Crude Oil futures carried Friday's gains into Monday, as concerns persisted that fresh economic sanctions slapped on Russia by the West for annexing Crimea could escalate geopolitical tensions and threaten Russian oil exports.

Soft Chinese output data capped gains, however, allowing for choppy trading at times.

On the New York Mercantile Exchange, West Texas Intermediate Crude Oil for delivery in May traded at $99.49 a barrel during U.S. trading, up 0.03%. New York-traded oil futures hit a session low of $99.06 a barrel and a high of $100.29 a barrel.The May contract settled up 0.57% at $99.46 a barrel on Friday.

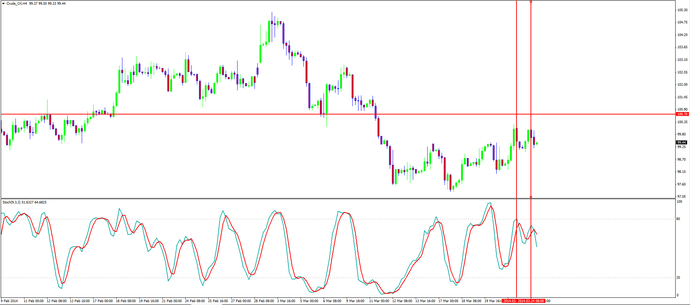

Nymex oil futures were likely to find support at $98.10 a barrel, Thursday's low, and resistance at $102.89 a barrel, the high from March 7.

The European Union and the U.S. last week intensified sanctions against Russian President Vladimir Putin and his allies to pressure his government to defuse the global standoff over Ukraine.

Western nations added new names to their lists of Russians and Ukrainians punished with asset freezes and travel bans.

Technically crude oil is falling from its resistance at 100.70 level and we can see a divergence forming on the stochastic indicator along with the formation of a double top. A really good opportunity to short crude oil with tight stops crude oil is a very rewarding trade.