Talking Points

- Crude Oil And The Precious Metals Rebound Strongly On Profit-Taking

- Natural Gas Extends Declines As Supportive Weather Speculation Fades

- Quarterly Forecast: Gold Remains Vulnerable To USD Strength

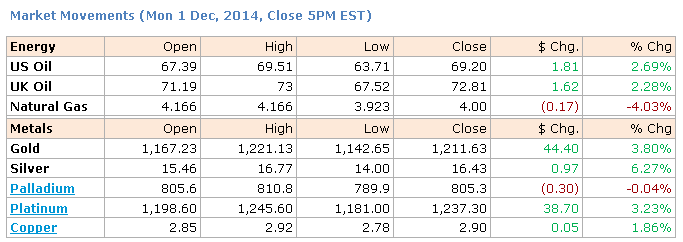

The precious metals rebounded strongly on Monday after initially suffering some substantial declines in Asian trading. Profit-taking on shorts may have offered an explanation behind part of the recovery, while a lackluster session for the greenback also likely lent some support.

Looking to the session ahead a light US economic docket begs the question of what could potentially reinvigorate the US Dollar bulls. Another soft session for the reserve currency could in turn leave gold and Silver some breathing space.

Crude oil witnessed a similar bounce at the outset of the week as shorts likely took some chips off the table following last week’s steep declines. Yet in the absence of supportive fundamental news flow the prospect of a sustained advance for the commodity is questionable – especially when the supply side story remains negative.

Also in the energy space; Natural Gas plunged by over 4 percent for the session to the psychologically-significant $4 handle. The fourth straight day of declines for the commodity were likely tied to forecasts for milder US weather conditions – which stand to reduce heating demand. As the weather-related speculation continues natural gas could be in line for further volatility.

ECONOMIC EVENTS

CRUDE OIL TECHNICAL ANALYSIS

Crude oil has managed to reclaim some lost ground and close back above the 67.25 target offered in recent reports. Its rebound has left a Hammer formation in its wake, which awaits confirmation from a successive up-day. If received the pattern could herald a short-term corrective bounce. Yet the scope for a more sustained recovery within the context of a core downtrend is questionable.

Crude Oil: Bullish Reversal Signal Emerges After Intraday Rebound

GOLD TECHNICAL ANALYSIS

An astounding rebound for gold has left the commodity retesting its descending trendline on the daily. The whipsaw has once again turned short-term trend indicators higher (20 SMA and ROC). Yet given the impulsive swings in recent trade the most recent turn should be treated with caution. This leaves a more constructive setup desired to offer a clearer directional bias.

Gold: Bounces Back To Trendline Resistance

SILVER TECHNICAL ANALYSIS

Just when silver was looking set to reengage its downward trajectory it has swung back to the 16.70 ceiling. A Bullish Engulfing formation has been left in its wake, yet awaits confirmation from a successive up-period to be confirmed. In the absence of validation and while sub the 16.70 barrier pressure may remain on the precious metal.

Silver: Impulsive Swing Prompts Retest Of Key Resistance

COPPER TECHNICAL ANALYSIS

Copper’s downward trajectory has become cleaner in recent trade. Amid signs of a downtrend from the 20 SMA and ROC the risks are likely skewed to the downside. A close below the June 2010 low near 2.766 may open the October 2009 low. However, caution is still suggested when adopting fresh positioning - given the commodity’s tendency towards whipsaws over recent months.

Copper: Breaks Lower Amid Persistent Downtrend Signals

PALLADIUM TECHNICAL ANALYSIS

Palladium is struggling to sustain its recent gains near the 38.2% Fib. This has left a pair of Dojis in its path. However, the candlestick formations are not considered key reversal patterns. Alongside signs of an emerging uptrend a pullback remains questionable.

Palladium: Struggles Near The 38.2% Fib.

PLATINUM TECHNICAL ANALYSIS

Platinum has produced a Bullish Engulfing formation after bouncing from the 1,187 floor. Yet confirmation from a successive up-period and close above the 1,242 ceiling would be required before the potential for a continued ascent would be made possible.

Platinum: Bullish Engulfing Pattern Emerges Near Key Floor