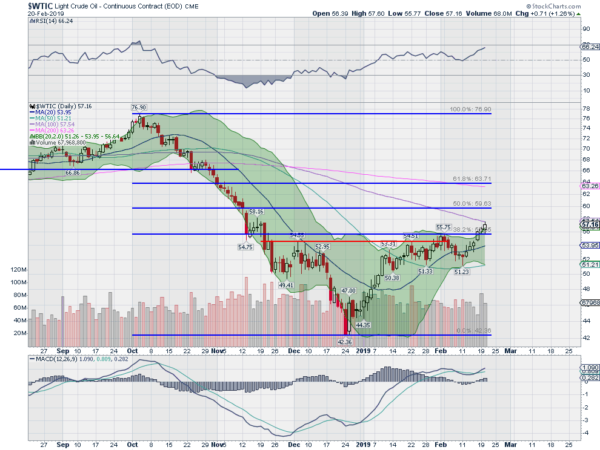

Last week I wrote that crude oil was looking for a retest of the January highs and a push through that area would signal more strength going forward. Well crude oil got that retest from the market and it passed with flying colors. Now oil is looking at new hurdles ahead.

It starts Thursday at its 100-day SMA. It has not been above that level since October. It has momentum behind it to continue up and over that level. The RSI is rising in the bullish zone with the MACD positive, crossed up and moving higher. The Bollinger Bands® are also opening to allow a move higher.

The 50% retracement of the the drop from the October high at 59.63 would be the next major milestone to cross and then the 61.8% retracement at 63.71. That would also put Crude oil over its 200 day SMA for the first time since October. If you look at the January sideways action as consolidation then a possible target on a Measured Move would look to the 62.50 area, close enough to that 61.8% retracement and 200 day SMA area.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.