Talking Points

- Crude Oil Recovery Limited As Global Supply Glut Concerns Linger

- Silver At A Critical Technical Juncture Following Astounding Rebound

- Quarterly Forecast: Gold Remains Vulnerable To USD Strength

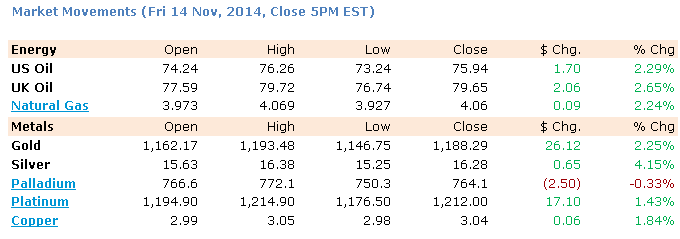

The precious metals witnessed an astounding rebound to finish out the week on Friday. Silver pared losses of roughly 2 percent to finish 4 percent higher for the day. A surprisingly soft session for the greenback and some profit-taking on gold and silver shorts were the likely drivers behind the bounce.

Despite US consumer sentiment climbing to its highest since 2007 and Retail Sales data beating estimates last week, the US Dollar bulls are treading cautiously. This casts some doubt over whether a strong set of upcoming US Industrial Production figures could reinvigorate the reserve currency. Another lackluster session for the greenback could in turn afford the precious metals some additional breathing room.

Similarly, crude oil bounced back on Friday with traders likely repositioning themselves after a significant slump earlier in the week. At this stage the rebound appears corrective, rather than being indicative of a greater shift in sentiment towards the commodity. This is given the fundamental backdrop remains one of lingering global supply glut expectations.

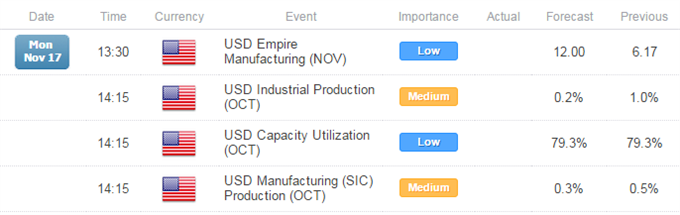

ECONOMIC EVENTS

CRUDE OIL TECHNICAL ANALYSIS

Despite crude’s recent rebound the commodity remains capped below the 77.00 barrier. Trend indicators also continue to point downward (descending trendline, 20 SMA, ROC). This suggests a potential run on the late September 2010 low near 72.70. A Piercing Line pattern deserves to be monitored with confirmation from a successive up-day and a close above 77.00 required to warn of a base.

Crude Oil: Spotlight On Late Sep ‘10 Low Near 72.70

Gold TECHNICAL ANALYSIS

Gold’s faces a test of several technical barriers including the 20 SMA and 50% Fib. While the core trend remains lower negative momentum appears to have stalled (as signaled by the ROC indicator). This suggests some caution is warranted when looking to enter fresh short positions.

Gold: Negative Momentum Fades Within Core Downtrend

Silver TECHNICAL ANALYSIS

Silver has leapt like a coiled spring after several consolidative sessions. This has left the precious metal at a critical juncture as it tests its descending trendline, 20 SMA and the 50% Fib. While below these barriers a bearish technical bias is retained with a potential downside target offered by the recent lows near 15.00. Yet fading negative momentum suggested by the ROC indicator suggests some caution is warranted.

Silver: Downtrend Remains Intact Despite Recent Bounce

COPPER TECHNICAL ANALYSIS

Copper’s recent rebound has generated a key reversal candlestick pattern. However, the scope for further gains may be limited while it lacks confirmation and given trendline resistance hangs overhead. Caution is suggested when adopting fresh positioning given the commodity’s tendency towards volatility over recent months. Further, trend indicators have proven prone to rapidly changing direction, suggesting a lack of strong conviction from traders.

Copper: Rebound Produces A Bullish Engulfing Formation

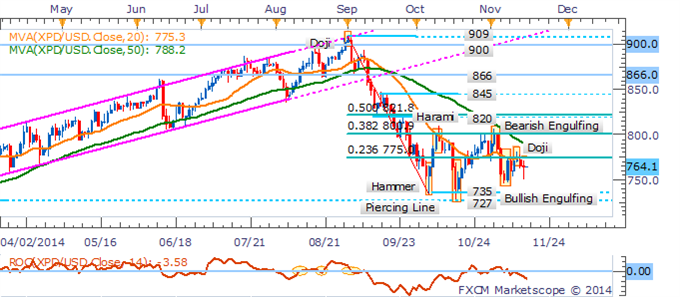

PALLADIUM TECHNICAL ANALYSIS

Palladium may be witnessing the beginnings of a greater retreat towards its recent lows near 735. Respect of the 23.6% Fib. and 20 SMA are suggestive that the bears are slowly strengthening their grip on the metal. However, some caution is suggested when looking to adopt fresh positioning. This is given palladium’s disposition towards whipsaws in recent trade.

Palladium: Bears Slowly Strengthen Their Grip

PLATINUM TECHNICAL ANALYSIS

Platinum remains inches away from the critical 1,187 barrier as a Bullish Engulfing formation awaits confirmation. Yet with trend indicators pointing downward (20 SMA, descending trendline) a breakout could pave the way for a push towards the July ’09 low near 1,101.

Platinum: At A Critical Juncture Near Technical Floor