At the start of a new trading week, it’s time to check in on some of my regular market analysis. I thought I would start with oil, which has reached an interesting inflection point. What follows this week is likely to define the longer-term direction for the commodity. And the most appropriate time frame to consider is the weekly as this is the most significant from a technical perspective.

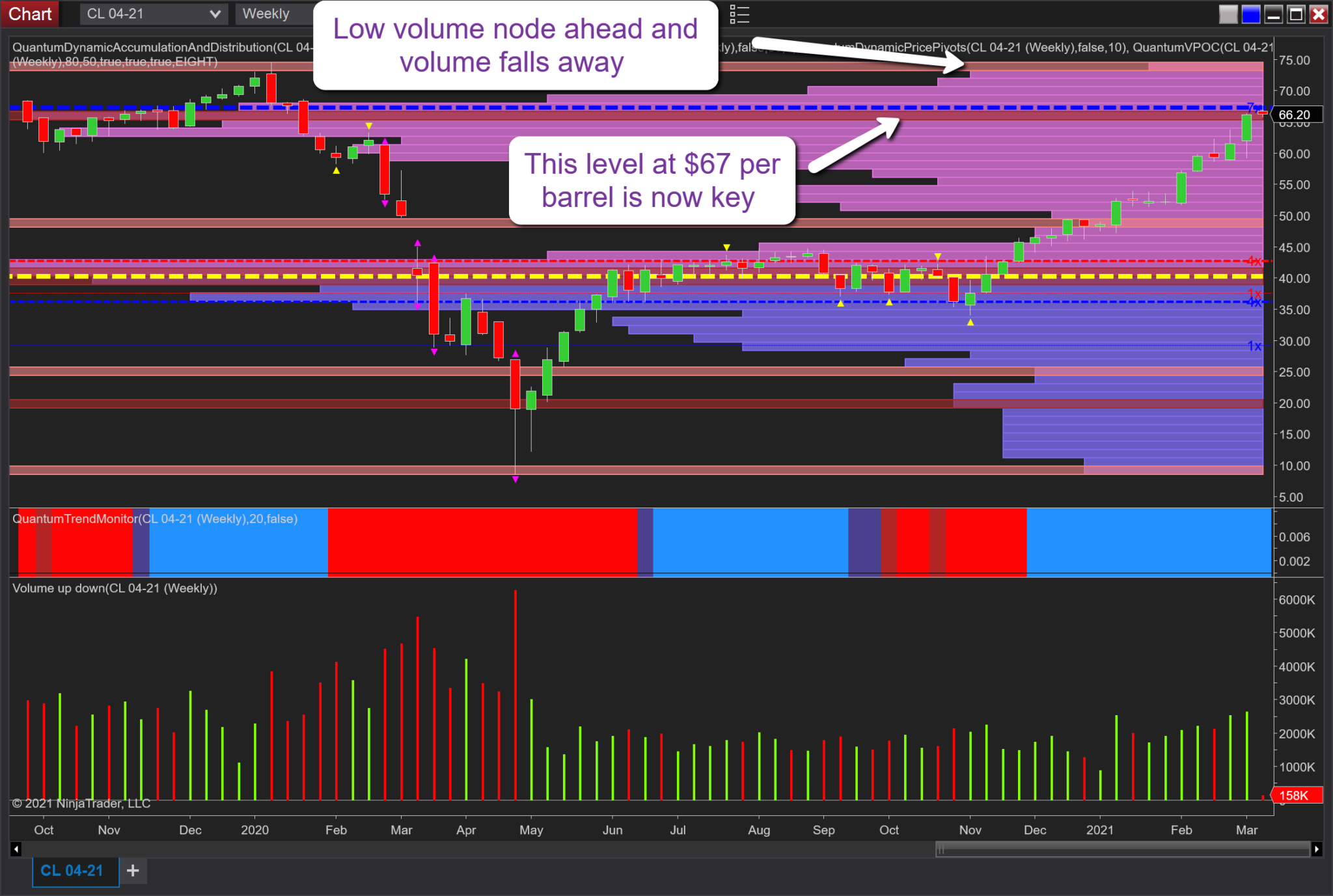

As we can see from the chart, last week was a positive one for the commodity, which saw it rise on a solid widespread candle on good volume and with the wick to the lower body providing some additional momentum. So, from a virtual process analytics (vpa) perspective, price and volume are in agreement and this was despite the massive build in inventory, which was the largest since 1982 at 21.5m bbls. This failed to dent the bullish momentum, as oil closed out the week at $66.09 per barrel.

But herein lies an issue, as the price has now run into the extremely well-developed resistance area, which sits above at $67 per barrel and marked with the thick blue dashed line of the accumulation and distribution indicator. The indicator presents these levels according to the number of times they have been tested and held, and so it delivers a visual and clear picture accordingly of how strong or weak each level is. In this case, it is extremely strong and, therefore, key in the development of the current bullish price action and whether it is going to cap further advances.

If not, and it is breached, this opens the way to a continuation of the present upwards trend. In addition, this level is also important for another reason as it is the point at which volume begins to fall away on the VPOC histogram and, therefore, reduces the resistance likely from a volume-based perspective. So if oil can break and hold above $68 per barrel, two things will happen. First, a strong platform of support will then be in place. And second, the price should move easily through to $70 per barrel and on towards $75 per barrel, which is the low volume node at the top of the chart in rapid time, and requiring less effort to do so. And once we have achieved $75 per barrel we can then move to the monthly chart for a longer-term assessment.

In summary, this week is all about whether this key level at $67 per barrel is breached, and in the attempt, we can expect some congestion, but longer-term I do anticipate this level will be taken out and the bullish trend to continue.