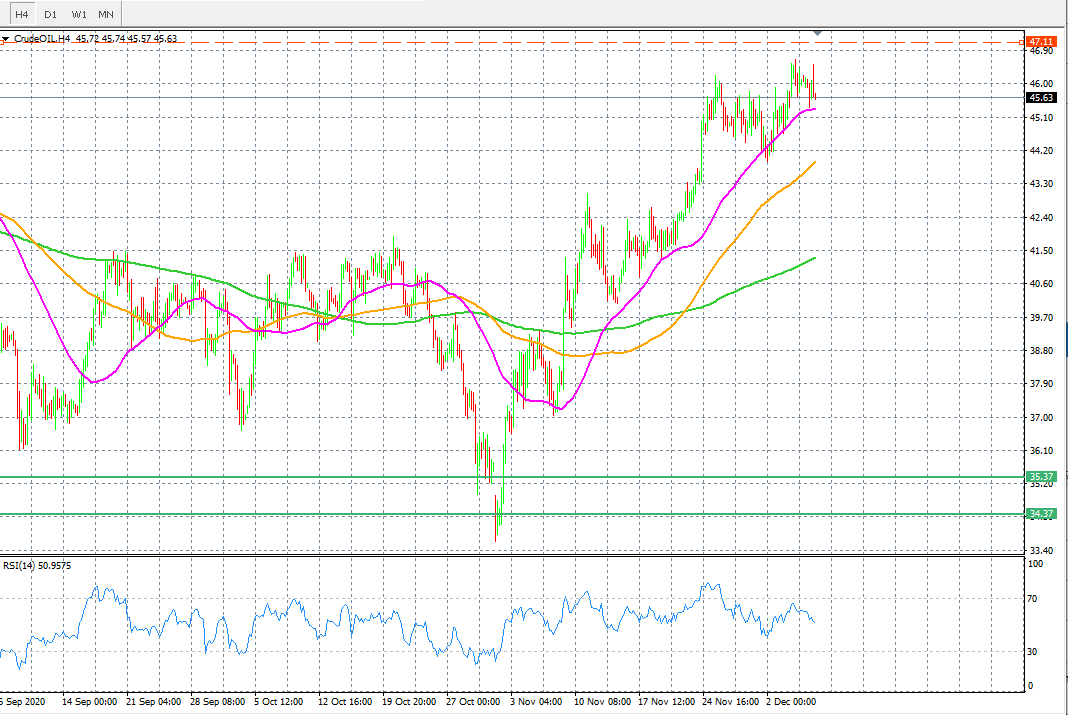

In terms of technical analysis, the price is retracing back towards its 50-day SMA on the daily time frame as the current move took the price too far and too fast. It is likely that the crude price may drop below the 50-day SMA as the price has tested this average not too long ago. However, the bulls may not need to lose their hope as long WTI continues to trade above the 100 and 200-day SMA on the same time frame as above. The near support for the crude oil price is at $41.50, and the resistance is $47.