- I've NEVER seen WTI implied options volatility lower. Front month ATM = 14%. March = 15%. Back in late March (2013) Crude vol was nearly this low (Implied vols across the board were near/at multi year lows at the same time). Between April 3 and April 18th, Crude dropped $10 and implied vols moved from 16% to 28%.

- Here's a longer term look at WTI price (yellow) and Implied vols (blue)

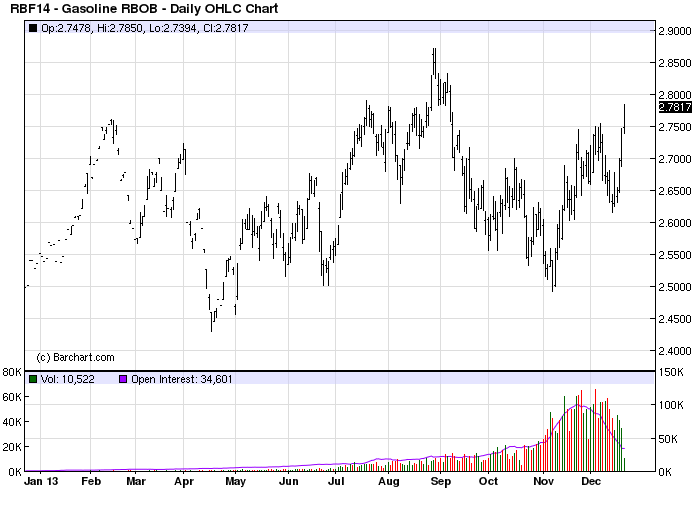

Remember a month ago when everyone was talking about what a great boon lower Gasoline prices would be? As a general rule of thumb, if they are talking about RBOB prices on national/local news...chances are you are VERY close to a top or bottom.

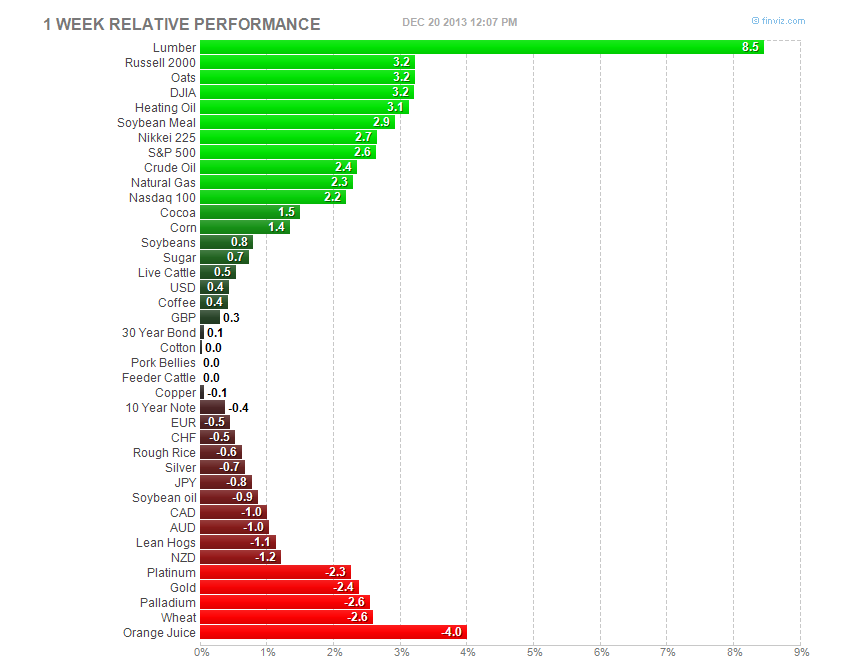

The past week has been a microcosm of the year...... in other words, a great time to be long equities, short metals and agriculture.

Performance this week:

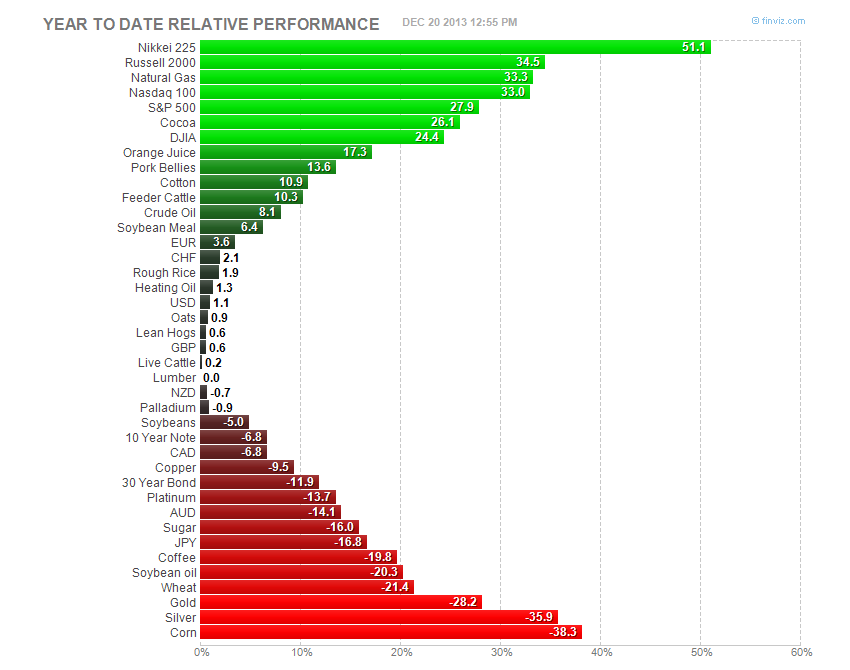

Year to Date:

Finally, Gold broke down again yesterday. The $1200 line gave way again. February Gold futures (GCG14) went pretty much right to the June lows. To this point, Silver and Gold have held the summer lows. It will be interesting to watch the Metals into the end of the year and early in 2014.

I regularly watch the (loose) "relationship" between Equities (risk/growth) and Gold (risk off/fear/inflation).

Here is a 10 year look at the SPY - GLD. The last time the spread was this much in favor of Equities was (ironically) Christmas week of 2007. The market has said "Bah Humbug" to the Gold bugs since September of 2011 (equities bottom and gold topped).

.......At some point in the not too distant future, I think Gold and/or Silver (if you can handle the volatility) along with Sugar will be excellent long term buys. I said the same about Coffee about 6 weeks ago. It's had a good run already, but if you're a buy and hold type and open to contrarian thinking, take a look at the "unloved" markets of 2013!