The sun is about ready to rise in the east. The grass on the lawn is green. And gold is down. But we all know those things. Let’s talk about a couple of interesting items that don’t have 100% certainty.

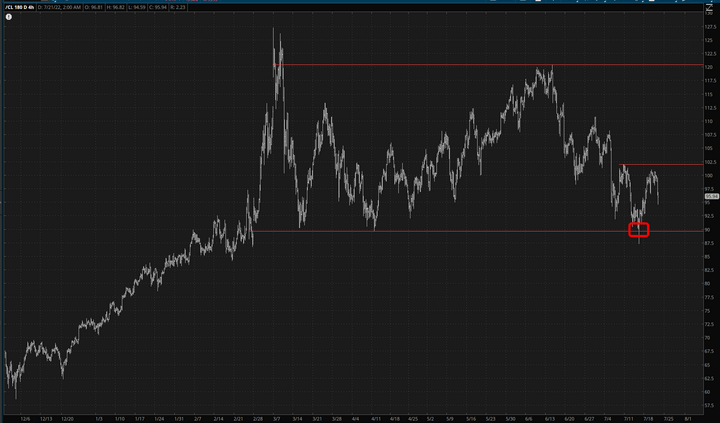

First of all, I’m pleased to see crude oil weakening again. As I am typing this, crude futures are down a nice, hearty 4%.

Looking longer term, you can see how the Ukraine war spike is way in the rearview mirror, and right now, the question is whether last week’s low is going to be taken out. I’m thinking “yes” and perhaps even before the weekend (although that’s stretching it).

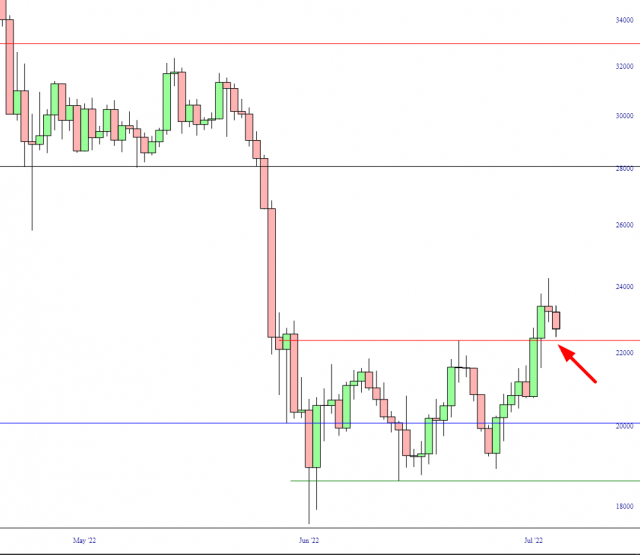

My crypto obsession remains, and so far the conjecture that Ethereum was going to exhaust itself once it reached its measured move has panned out. The explosive rise on Monday was “all she wrote”:

Bitcoin is the more important question, not only because it is the biggest of the big, but also because it actually stands a chance of a failure bullish breakout. Keep an eye on that line at about $22,300.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.