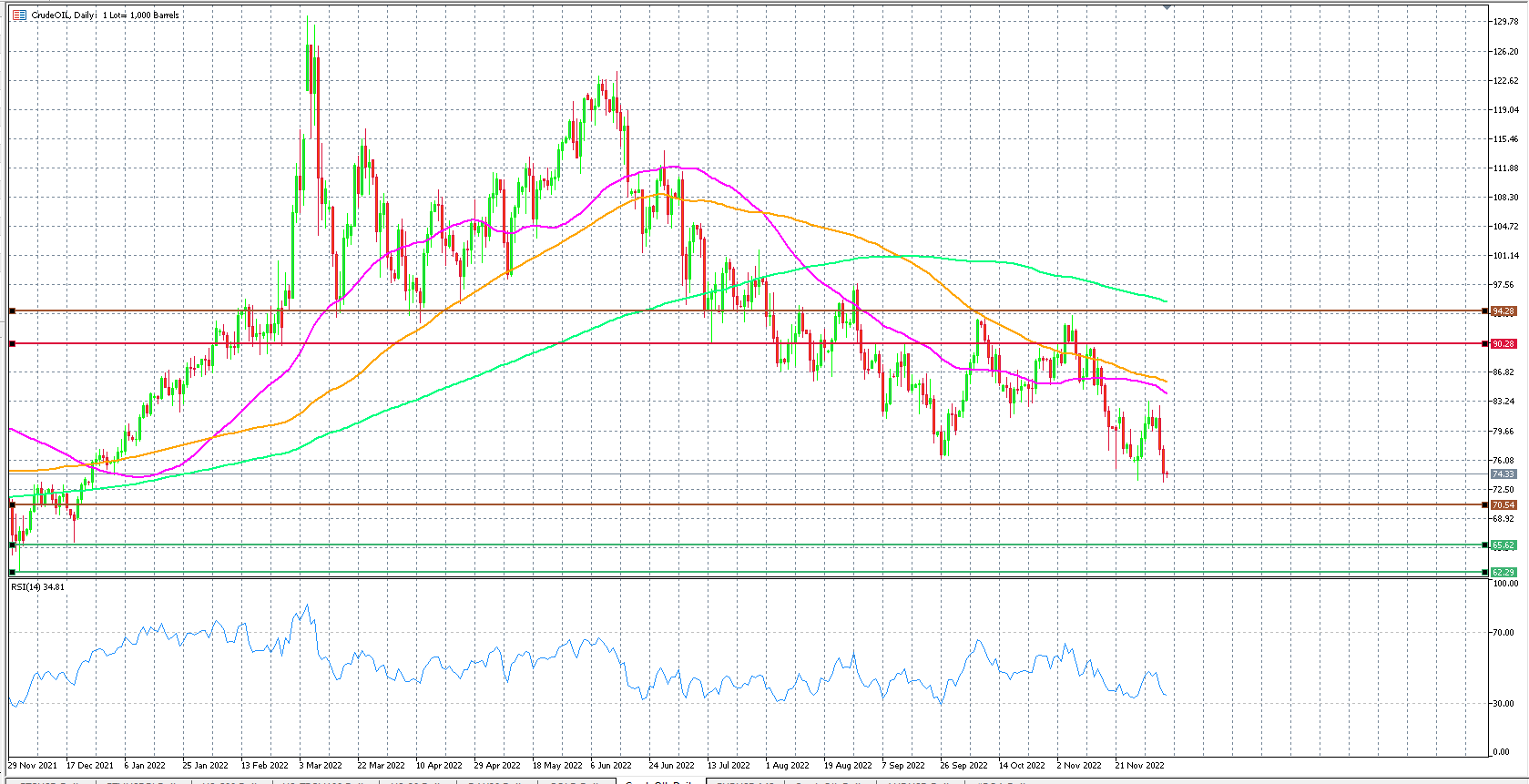

Oil prices saw a serious correction yesterday, and the prices of Crude and Brent oil have been falling for the past two consecutive days. Oil prices are still very much linked to demand, and every day we hear more possibilities of a recession taking place in 2023, which is not positive for oil prices.

We know that OPEC has decided to lower oil production, but the influencing oil alliance has made no aggressive supply cut decision. Hence traders are more worried that with growth slowing down, there are more possibilities that we may see an oil supply glut forming as the US oil drillers are still pumping oil at a record pace.

In addition, we need to have China completely ease off its zero-COVID policy stance; without China, oil demand is unlikely to visit the same demand level that we had pre-COVID. In addition, traders need to remember that artificial factors mainly drove the recent rise in oil prices. The real price of crude is more likely to be in the range of 65 to 75; this is where the price is trying to find a new consolidation range.